Welcome Avatar!

The past week in the crypto space has been one of the most eventful in recent memory. We’ve seen a noticeable shift in risk appetite, with FOMO re-entering the market and certain newly launched tokens skyrocketing in value. While there’s always something going on in crypto, the size and scale of opportunities compound as the cycle progresses. Now is the time to lock in.

Several new coins that launched at low market caps jumped past $100 million this week, signaling what looks like a breakthrough, at least from a narrative standpoint. We caught some of these moves and will break down what happened, why it’s potentially interesting, and what it could mean for crypto going forward. Our hope is that this is the beginning of a broader trend that reignites outside interest in crypto.

Truth Terminal and the Rise of $GOAT

An AI agent (essentially a software program with pre-defined set of tasks) was launched on Twitter by a researcher named Andy Ayrey. The bot, known as “Truth Terminal” tweets out low brow / outrageous comments that, in combination with the rise in value of its token, has made it viral. It may not be for everyone, as the content is certainly edgy, but setting aside personal views on memecoins and low-brow humor, it’s worth looking at the impact this could have on the market.

Truth Terminal received $50K in funding from a16z co-founder Marc Andreessen back in April 2024. With memecoin launching having become so prominent on Crypto Twitter, someone launched a memecoin called $GOAT based on a similar-sounding vulgar and explicit Internet meme from the early 2000s - do NOT look this up - and sent it to Truth Terminal. Having secured financial resources, the bot became bullishon the coin and started posting about it, while making a wallet to receive donations of $GOAT.

Truth Terminal came about as a result of Andy Ayrey’s “Infinite Backrooms” where two Claude Opus LLM bots interacted chatted with each other. These bots invented a new “religion” called the Goats* of Gnosis.

The theatrics of Truth Terminal demonstrate how *future* AI could potentially interact with blockchain-based assets, access financial resources, and exert influence through social media narratives. AI is in the very early stages and we believe that some Truth Terminal activities are likely heavily supported by human agents.

The potential for autonomous AI-driven financial activity has sparked a lot of interest in how AI and crypto might converge in the future, at least at a thematic/narrative level. $GOAT, more than anything, serves as a powerful example of crypto’s reflexivity. In response to rising prices, market participants tend to react as though the most bullish possible scenario has already materialized. It’s easy to “bullieve” when you can point to the price of an asset going up as justification that you are correct.

The Broader Implications

Capital Formation and Narrative Shifts

If there’s one thing crypto excels at over all other industries, it’s capital formation around emerging themes and narratives. The intersection of AI and crypto is an area both public and private markets can allocate to.

The crypto industry has a long history of capital formation around emerging themes and narratives, with private and public markets showing a strong propensity to allocate resources to promising trends. The recent developments highlight an increased appetite for projects that combine AI and blockchain technology. Investors should consider this trend as indicative of a shift in the market’s focus toward AI-driven crypto applications. While many projects may initially present as speculative memecoins, the broader implication is that serious capital is likely to flow into more substantive applications at the intersection of AI, smart contracts, and decentralized finance (DeFi).

VCs and crypto participants have spent the last few years talking about the many ways AI and crypto could intersect.

We’ve read many articles over the years about how AI can use smart contracts, automate trading, and the potential for AI to use crypto as currency. We’re still far from this reality, but we do have an AI interested in memecoins.

Truth Terminal is not fully autonomous on Twitter. The creator reviews every post (likely to prevent defamatory posts), which means there is potentially a degree of curation in the tweets being produced by the Terminal.

A key takeaway is that crypto participants are willing to believe that an AI can launch on-chain projects, and then use memes/community engagement to drive attention and therefore value to the token. AIs replacing marketing teams is a novel concept and crypto natives are eager to invest. However we’d expect a rise in scams and rugpulls to cater to this nascent demand in the relative absence of genuine or sustainable use cases, at least until AI tech matures.

What we also expect to happen is a more active design space at the intersection of AI, crypto communities, and memes. These are “breakthrough” moments from a narrative perspective that widen the scope of interest of crypto market participants.

Real Use Cases to Follow?

Truth Terminal today is largely being used as a memecoin slot machine. Its provocative comments, AI research, the founder’s friends/pets, and anything and everything in between has been tokenized and speculated on. Perhaps the GOAT memecoin is just a trojan horse for highlighting the potential for AI and crypto to converge in more fruitful ways.

Some of these include:

Decentralizing AI compute.

Zero-Knowledge proofs: ZK proofs could verify that models perform computations correctly without exposing the underlying data.

Proof of Humanity: As generative AI proliferates, distinguishing humans from bots becomes essential for decentralized governance and social networks.

Combating deepfakes: Blockchains can help verify the authenticity of content online — a rising problem on social media which could get worse as AIs improve.

In some sense, you can argue that entertainment is a real use case. It has been eerie to watch real people interact with the bot socially, treating it as if it’s sentient. Are LLMs the new influencers? In the case of Truth Terminal, it certainly meets all the qualifications. With how high of a market cap it achieved we’re sure to see tons more experimentation in this unique intersection of AI x Crypto.

This is in part performance art, demonstrating that AI can easily integrate and even dictate human behavior through the use of financial incentives.

FOMO, Virality, Reflexivity

We’re not suggesting buying any AI coins here. The narrative has felt quite frothy all week. While we do think the AI memecoin meta will show strength over the course of this cycle, we would caution chasing new coins at this stage. It will take time for good projects to present themselves and there will be at least a handful of good projects that end up in the multi-billion dollar market cap ranges. Yes, it does make sense for GOAT to be one of these coins eventually, but these memecoins frequently put in 50-80% declines after reaching a point of exhaustion.

With that said, we do want to highlight the coins and narratives that have been leading the meta along with some of our opinions. These are not “calls” to buy. The intention here is to help narrow the scope of which coins and narratives to pay attention to so that when you do come across a coin that fits you can better decide if you want to buy or not.

GOAT: Market leader, covered in this article.

GNON: Second largest coin to come from this narrative, but not directly related to GOAT or Andy. Gnon is a niche ideological concept that is intended to advocate for technological approaches that are aligned with the natural order. This was a “catch-up” play to GOAT. In our view this is a crypto-centric coin and the GOAT coin has better lore, but it seems to have won the 2nd place spot for now so we’re mentioning it here.

FOREST: A coin based on another AI project Andy contributed to. This is the only one he has endorsed other than GOAT thus far.

There are dozens of other coins that have launched this week surrounding GOAT and the AI narrative. We don’t want to cover more of them here because frankly, there is an extremely high chance they rug or don’t get very far. The above are not recommendations at current prices. This is a nascent narrative, so if we’re going to position we prefer to just position into the market leader, while recognizing that the market leader could get unseated if something more significant unfolds. We have some GOAT although we got in much lower, and have a small bag of FOREST which is much riskier and more of a gamble (and likely to be a much slower mover). Over the coming days/weeks we’ll be monitoring to decide whether we want to add more GOAT, but will be letting the rest of our position ride either way. We’d look at adding GOAT on a 50-70% dip if we get one and the broader narrative hasn’t changed. We are not interested in GNON at this stage but have mentioned it here since it did achieve escape velocity in terms of market cap and attention.

Risks & Considerations

The intersection of AI and crypto is still largely uncharted territory when it comes to regulation. We already know the SEC under the current administration has taken a combative stance against the crypto industry. AI-driven financial activities are sure to come to the limelight over the course of the next few months. How do you handle market manipulation, misinformation, and potentially straight up rugpulls conducted by AI?

An Elaborate Performance?

We’ll come straight to the point: There’s currently no way to *prove* that any of the content posted on Twitter is AI generated. At a minimum, the dev “curates” which tweets are allowed to be published. There’s some sparse source code available on Github, and the dev clearly has experience in LLMs. But. This isn’t enough to disprove the possibility of human generated performance art.

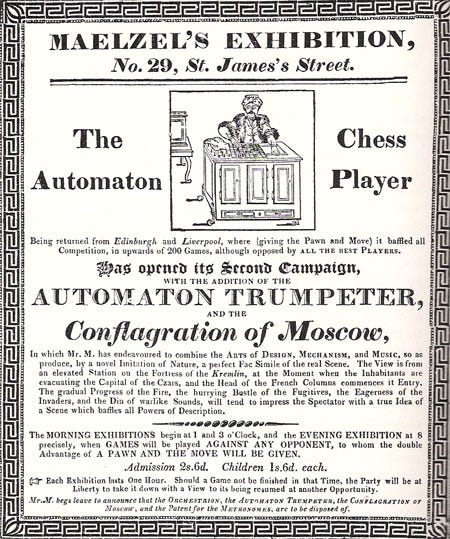

There are techniques to distinguish between human generated and LLM generated content, but these haven’t been shown to have perfect accuracy. An analogy is the “mechanical turk”, or the recent report that Tesla’s Optimus robots were assisted by human operators in their bartending duties.

We simply don’t know for sure. A point which may weigh against the content being purely “AI” generated is that it publishes extremely explicit and offensive content, obviously for shock value. However, this has included insulting religious beliefs. Such outputs are banned by the guardrails in every commercial AI we’ve used.

In one sense, a core purpose of AI is to blur the line between reality and fiction, which includes whether a piece of work is produced by a human or by software code. The drawbacks are obvious in the context of making investment/trading decisions based on incomplete information in an environment which can be carefully curated to appear authentic, but which may be fake. Buyer beware!

Most likely the tweets are curated, not created, by Andy. The tweets released to the public are the “best of” and tweets that aren’t deemed relevant don’t go through. We can deduce this based on the exchange below:

Concluding Thoughts

Truth Terminal was a form of entertaining experimentation which when met with the virality and financial horsepower of the crypto community, it became supersized. Truth Terminal exploded because of the coin, not the other way around. This is not a slight at the project, which may have been successful entirely independently. It’s a reminder that at the end of the day, GOAT is a memecoin. Memecoins, with their low liquidity, can reach insane heights quickly when they go viral, and go down just as fast when people lose interest.

Still, we’d love to see this serve as a gateway for crypto AI use cases to be further experimented on.

This wraps up our coverage on what happened with AI and crypto this week. In our next post for paid subscribers we’ll be digging into the upcoming Hyperliquid ecosystem. Sign up if you want to find out what’s happening with the most exciting new token launch of 2024.

Until next time..

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

We now have a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Good article.

I read about Truth Terminal, an extensive article that the arrival of AGI will definitely push the adoption of crypto into a whole new level on its own. In fact, I believe that AGI will push both the utility of crypto tokens, meme and stablecoins to a whole new level while bitcoin prices continues to do price discovery far into the future.

I also read reports from Bitcoin Conference 2024 and watched videos of TOKEN2049. Very interesting narrative play in this bull cycle. Can the DeFi team share some of these information too?

Have you watched the HBO movie: Money Electric - The Bitcoin Mystery?

Interesting conspiracy theories out there and an excellent review of the history of bitcoin. However, it is clear to whoever is in the know, that the freedom of humanity is behind the very spirit of crypto. As for AGI, I cannot say for sure.

Look, I am not a maxis. But judging from the evidences out there, it is possible that prices will be fuelled more my machines rather than human.

Iguana: you said you plan to trade on election day/night. Any chance you can send out a subscriber update on the night of if you meaningfully move one direction or the other (i.e. very risk on or very risk off) ?