Welcome Avatar!

Bitcoin is up a whopping 37.5% in the last 7 days and up 67% since we first informed paid subscribers about buying back in November 2022.

It’s a commonly held view (and frequent enough occurrence) that when Bitcoin sees an aggressive run, it sets the stage for a rotation into altcoins. People expect that others will chase after coins again from their BTC profits, so they chase after coins in advance.

To top it off, one of the most anticipated tokens in crypto is launching via airdrop next week. This airdrop has brought a ton of attention back to crypto. A lot of people will be firing up their dormant wallets to nab these tokens as soon as they’re available.

It will be a momentous occasion for Arbitrum. For the airdrop receivers. Even for the bridges people use.

But will it be good for you, the prudent investor-trader hunting for altcoin opportunities?

There are certainly many people who would like you to think so.

Maybe they truly believe it, maybe they don’t and are talking their book.

Either way - you’re here to find out what we believe.

And we’re not convinced.

We will take a contrarian stance here and give you our reasons why you should not ape into a bunch of altcoins despite Bitcoin’s rally.

We have a lot to cover and it’s all mission critical. Here are the topics:

Market expectations for altcoins (free)

DeFi Education’s expectations for altcoins

DeFi Education proposes a Short (!)

Altcoin performance update

Update on majors / DCA

Why the Market is Expecting an Alt Season

The first and easiest answer is.. Majors are up huge!

There is a general sentiment that if BTC goes up a lot, some people use their profits to make trades on altcoins. Some feel this has already been validated since many alts are up huge on a dollar basis. But remember that their performance has to be measured relative to the majors. We dive deeper on this week’s altcoin performance in our market update later in this post.

The second is Arbitrum, the gift that keeps on giving. It’s no surprise that Arbitrum coins have done well - traders are expecting capital to flow into the Arbitrum ecosystem to chase the upcoming airdrop. Some are expecting that the ARB token launch creates a “wealth effect” where capital stays in the ecosystem and trades around. In anticipation of people buying coins… People are buying coins. Yes that’s really it. Remember that markets are all about future expectations. With a lot of “tourist capital” having left the market, the remaining participants are piling on top of each other to capture any remaining alpha. This leads to much tighter “gameplay.”

Sidenote: a common misconception we’ve seen is the idea that an airdrop is billions of dollars falling from the sky. That is incorrect - you can’t just conjure money out of thin air by launching a token! If you could, we’d all be gazillionaires. That token needs to be supported by *liquidity* to have any value. If you have a billion tokens no one wants, any arbitrary price you attach to it is irrelevant.

Finally, the elephant in the room: people are expecting the Fed to pivot or at least pull back from its “warpath” against inflation (destroying asset prices).

Why do people believe the Fed would reverse course? The 30,000 foot view is that people think the trouble brewing in the banking sector from higher rates (detailed discussion here) is causing the Fed to take another look at the rate at which the raise rates. Bulls are predicting that further disruption in the U.S. financial system will occur and force the Fed to reverse tightening.

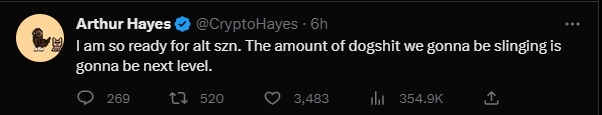

In addition to the above, some influential and well-capitalized people in crypto have stepped forward and volunteered themselves for a main character arc.

CZ and Balaji both made strides towards becoming crypto’s next main character.

Last week CZ said in a tweet he planned to buy $1 billion of BTC, BNB and other assets. This was around the time crypto began to run in a significant way (as banks went to zero!).

Yesterday, Balaji put out the “BitSignal” and made a $1 million bet on BTC being north of $1 million within 90 days. He also gave up to $1 million away in a giveaway for people who shine light on the current state of banking in the U.S. While this may have had some minor effect, we don’t think Balaji alone can move a market the size of Bitcoin just off his tweets. There are a confluence of factors at play here of which Balaji is one. We are thankful for his efforts in indirectly helping our crypto portfolios and respect his work on network states but respectfully disagree with him.

Besides, even if he was right you’d be better off buying and holding more Bitcoin (never a bad idea if not denominating in fiat) instead of buying a bunch of altcoins (exposure to high risk tech startups).

That should give you a good pulse on what everyone else is thinking,

We have our own views on how this is likely to play out and how we plan to manage our risk and maximize our upside. The rest of the post is for paid subscribers and covers:

Alt season + near-term macro

Shorting one of CT’s favorite tokens

Altcoin performance update

DCA update