Welcome Avatar!

In today’s holiday edition of DeFi Education, we wanted to give all our readers a review of everything that’s happened this year.

We’ll also cover our major lessons from our adventures as cartoons in crypto.

2024: The Year of Legitimacy

Bitcoin was created as a permissionless “peer-to-peer” electronic cash system. The philosophy behind creating a form of money secured by cryptography rather than human organizations aimed at nothing less than revolution. Decentralized Finance was born in that revolutionary culture: we were going to allow anyone with access to the Internet to do their own banking, borrowing, investing, and trading - without permission from anyone.

All the crypto bankruptcies two years ago demonstrated the folly of placing your permissionless cryptographic assets in the hands of intermediaries. (We warned everyone here not to use fake centralized CeDeFi).

Ironically, the FTX estate only fully repaid DeFi protocols. The immutable smart contract code made it impossible for DeFi investors to accept any form of “haircut”. FTX customers have waited more than two years to access their funds. Claims will be paid based on the dollar value of FTX accounts at the bankruptcy date, meaning that anyone who kept 1 BTC on the platform will receive a total payout of less than $20,000, around 1/5th of the cost of repurchasing the lost Bitcoin.

It is therefore most amusing to us that the increase in the crypto market cap this year was driven not by improvements in the technology, or any mass realization of the unique value propositions of digital assets. Instead, it has arguably been driven by “legitimacy” - by the fact that the US securities regulator approved Blackrock and other TradFi titans to offer spot crypto ETFs to the general public (Q1), and by the President-elect endorsing crypto (Q4). In other words the gatekeepers have given you permission to use the permissionless financial system.

Well, they say there’s no such thing as bad publicity!

While enjoying the irony, we do recognize that legitimacy helps the DeFi ecosystem in a number of ways. The SEC’s notoriously crypto-hostile chairman Gary Gensler will resign in January. Crypto regulation will change (but it remains to be seen if the changes favor corporations vs independent developers). It’s now less risky to pivot to a career in crypto. This will open the field to timid talent, and result in more competition. Side note: the best time to kick off a career in crypto was when we launched our course two years ago. The second best time is now, since you’re guaranteed that the industry isn’t going to die. More people will accept crypto as a legitimate financial system, making it worthwhile to build new products and services (larger TAM). And there will be a steady trickle of net inflows as the entire wealth management industry start allocating a few percent of their clients’ portfolios to digital assets.

You Are Still Early

We can’t say this for much longer as we are on the cusp of mass adoption. But. It has been true every year we’ve been producing this newsletter and it’s true today. In less than two years, Hyperliquid has gone from an idea to a ~$35 billion dollar project. With a team of less than 10 people. This is one of the best industries for a founder.

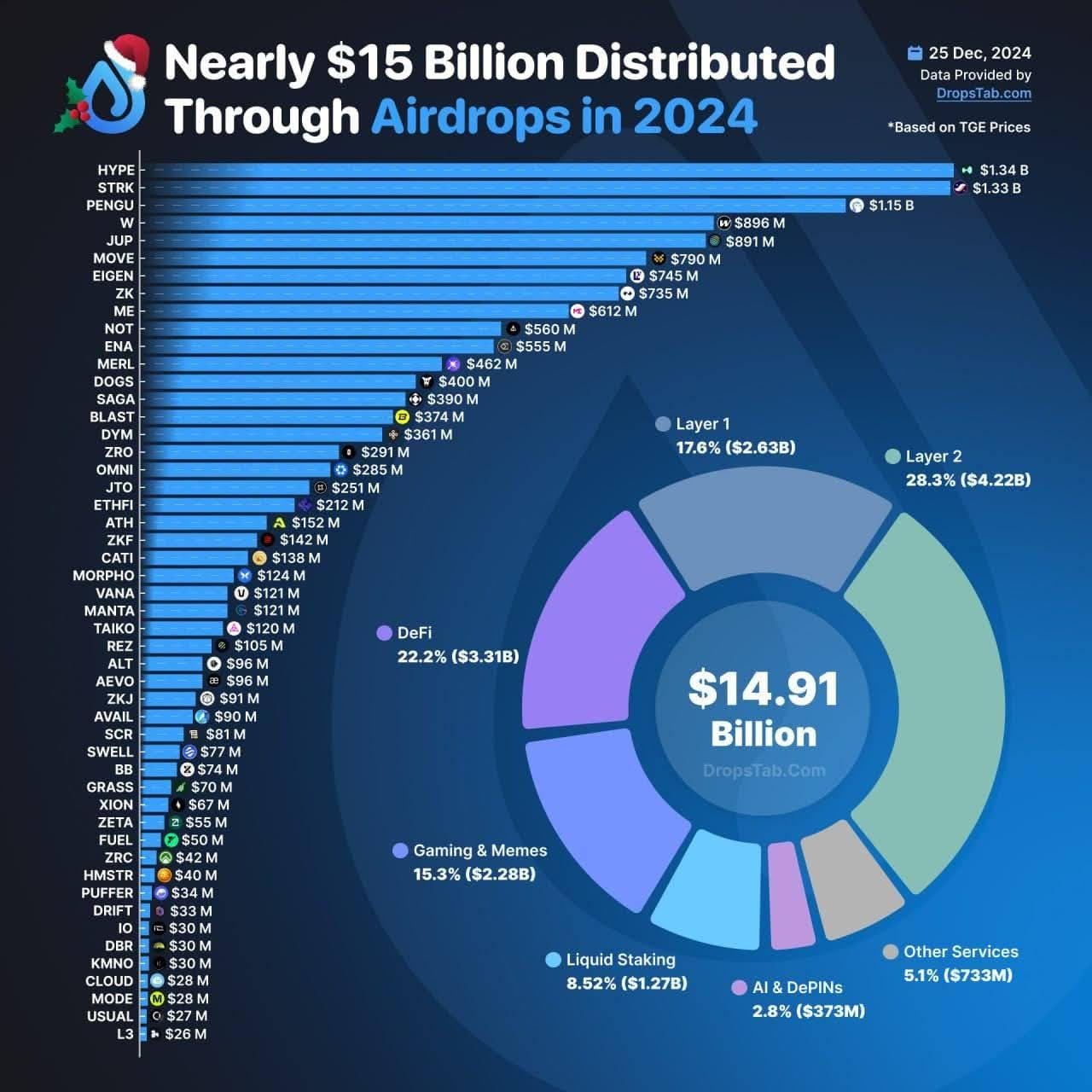

For those who don’t build projects, literally billions of dollars of free money has been handed out to early adopters who ‘beta test’ new DeFi software.

Finally, investors have had the opportunity to increase their risk capital by 2-10x this year on non-meme crypto projects. By the time a traditional company hits IPO, it may be fairly valued or even overvalued - legions of professional investors have already had the opportunity to buy (and sell!) equity at earlier stages in the venture’s history. Quality crypto projects can launch at fairer valuations, allowing more potential upside for the public. Crypto participants are aware of the VC model and we’d predict (based on Hyperliquid’s successful launch) that projects will need to offer liquidity to the public earlier and at fairer valuations in the future. More opportunity for you.

Other Key Themes of 2024

Memecoin Mania

The biggest trend of the year was memecoins and most of this activity took place on the Solana blockchain. This trend started gaining steam towards the end of 2023 and really took off in March of 2024 as coins like WIF received listings from Robinhood, creating a huge speculative boom across memecoins as whole. The core premise? Mostcrypto token performance is a function of attention, and memecoins allow you to speculate on attention without the overhang of “fundamentals” and “teams.” When combined with an anti-crypto regulator in the U.S., the market turned to memecoins as a way to speculate on crypto assets.

We expect the memecoin market to make a resurgence in 2025.

DeFi Renaissance

Memecoins led the way up until Q4. With the US having its first pro-crypto president, there was a much greater appetite for fundamentally strong protocols as the regulatory overhang was lightened. The launch of World Liberty Financial and the Hyperliquid airdrop also reminded the market about the value of strong DeFi projects like HYPE, AAVE, etc. Memecoin market participants also realized that perhaps “mass retail” wasn’t going to be coming to buy their overvalued memecoins and may instead opt for entirely new coins (such as the “Chillguy” coin which went to $500 million market cap in a matter of days) or focus on their favorite coins from last cycle such as XRP and DOGE.

We expect DeFi to become a hot sub-sector of crypto again in 2025, driven both by projects building on the Hyperliquid layer 1 blockchain and new institutional interest in the well established “blue chip” protocols.

Artificial Intelligence x Crypto

In Q4 we also saw a proliferation of coins for AI agents, brought to life by Truth Terminal and GOAT. The context: an AI agent (essentially a software program with pre-defined set of tasks) was launched on Twitter by a researcher named Andy Ayrey. The bot, known as “Truth Terminal” tweets out low brow / outrageous comments that, in combination with the rise in value of its token, made it go viral. This drove a ton of speculation around AI agents, agent infrastructure, and the ways AI-wannabe tech interacts with crypto. Base and Solana have dominated the AI field. Virtuals and ai16z are the most notable of the bunch, but there have been tons of projects in the sub $100M range for those who are trading.

Security

Losses from crypto hacks are ~$2.2b so far in 2024, a 40% increase YoY.

Access control vulnerabilities were the most common attack vector, overtaking software code bugs since 2023. This reflects a trend towards increasingly sophisticated targeted attacks against team members, often involving real world interactions (e.g. phony job interviews).

The biggest targets were exchanges, with DMM Bitcoin and WazirX each losing several hundred million dollars; followed by bridges. In DeFi security, smart contracts from reputable protocols have proven to be robust, so attackers have been more aggressive at targeting web2 infrastructure (DNS, CDNs, fake paid search links) to execute frontend attacks.

As for the perpetrators, the majority of value is believed to have been stolen by DPRK linked groups. Hacks linked to North Korea more than doubled from a year ago, to a record high of $1.3 billion in 2024 according to Chainanalysis. Cybercrime remains an important tool to evade international sanctions.

As the threat landscape evolves, here’s our top tips for staying safe:

Use a hardware wallet.

Diversify. Keep funds on multiple wallets, don’t concentrate funds in a single token or protocol (including Layer 1/2s).

Secure the majority of your portfolio with multi-sig (Gnosis Safe on EVM).

Learn how to read a transaction on your hardware wallet (or simulation on Gnosis Safe) before signing, so you can avoid malicious transactions.

Have a separate device (not a smartphone!) only for crypto transactions.

Prefer battle tested protocols with top tier auditors e.g. Aave, and prefer fully decentralized protocols with no “admin keys” or similar team access.

Be cautious when interacting with protocols which use off-chain components. This applies mainly to bridges. Send smaller test transactions first and limit your maximum tranche size when bridging.

Also be cautious with newer protocols and when the team still retains admin controls. If the upside justifies the higher risk, then limit your total exposure (separate wallet with small portion of portfolio). If there’s no significant upside, avoid. Also beware of low-effort forks (this is why we don’t “farm” the 21st Compound/Aave fork on the 39th chain).

(Telegram) trading bots. Not Your Keys, Not Your Coins. You’re trading convenience for security. You can improve your security posture by moving your tokens back to your private wallet as soon as possible after swapping. Don’t invest what you can’t afford to lose, and beware of headwinds from high trading fees.

Improve your discernment. X accounts of prominent influencers get hacked. Some data on block explorers can be spoofed. If you have a profile in crypto, a hacker might pose as a potential employer or investor to steal your assets. Everyone needs to strive to be better at discerning real from fake and noticing red flags. Stay humble, stay curious, and good luck!

Key Events

Q1 2024

It was an auspicious start to the year in crypto. Bitcoin was trading at ~$44,000 ahead of the hotly anticipated Bitcoin spot ETFs launch (January 11). Q1 was the most bullish period in crypto since 2021.

After a month of extensive testing, we were pleased to recommend farming a relatively unknown perps DEX called Hyperliquid. This proved to be our most valuable post of the year. Many of you earned a six figure US Trash Token airdrop.

The protocol and the airdrop exceeded our modest expectations:

“DeFi team have a bet on whether our farming returns will cover the rent on a NYC apartment.”

One airdrop turned into 3 (bonus PURR cat coin drop in May, extra NFT drop for the top 5,000 wallets). Points season was extended 3 times. And HYPE token FDV flipped FTX’s peak valuation (~$30b) after pulling a 10x within 3 weeks of TGE.

We’ve a few “diamond” league farmers in the DMs who received seven figures of airdrops and so could now buy an NYC apartment.

Congrats to everyone who took action!

Don’t forget to secure the bag!

Q2 2024

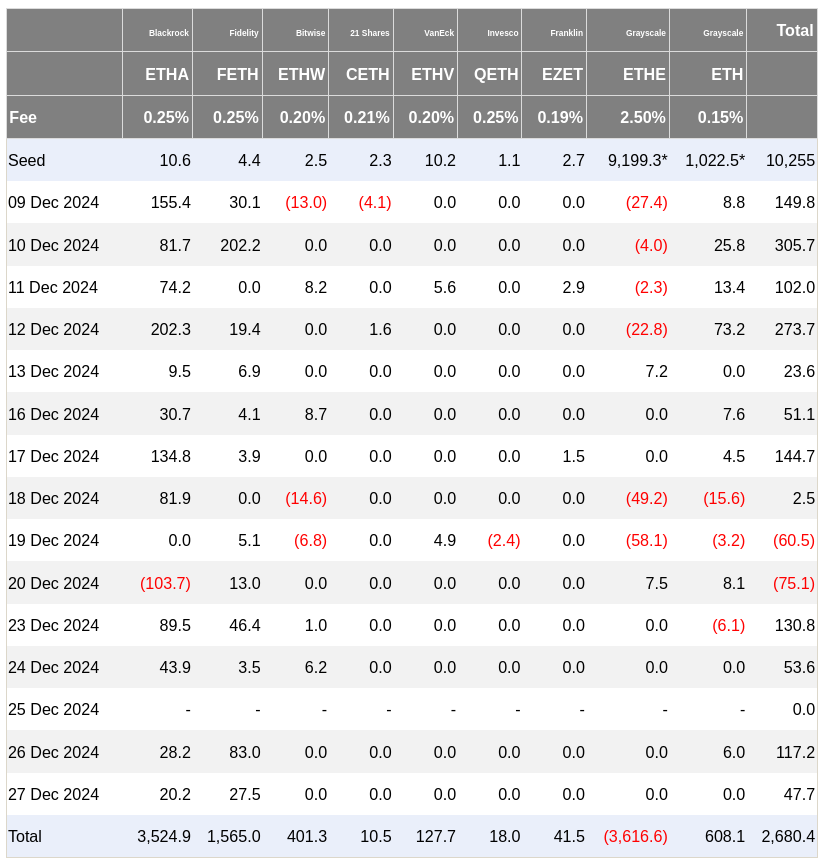

March 12-13 proved to be the H1 market top, and Bitcoin’s much-anticipated halving occurred on April 19. Ethereum spot ETFs were finally approved on May 23, after long delays which tested the conviction of some participants. The ETFs did in fact turn out to be “sell the news” events and BTC failed to make a meaningful break of last cycle’s all-time highs.

Q3 2024

A brutal crypto summer saw Bitcoin erase its entire post-ETF launch gains by August. Many alts were down > 60% from March peaks. The Ether ETF launch proved to be a “sell the news” event as billions of dollars trapped in the Grayscale ETHE fund hit the market and found few willing buyers. Post launch, Ether crashed from $3,500 down to the eventual Q3 low of ~$2,100.

DeFi Education readers were marked safe from the most violent few days of the crash with a timely warning: Entering the Bearhole.

And yet, the summer still provided abundant opportunity if you were looking. Onchain memecoins on Solana were still experiencing a lot of volume, and there were multiple new launches that went from zero to over $100 million market cap. Many of the memecoin winners from this period such as Fwog, Neiro, and Moo Deng are still alive and kicking. A number of coins on Base continued to bleed out, allowing those with conviction and insight into the chain to pick up AI and memes at cheap valuations to profit in Q4.

Q4 2024

Bitcoin finally recovered to new highs in October (study seasonality).

Q4 was dominated by a massive repricing of cryptoassets following the election of Donald Trump. Shortly after November 5th, Hyperliquid announced its TGE. A new hope for crypto markets under a pro-crypto administration opened the playing field from memes to DeFi, AI, DeSci, and some infrastructure. Founders became more willing to take risk and launch tokens, and we anticipate this trend to continue going into 2025. The stage has been set for a true crypto bull market that supports public altcoin markets in 2025.

Lessons from 2024

Study Seasonality

How does crypto *typically* perform during summer (don’t look this up…yet).

Thought of your answer? Write it down somewhere. Then put a confidence score - how sure are you that you’re right? (e.g. scale of 1-5)

Now look at the data.

While there might be years which don’t conform to typical trends (such as when you get multibillion dollar TradFi inflows for the first time), you can and should lean on seasonality in crypto.

This leads nicely to our second point.

Plan Your Trade / Investment

It’s better to plan than to react. What will you do if the market outperforms your expectations in a short period of time? Going into the March high some of us took off all leveraged exposure to majors, but kept spot. If you’ve a good track record for timing the market (a couple of trades/year) or have a very large position relative to your risk tolerance, you’re setting yourself up for stress and sub-par performance if you don’t trade around your position on the few obvious signals each year.

For others, you’re better not monitoring price performance *at all* and simply aim to take profits at (or more realistically, some short time after) the cycle top.

You’ll decide (preferably in advance) how actively to manage your position based on considerations like your tax structure (long vs short term capital gains), how involved you are with crypto markets, and your level of skill/talent as shown by your track record. A general rule of thumb is that performance of majors follows the market cycle / business cycle, but altcoins are more fickle with key sectors falling in and out of fashion quickly (weeks to months rather than years).

If you’ve decided to be “hands off”, then you’ll endure many large drawdowns (e.g. you’ll hold ETH from $1,800 to $4,000 back to $2,100 and will still hold as it goes back to $4,000 and down again to $3,150. We hope you’re getting good staking / farming yield on hands off investments as either your core thesis will play out over years, or you’ll be stuck with a loss as attention moves on. If you’re hands off, prioritize diversification to reduce the risk that the ~4 coins you picked are the laggards, unchanged over a year while seemingly every other coin is up!

If you’ve decided to be more “hands on”, you’ll rebalance your portfolio more frequently, taking some risk off existing positions to fund new speculative bets. This is great when it works (you won’t be bagholding coins for months or dealing with 50% drawdowns on your whole portfolio) but it comes at a price. You’ll need to commit much more time to researching crypto, monitor markets frequently, and the high turnover can be a drag on your returns if you don’t time the rotations accurately.

In our opinion the key is to decide what you are going to do ahead of time. What’s your strategy for majors? (hold until end of cycle, until major key level/catalyst when you rotate more to alts, etc) How will you play alts? Hold for “10 baggers” on smaller position sizes, or take more concentrated positions but sell half at a double? You can always make small adjustments to your plan, but if you don’t have a plan then it’s easy to get lost in the counterfactuals and always feel like your position is wrong.

tl;dr - many crypto investors didn’t make money between the March record highs and the November record highs. Many sold during painful summer drawdowns.

We recommend you make a plan which aligns with an honest appraisal of your abilities and play to your strengths. If you’ve a favourable tax condition and are decent at timing intermediate (multi month) tops then it doesn’t make sense to sit through 50% drawdowns. If you are busy and automatically buying more crypto every month, don’t waste your time checking prices daily.

Product Selection and the Risk Curve

If the Street is getting set up to buy Bitcoin, then buy Bitcoin. We got ahead of ourselves selling most of our BTC exposure into ETH (for later cycle outperformance) around 0.052 ETH/BTC ratio. Once the market showed its hand it made sense to rotate back into BTC. In the end, you have to decide what your time horizon is. The institutional bid was Bitcoin and we overestimated market efficiency in pricing that in.

Ethereum has historically performed well in Q1, and recent ETF flows have been firm.

Concluding Thoughts

If you’re reading this, you’re still early.

Everyone needs to have some stake in the future of crypto or risk being left behind.

With permissionless money receiving the stamp of approval from the gatekeepers of society we expect unprecedented growth in the year to come.

This is the right time to get a foothold, find your niche, and make the most of the opportunities before they’re competed away.

For the last 3 years we’ve consistently helped our subscribers avoid big risks (hacks and the fake ‘DeFi’ companies which all went bankrupt) and capitalize on opportunities from timing the bottom of the bear market, making the bull case for Coinbase stock when the market believed the SEC would regulate them out of existence, and discovering the next 100x projects like Hyperliquid.

Join us for another wild year…

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

We now have a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

“Hyperliquid’s successful launch) that projects will need to offer liquidity to the public earlier and at fairer valuations in the future. More opportunity for you.”

Network effects will congeal around projects who recognize this. This will be one of the biggest edges those projects will have.

Anyone who can help projects achieve this will be well rewarded. <cough> <cough>

I own a ton of ETH but don’t farm or stake. Can you critique my thought process please?

1) staking is low APR and it seems like there is risk involved. Not sure added risk is worth 3 percent?

2) same thoughts for farming but with added risk and added time and attention involvement. If you were going to farm with ETh where could I educate myself on that?

Thanks!