Welcome Avatar!

When most people sign up for a crypto exchange, they’re not thinking about the financial health and risk of insolvency of the counterparty they’re dealing with. When you come from the world of traditional brokerages, you generally don’t need to worry about it. U.S. brokerages are highly regulated. If a brokerage fails, accounts are migrated to a different brokerage firm.

If you’ve been following crypto bankruptcies at all you know that having your assets on an exchange comes with risk. As we’ve stated numerous times, storing coins on an exchange would make you a general unsecured creditor in a bankruptcy.

The tweet above was proven out over the last year following the bankruptcies of Celsius, BlockFi and FTX.

To ensure we help our readers avoid catastrophe (or at least see it coming) and keep a pulse on everything that is going on in the crypto sector, we like to tune into Coinbase’s earnings calls. They just released their Q2 2023 earnings.

In today’s post we’ll take you through the most important aspects of what they reported and provide our commentary along the way.

Let’s see what is going on with crypto’s most trusted exchange.

Q2 Earnings at a Glance

Coinbase generated positive “Adjusted” EBITDA after reducing its recurring operating expenses by 50% in Q2 2023 vs. Q2 2022. Layoffs were a large component of their cost savings, with Coinbase ending Q2 with 3,400 employees - a 30% reduction in headcount year over year.

Unsurprisingly, trading volume has continued its downward trend due to the lower volatility environment in crypto. Transaction volume declined 13% from Q1 2023.

In an effort to stabilize the long-term business model (and perhaps cool market sentiment), management stated they are looking to expand beyond trading and double down on key crypto growth areas such as payments, messaging, and social apps. Coinbase wants its app and Coinbase Wallet to serve as the gateway for customers to access on-chain utility.

In Q2, Coinbase launched derivatives services in certain non-US jurisdictions. The company launched Bitcoin and Ethereum futures for non-US institutional investors through an API.

A key theme of the earnings call was regulation, with the current regulatory environment in the U.S. being a major obstacle for the growth of Coinbase. The company is trying to get case law created by pushing back on U.S. regulations. For what it’s worth, they certainly have the cash to fight.

On the call, CEO Brian Armstrong went as far as to say that some outliers in political leadership are engaging crypto outside the bounds of the law. This is a pretty aggressive stance for a CEO to take on an earnings call! Coinbase’s Chief Legal Officer Paul Grewal said they expect to win in their battle against the SEC, though we would take that with a grain of salt since this is uncharted territory.

Management urged signing up as a crypto advocate through standwithcrypto.org to push America to embrace crypto technology. We do not plan to be part of such a list, but we are happy to support the fight from the background (and with our Substack).

Another key theme has been cost and scalability, which Armstrong expects to be solved through Layer 2 solutions. He likened the transition to going from dial-up to broadband internet. Additional crypto utility will be enabled by and is reliant upon crypto’s ability to provide cheap and fast transactions. Only then is crypto a viable alternative to the existing financial system for the average individual.

The earnings call offered insight into where Coinbase management will be expending resources (both financial and human capital) in the years to come. These include:

Legal/regulatory battles

Expanding beyond trading

Managing costs

Expending substantial resources towards legal battles is rarely viewed as favorable. In the case of Coinbase however, they’re the only ones with the resources, regulatory relationships and “clout” to pull this off. Succeeding in the legal battle would unlock massive value for the crypto industry which, in turn, will generate value for Coinbase in the long run. Usually, you want management to expend their time on customers, product, operations, etc. The crypto industry has reached a point where regulations are the biggest hurdle standing in the way of all other progress.

How Does Coinbase Make Money?

Historically, the vast majority of Coinbase’s revenue came from crypto transactions from Coinbase retail traders. Coinbase facilitates transactions by matching buyers and sellers. This made Coinbase heavily reliant on high crypto prices and market volatility which disappears between crypto’s “bull runs”.

As you can imagine, Coinbase’s trading business has gone through a difficult period, with YTD Q2 transaction revenues falling 59% going from $1.7 billion in 2022 to $700 million in 2023.

Offsetting part of this decline has been the increase in interest income from Coinbase’s USDC revenue share. Despite a decline in USDC market cap quarter over quarter, Coinbase earned $240 million in revenue from interest income in Q2 2023. This income source now represents 31% of revenue for Coinbase compared to only 2% last year.

Bitcoin makes up a larger portion of the trading volume, increasing to 40% vs. 31% this time last year. Interest in trading alts rises and falls with broader crypto market sentiment.

Financial Results

Total revenue for Q2 2023 was $708 million, down 8% quarter-on-quarter. Net revenue was $663 million, down 10% quarter-on-quarter. The company reported a net loss of $97 million and Adjusted EBITDA of $194 million.

Despite management’s desire to expand beyond trading per the earnings release today, Coinbase continues to be a trading operation driven by retail. Retail traders pay much higher fees and compose 95% of trading revenue. Should Bitcoin and Ethereum ETFs receive approval, the custodial fee revenue should experience a substantial boost.

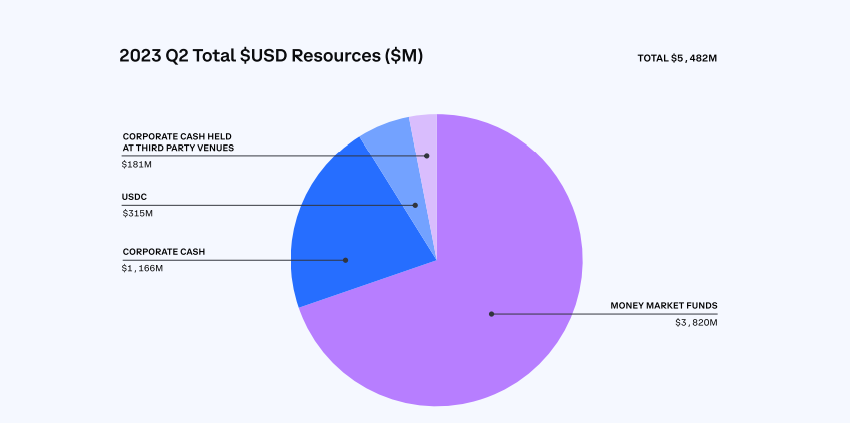

Coinbase has $5.2 billion in cash and cash equivalents and actually generated cash from operations in Q2. One year ago when the crypto market was crashing and everyone was writing about Coinbase going bankrupt, we wrote that Coinbase's bankruptcy risk was overblown. The company has stabilized its operations and minimized its cash burn, and still has over $5 billion in liquidity to manage further downside risk. The company has $3.4 billion in debt with the nearest maturity of $1.4 billion being 3 years away.

TLDR: Coinbase continues to be financially healthy.

With a more stable financial profile compared to one year ago, it would be a good time for Coinbase to get aggressive. They seem to be doing so by 1) fighting instead of folding on the U.S. regulatory battle 2) expanding overseas 3) building out institutional custody 4) building out their own blockchain network (BASE). We’d like to emphasize that these are all longer term fliers, and are unlikely to provide meaningful contribution to Coinbase’s bottom line in the near term.

Analysts are quite bearish on the company according to the estimates compiled by Bloomberg below.

However, bank analysts have historically misunderstood the crypto industry and are 3-6 months behind. They should just call us for insights next time at 1-800-CARTOON.

The company has been shedding costs aggressively. Even stock-based comp is roughly half of what it was last year, sitting at ~$200 million per quarter (~$240k/employee). Stock-base compensation has been of point of contention for Coinbase investors (and tech investors more broadly).

The primary threat to Coinbase’s prospects remains regulatory. We’ve provided detailed thoughts on this topic in this post.

For Q3 2023, Coinbase expects subscription and services revenue to be at least $300 million. They generated $110 million in trading revenue in July, so we can assume somewhere in the ~$300 million range unless it falls off a cliff for August and September. Coinbase anticipates technology & development and general & administrative expenses to be $575-625 million.

Concluding Thoughts

This is a relatively quick update because the earnings release was uneventful (if you’ve been following along with crypto). In the crypto market, uneventful is a good thing.

Here’s an important consideration: Coinbase is on a path to being the only game in town.

Binance is fighting a crackdown on its operations globally and may never have a meaningful U.S. operation again. FTX is gone, and “FTX 2.0” is not likely to gain ground against Coinbase in the U.S. for years to come, if at all. Gemini has small market share, and Kraken appears to be much weaker financially.

If there’s going to be a future for crypto in the U.S., who else has the market capture, consumer trust, brand, and war chest to challenge Coinbase’s dominant position?

Next week on August 9th, Coinbase’s L2 “Base” will be launching publicly. Developers have been building and testing since July.

In an upcoming post for paid subscribers, we’ll be covering Base in more detail.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

We now have a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Someone needs to tell coinbase that the 'three months ended June 30, trading volume by crypto asset, 2023' section in their 10Q doesn't foot to 100% and that a 'plz fix' is in order.