Welcome Avatar!

Over the years of running this publication we have seen thousands of crypto market participants enter, leave, and re-enter the crypto market. People wait for prices to go up to get interested in crypto, and they leave when prices go down. We have come to accept this as a natural part of the human experience. It’s sufficient to say that success in markets over a long period of time is inherently unnatural. Trading and investing because of emotional response is how you consistently underperform. Today we’ll talk about how to best allocate your time as a busy professional, business owner, or portfolio manager to maximize your gains from crypto across cycles.

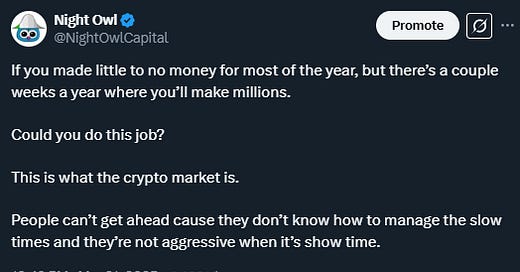

An Objective Look at Crypto Markets

We recently tweeted the above to highlight the nature of crypto market returns — long periods of sideways or declining price, followed by explosive rallies that account for most of the upside. A quick look at the Bitcoin chart is all you need to verify this.

As recently as 2024, Bitcoin topped in March then chopped for a whopping 241 days before making new highs in November. Bitcoin then put in a 50% move in just one month before topping again. This pattern has played out across Bitcoin’s history — a few weeks of gains provide nearly all of the returns. For example, in 2021 – a massive bull market year – if you held Bitcoin only on the 10 best-performing days of the year, the cumulative return would have been about +179%, whereas holding for the other 355 days yielded –43% (negative).

This price performance has been the primary reason investors have been told to “HODL.” Unless you’re exceptional at timing the market, you’re likely to miss out on all of the gains Bitcoin offers.

Drivers of Crypto Market Activity

This posits an obvious question: why does this occur? Bitcoin does not have traditional fundamentals. It’s not used as an input for production like other commodities and doesn’t have cash flows like a company. The core demand is speculative in nature — investors are constantly asking themselves what could the asset be used for in the future and at what scale?

As a result major shifts in price coincide with strong, easily identifiable catalysts and narratives. These include:

Halving cycles (less important today)

Institutional adoption (pension funds, accessibility in retirement accounts, ETFs, etc)

Regulatory changes (bans, endorsements, use as legal tender, strategic reserve)

Global and US macro catalysts (Bitcoin used as an expression of risk appetite in the market, inflation hedge narrative, etc.)

A simple heuristic for which catalysts and narratives are important: it should be obvious. If the average retail investor can’t understand it, it’s probably not that important. The most simple narratives have provided the most explosive booms. Examples include:

Tesla buys Bitcoin

Bitcoin ETF

Pro-crypto President and Strategic Bitcoin Reserve

Recession fears

Money printing

Bitcoin, while technically complex, is a simple asset. If you need a 200 IQ to understand a narrative, it’s probably not that important.

But.. US Equities Correlation

Perhaps the biggest critique against Bitcoin’s “Store of value” narrative is that it is largely treated as a high-risk asset by many investors. Bitcoin’s behavior has shifted over 2020–2025 from an initially uncorrelated asset to one often moving in tandem with U.S. equities during market extremes. Periods of high Bitcoin volatility have generally coincided with a strong positive correlation to stocks (e.g. the S&P 500). BTC historically rallied during periods of high risk appetite (e.g. during quantitative easing) and sold off when this appetite evaporates (e.g. rate hikes).

Data indicates that declining Bitcoin volatility has sometimes coincided with lower equity correlation, but not consistently enough to declare a permanent regime change. When Bitcoin was quiet and range-bound (low vol), it wasn’t as tied to stocks, and participants focused on crypto-specific drivers such as the ones we listed above.

The bet you are making from a fundamental perspective on Bitcoin is that eventually investors view it less as a risk-on asset and start viewing it as an asset they flee to during periods of chaos. With only a 15 year history compared to the centuries of history that gold has, it’s going to take more time before Bitcoin is used as a true safe haven asset by institutions. There are signs that Bitcoin is slowly maturing into a more independent asset class, such as a rising gold correlation in late 2023. Our view is that Bitcoin needs to perform well under market crisis situations to cement itself as a gold-like asset.

How to Play It

For many of our long-time readers this is review. What matters is how you actually engage with the market and generate value for your portfolio taking the market dynamics into account. Last summer we began to advocate for a more actively managed strategy. Here’s why:

There are long periods in between crypto’s outperformance

Crypto majors are now easily accessible by anyone who wants to buy from retail to institutions

To continue to outperform going forward, you have to better understand the altcoin marekt

There is a case to be made for less HODLing and more trading — if you have the skills and time for it

For example, during 2024’s 8 month chop you had the following opportunities staring at you all year:

Farming Hyperliquid (as shared by DeFi Ed all year)

Onchain memecoins

Select outperformance in tokens of fundamentally solid projects (Aave, Aerodrome)

In 2023 you had the beginning of the memecoin meta, the launch of Pepe which ran to multi-billion dollar market caps, and the ability to buy SOL at low valuations. In 2022 most of the opportunity was in shorting (or simply avoiding) the crypto market and buying the cycle lows in November.

The challenge we believe market participants today are facing is that they want to be paid for being early, but there is no one left to frontrun. Your edge in the 2017 cycle was being early to a largely unregulated space with limited infrastructure for people to buy. Halvings were also still relevant at this time. In the 2021 cycle, your edge was that people didn’t quite understand how to analyze crypto assets and you could simply frontrun speculative flows into a broad range of assets (DeFi, NFTs, gaming/metaverse, various L1 tokens). In the 2024 cycle you had to get good at asset selection. It is no longer enough to expect an “alt season” where money flows into every single coin. Now, you have to be able to identify which coins to buy and when, and then recognize both broader market froth and overvaluation for single names.

The rewards for being good at asset selection continue to increase with opportunities like HYPE resulting in a multi-billion dollar wealth generation event for their users. The downside of being stuck in underperforming assets becomes more costly as you consistently end up with less BTC.

We believe the opportunity set continues to improve as crypto continues on its path of adoption and rising credibility across the world. This also means it will become increasingly competitive as there are larger players looking to benefit. However, the vast majority of these players are still unable to participate in onchain activities at scale, which means there is still meaningful asymmetry and edge from being a retail participant.

A Framework for Approaching Crypto

We arrive at a high level framework for approaching crypto that takes all the above into account.

Bitcoin continues to be the barometer for success in crypto. BTC is the benchmark asset

During periods where Bitcoin is range-bound, you want to be looking for opportunities to farm new projects, buying Bitcoin after significant liquidation events, and for those with more time to allocate to crypto work on developing a unique market edge.

Maintain a running list of the dominant catalysts and narratives impacting crypto. For example, the major themes today are the bitcoin reserve, an upcoming regulatory framework for crypto assets, Fed Reserve policy, recession expectations, Trump’s commentary and Michael Saylor’s BTC purchases. Start developing your own views on the market so that you can arrive at unique angles.

Monitor public crypto sources for altcoins opportunities. If there is a major opportunity it is discussed on DeFi Ed, but we tend to avoid short-term trades given the format. The big opportunities are almost always the ones you will see talked about frequently but feel that you are “too late.”

Identifying periods of froth and recognizing that these are the times to start selling not start buying. We will expand on this in an upcoming post, but if you have been in crypto for some time you should be able to identify “top signals” and at minimum know when to stop buying.

In an upcoming post for paid subscribers we will be highlighting our most recent framework for discovering, analyzing, and entering/exiting altcoin positions with the goal of outperforming BTC. If you’re new here subscribe for full access to future articles.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

We now have a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Hi DeFi Team,

Thank you for the valuable write-up.

We can see that bitcoin will be consolidating for a while before making its next move. Are you still convinced to DCA between the price levels between $69k to $75k, or have you guys adjusted to higher levels for example, $75k to $82k?

What about those upcoming spot ETFs that will be eventually approved? Do you see any significance to accumulate these coins when prices drop further?

What AI plays do you guys see that will benefit from mass adoption?

Thank you.

@iguana can you please elaborate on your “this is financial advice” tweet?