Welcome Avatar!

We’ve been harping about “asset selection” in crypto for the better part of the last year. In today’s post we talk about exactly why it’s so important and how you can get an advantage by understanding this fundamental principle of markets.

The Importance of Asset Selection is Not Unique to Crypto

Back in the earlier days of crypto (2017), altcoins benefitted from an “everything goes up” phenomenon. This is not unique to crypto. In the early phases of an industry’s development, market participants benefit from broad exposure to the industry. Markets are less efficient, valuation is less understood, and the winners are not as established.

As an industry evolves, the market develops a view around the metrics that matter and capital increasingly flows to the best businesses. You can start to differentiate between winners and losers. These winners pull ahead, and the market becomes more fragmented.

Over time, the dominant players in a market are well known and overall industry growth is not enough to lift all boats. Broad exposure yields market-like returns, but generating “alpha” requires picking undervalued or overlooked names. Investor capital flows to the best businesses.

While crypto is far from mature, we have seen a number of signs that dominant players are capturing more capital while the remaining players underperform or die off. If you’ve been reading our paid newsletter you’ll know exactly which winners we’re referring to.

Market Breadth

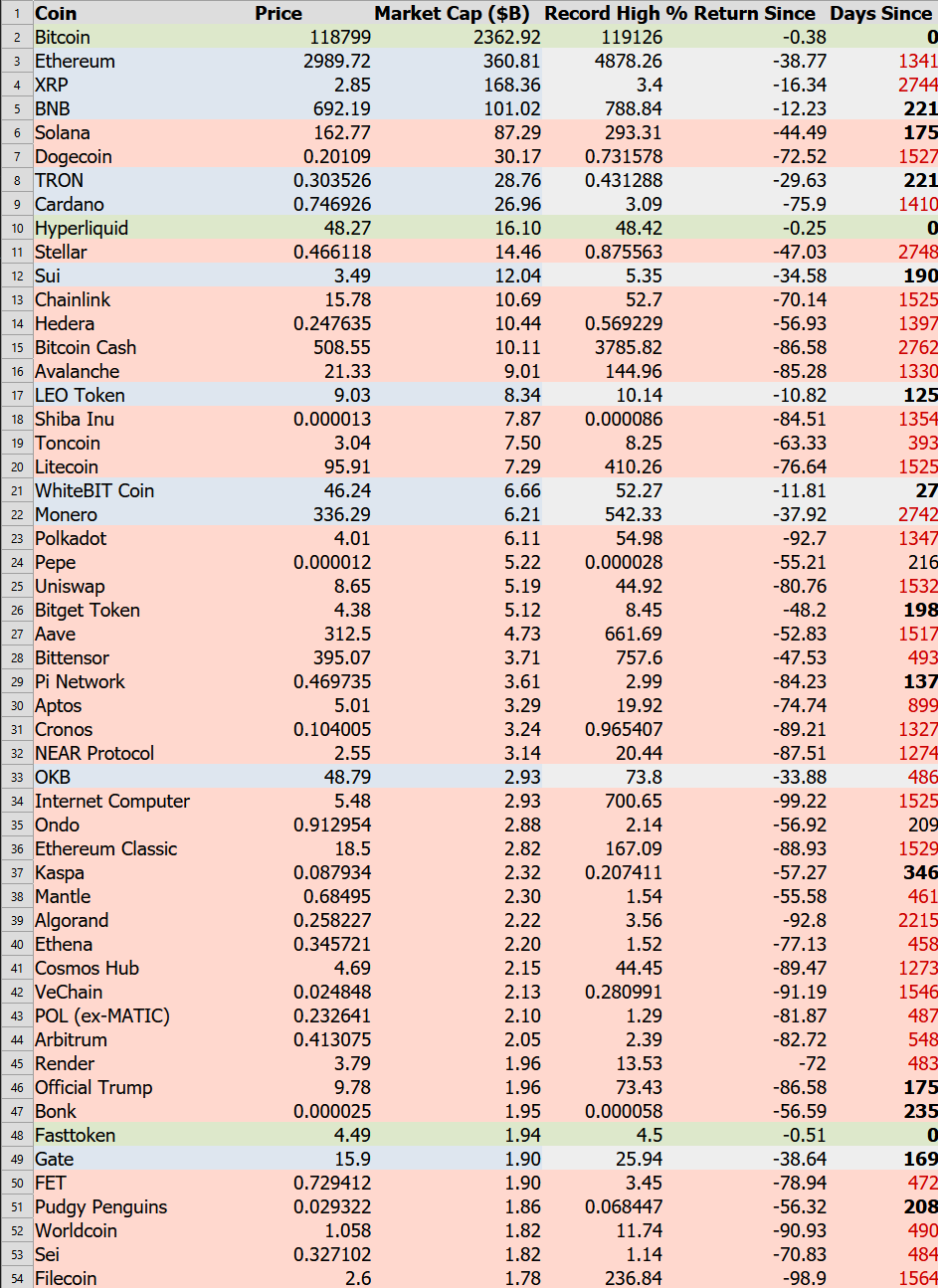

Below are the top ~50 coins by market cap courtesy of the Coingecko API.

We’re going to focus on a few key metrics:

Coins currently at record highs (green highlight)

Coins that made a record high in the last 12 months (bold if yes, red if not)

Coins which are trading worse than 40% below their record high (red highlight)

Summary:

Only three coins (6%) are at record highs: Bitcoin, Hyperliquid, Fasttoken

Only 15 coins (28%) made a record high in the last twelve months

Only 14 coins (26%) are down less than 40% from record highs

There are many overvalued coins with infinite VC unlocks in the top 50. We’ve favored a barbell approach:

Bitcoin and some select high cap altcoins with a strong, defensible thesis e.g. ETH or HYPE)

new coins, fair launch coins, small to micro cap coins with potential

The middle, which would include previous market leaders like Solana and Dogecoin, have shown poor returns after they’ve hit their peak mindshare. This makes sense when considering the sheer amount of capital required to “pump” large cap coins - although there’s risk appetite for crypto investments we’re seeing more capital rotation between hot coins and hot sectors rather than the “alt season” phenomena of prior cycles where all coins went up together. This reflects a maturing market.

The Good Part

Despite the glaringly obvious signs that asset selection is becoming increasingly important in crypto, most people still haven’t realized it. The average market participant is slow to adapt to new realities, which means you can get ahead by mastering the foundations. Since the inception of this publication we have preached understanding crypto with a “bottom up” approach to the industry. 4 years later as crypto becomes a playground for major institutions, everyone is catching up to the importance of fundamental analysis.

In this next section we’ll talk about how you can combine the concepts of asset selection, fundamental analysis, trading, and markets knowledge to develop a number of profitable trades around the same coin and event.

Finding Alpha in Event Driven Situations

Major events like the launch of popular new coins provide an opportunity to profit from higher participation and emotional/FOMO traders. For paid subscribers we put out a pre-launch scenario analysis on the PUMP token. Below you can see how we played it and the setups we got involved in.

1. Bonk Beta

Before the launch we wrote:

Recent market share metrics also illustrate that LetsBonkFun (the launchpad associated with memecoin BONK) has significantly eaten into Pump’s market share.

and in our trade suggestions section:

If PUMP outperforms expectations BONK ($2b FDV) is a potential catch up trade

There is a lot of uncertainty surrounding a new coin launch. Markets are typically volatile (30-50% swings in a few hours are common) and illiquid. This limits the position size you can use. An amateur might think that Pump was the better buy than Bonk because the former had a larger percentage gain on the day. A professional can potentially realize a larger profit, on more size, while taking less risk in the BONK product based on taking a catch up trade.

BONK has a similar product/tech stack, is eating into Pump’s market share enough to be considered a competitor, was trading at half of Pump’s ICO valuation, and has a known historical volatility profile. Although past price performance is not necessarily predictive of future results, future volatility tends to correlate extremely well with volatility in the recent past. Whether you are using quantitative or qualitative methods to assess market volatility you need a trading history to do so which you simply do not have with a new coin.

We felt being positioned long BONK gave a greater margin of safety to cut the trade without significant loss if the PUMP launch was a complete flop, while allowing good upside participation if the launch exceeded expectations. BONK is also quite liquid and the known volatility profile and lower assumed downside risk allows more size. BONK rose from ~22 on launch day to ~40 today providing solid returns, including for traders who pre-positioned the day before the pump launch.

2. Arbitrage Opportunity

If you’re in the US or did not KYC on specific exchanges there was no way to make money directly on this, but it is still useful to know what other participants are doing because it impacts the market. Arbitrage was almost certainly responsible for the rapid dip on premarkets prior to official launch, so understanding the dynamic can help you avoid being spooked by large selling on perps ahead of launch.

While the public sale was still open (to KYC’d participants only, via centralized exchanges) it was possible to invest in the token at a $4b valuation. On no-KYC venues, for example the permissionless DeFi exchange Hyperliquid, pre-markets for the token were trading above $4b. The trade is simple (if sufficiently capitalized to avoid liquidation during a volatile token launch):

Buy the ICO at $4b

while simultaneously short selling premarket perpetual futures on Hyperliquid in the same quantity

wait for your spot ICO tokens to be unlocked

sell the spot ICO tokens on a DEX

while simultaneously closing your short perpetual futures position

You should always know the reason you’re should get paid for a trade. In this case, investors who did not KYC had to pay a premium to market makers to get exposure to the token on a non-KYC venue. If you have access to both you can provide a service to other market participants in exchange for profit.

This opportunity is almost too obvious to write about - everyone should now be familiar with arbitrages in the less efficient DeFi markets. Whether CEX<>DEX or cross-chain when the same asset trades at different prices across venues (violating the law of one price), there is a profit opportunity. Arbitrages occur somewhat regularly in crypto, so it makes sense to focus on the opportunities where you will face less competition. If you’re not building out your own automated trading infrastructure then it makes sense to focus on manual opportunities, which occur during conditions where automation runs out of capacity or isn’t switched on (think new coin launches, mass liquidations, exchange withdrawal bottlenecks, etc).

Caveat: ByBit Issues

In an unregulated space like crypto, it’s important to consider all the different ways you could potentially get hurt. Users of ByBit reported sending capital to the Pump ICO and later being told that they did not receive an allocation.

Most users likely expected that they had been filled because the order was put in and later refunded. The volatility resulting from the launch and illiquidity of the perps market made it such that a 10 minute delay could result in a significant loss.

Risk management is how you prevent the unknowns of a trade from delivering significant losses, and becomes even more critical when employing more complex strategies like arbing a new launch.

3. Trading Against Uninformed Counterparties

Trading is highly adversarial and your competition are some of the smartest and well capitalized entities on the planet. For the majority of people and the majority of the time the best trade is not to trade. Every time you buy, someone has to sell to you, and it’s challenging to know whether the seller - your counterparty - knows more about the fair price of the asset than you do.

Of course markets are only driven partially by fundamentals. Knowledge and estimates of flow and future flow are relevant considerations. It’s sometimes valid to buy an asset at an overvalue if you have a strong prediction you can sell it at an ever more inflated value to a ‘greater fool’.

In an ideal world, when you trade, you want to trade against an uninformed counterparty. Someone who is likely to lose money on their trade. At minimum you want to trade with someone who is just guessing about the asset price. If your counterparty has better information than you, this increases the odds that you’ve done a bad trade (depending on your hold time).

Trading against guessers and gamblers avoids the losses incurred when trading with informed participants, which is why retail can trade at Robinhood for free and why top hedge funds pay to take the other side of their orders (payment for order flow, PFOF).

How does this relate to PUMP?

The launch was very well advertised. Distribution was good. The public had the opportunity to buy in at $4b. The non-KYC’d public had the ability to buy in around $5b. Billions of dollars were filled at these prices. Then the official launch occurred and the market traded for 4, 5, 6, 7 hours with derivatives listed on Tier 1 CEX. Who has an opportunity to buy a coin at $4b, $5b… and waits hours and hours and eventually buys $7b due to fear of missing out? Not a smart counterparty.

We’ve run through the fundamentals and the launch structure in the pre-launch analysis, and we made the point that crypto participants are increasingly cynical and looking for a quick return rather than being willing to invest in coins for the long term.

If ICO participants have a cost basis of $4b and are looking for a quick flip (e.g. with a target of doubling their money), where is the sell pressure likely to start? $8b is a good guess. And with sophisticated participants having a lot of size to move and gaming out that others may front run, you can expect those offers to “step down” a little to ensure they are filled. Competitively. Add the logic that everyone has already had an opportunity to buy at lower valuations and you’re left with a conclusion that the marginal buyer at $7b is probably not a smart counterparty. Either they’re being forced to cover due to overleveraged shorting, or they didn’t execute a buy plan at sensible valuations but instead waited to overpay nearly double for the same asset on the same day when nothing had changed fundamentally (we covered in our previous post why this was not the same case as the HYPE launch).

We were happy to “lean on” what we assumed would be a large stack of *real* offers up to $8 billion (you can check the order books but be aware of “spoof” orders). And go short the market a couple of times around the $7b area, front running a large amount of assumed future supply combined with what we think was a small amount of marginal future demand (recalling we’d assessed buyers as “dumb” at this point and there’s not a lot of dumb money by definition).

Short selling is a professional activity and not suitable for all investors. However you can use the information on the locations which present good risk/reward setups for shorting to simply take profit on your long positions (if you bought any).

Pump topped out at ~$7.2b on DEX and has traded down to $5.6b over the following day. There were a few opportunities to enter shorts for 10-15% returns leaning on others wanting/needing to sell. See our prior post and real time commentary for more color on this.

That’s all for today! If you enjoyed this post and want access to our analysis before the rest of the market catches up, subscribe to our paid substack.

Until next time..

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

We now have a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Thanks for another timely post. With most alts flying last couple of weeks, good reminder to be selective.

Has the recent price action and ETH flows changed your guys view on summer chop?

Raise your subscription price.