Welcome Avatar! This is the DeFi overview for beginners. In a sentence, banks are being replaced by software code as we speak. Long-term the vast majority of transactions will be done with smart contracts. Similar to how e-mail displaced the majority of snail mail, smart contracts will replace middlemen.

Big Picture

Up until DeFi became usable, Bitcoin and other major crypto currencies like Ethereum were *unproductive assets* in your portfolio. All you could do is buy and sell it or exchange it for goods and services. With smart contracts, you can now take loans against it *or* loan it out.

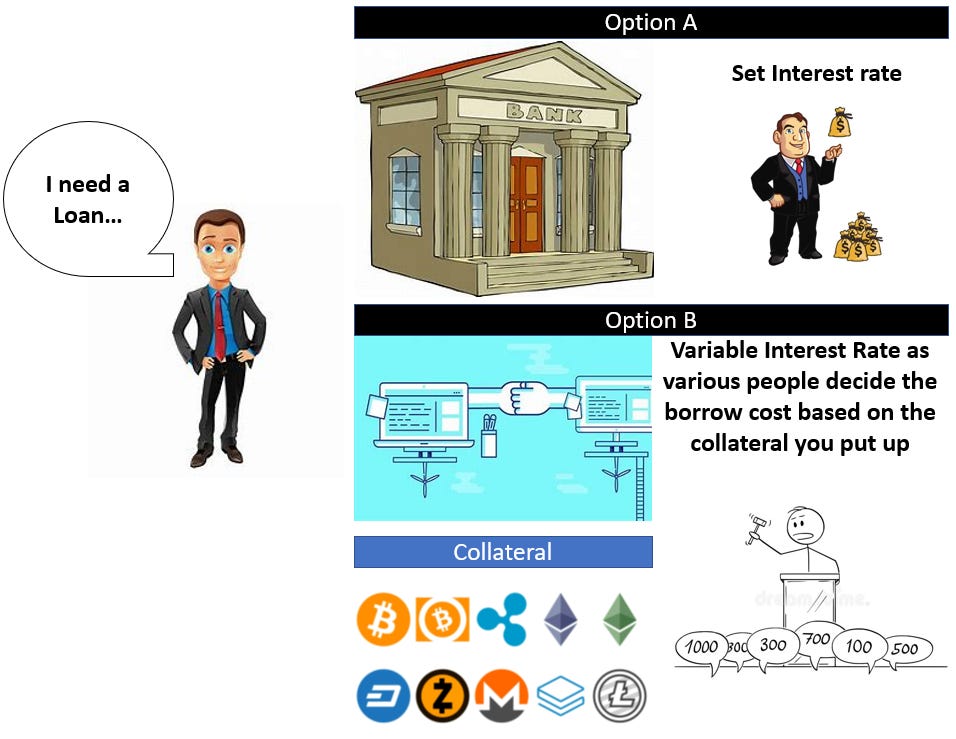

Collateralized Loan: Imagine a world where you could lend out money, knowing that there was collateral staked (avoid total loss). On the borrower side, imagine a world where you could take out a loan for stable coins (US Token) without interacting with a bank. This is what exists today.

Image Credit: Stably

This is quite important. We can look at simple examples of how this helps a crypto currency owner.

Example 1: Say you have a sudden $10K bill to pay (medical cost). Instead of selling part of your 4 BTC holding (current value as of June 18 around $140K), you want to pay the bill *and* have no taxable event. Congrats you now have an option! What you do is put your 4BTC up as collateral and borrow $20K. As long as you pay the $20K back and the price of BTC doesn’t drop significantly, you will successfully pay the expense, keep all your Bitcoins and avoid a taxable event. All 100% by the book.

Before DeFi you would be forced to sell part of your BTC, incur a taxable event and use that to pay the bills. If the price of BTC goes up you’re buying at higher prices to accumulate the exact same amount of BTC.

Example 2: Say you’re sitting on a bunch of crypto assets. You think that they will go up roughly the same. Just call them Token A and Token B. If you think Token A *and* Token B will *both* be up 10% over the next 12 months… you’re better off putting them into a liquidity pool and generating a yield. In basic terms, by putting the tokens into a liquidity pool you allow yourself to earn interest on the assets. If you held them alone, you would only see price appreciation. By putting them in a pool, you get a yield.

In a scenario where you think one token will go up massively and the other will not, you should *not* do that. You would suffer from impermanent loss (covered later).

Example 3 (Somewhat Futuristic): If you have a choice between fundraising from the entire world (7 billion plus people). Or. Fundraising from a few banks that charge a 7% commission, what are you going to do? We think you know the answer and that is one of the main reasons why we think DeFi is going to be extremely successful. The IPO fee of 7% due to “relationships” comes under direct attack.

Many companies would likely say “Well I don’t want random investors”. Great. You can put the issuance schedule in a smart contract. What you’re really saying is you don’t want them to suddenly sell everything on day one. What do you do? You go through an ICO for $10 a coin and make sure that people can only sell say 20% after 6 months, another 20% after a year etc. Now you’re attracting the client you wanted regardless of where they are and how much they are worth. No one really cares about the name of the person who owns their coin/shares. They care about long-term commitment.

Example 4 (Futuristic): Long-term the DeFi space and the NFT space will converge. What this means is that your digital art can be borrowed/lent. *More* importantly, physical assets will likely become smart contracts. For example, every single home in the USA is a NFT (non-fungible item). If we can replace paperwork with code, you can reduce friction and add an immense amount of value at the same time.

Thinking this through, if you look at interest rates… They will begin to vary. Someone who borrows $50,000 US Token against a home would likely pay a lower interest rate when compared to someone borrowing $50,000 US Token against a scam coin. Just like the real world. Dangerous collateral (pawn shops) would not have the same rate as safer collateral (stocks, homes, etc.).

All of this inefficiency could just be lines of code (the loan, the deed, the transfer of assets etc.). Currently too much red-tape to cut so it is more futuristic. Image from RocketLawyer.

Example 5 (Futuristic): If we know that all items can now be traded 24/7/365 why would the stock market be limited to a weekday trading schedule. It would mean that all assets could be freely traded 24/7/365 regardless of geography. The main issue here would be paperwork (all the regulations associated with buying/selling certain items). However… There is no reason it cannot be done.

Beginning of Evolution - Decentralized Exchanges (DEXes)

Currently, the vast majority of people use middlemen to acquires stocks or crypto currencies. They go to a specific place such as Coinbase to acquire their crypto assets and they go to a centralized broker like Fidelity to acquire stocks/bonds. Also. The central broker holds all of the assets. The only exception to this is really crypto where the smart people take their coins off of Coinbase/Kraken and move them to cold storage (run their own node, use a hardware wallet etc.).

Now why does this system exist in the first place. The reason it exists is that people need an easy place to exchange goods. We go to super markets for food, go to brokerage firms for stocks and go to drilling sites for oil. Some of these things cannot be decentralized. For example an apple farm cannot be decentralized (you need a place to grow all of the trees).

Now the fun begins! Why in the world do we need a centralized exchange to trade stock certificates? We do not. If you put all of these certificates onto the internet it is actually a lot easier. You can see buy and sell orders from every single person with an internet connection. The only reason this doesn’t work right now is due to regulations.

If you think about crypto, there is absolutely no need for a Centralized Exchange (such as Coinbase) over the long-term. Decentralized exchanges such as Uniswap, 0x, Sushiswap, etc. already do more volume than Coinbase! So. The future is a decentralized exchange environment.

As a note to keep ourselves honest here, centralized exchanges will still exist. Large funds with tons of regulation involved will be around for a long time. The big picture is that the decentralized side will gain more mass adoption over the long-term.

Quick Flashback: Individuals who are looking to fight change will say “things work fine the way they are”. This is the same thing people said about mail, phones and fax machines when the internet came out. Why is this so valuable? These centralized entities (Banks, Exchanges, etc.) all make tons of money. They have *huge* overhead costs. Just add up the operating expense line for any exchange or bank. It is insanity. Now imagine a world where there is absolutely nothing and it is all done with software code. Now you’re seeing the power of a Decentralized exchange. As a simple example: part of the reason for a $30 wire transfer fee is the overhead costs. If there were no overhead costs, the wire fee would likely collapse.

Creating Utility with DeFi

At first there was no way to create actual utility from your coins. Eventually many protocols popped up that allowed you to earn yield on your crypto assets: Yearn Finance, Compound, Sushi, Unit Protocol, Bancor and many many many more. Instead of simply exchanging coins for fiat or vice versa, you created functional utility.

Say you have $100,000 in Bitcoin gains. Instead of paying tax on this you want to hold onto your coins and borrow some money. Now you can. You lend out your $100,000 worth of bitcoins as *collateral* and receive $20,000 in USDT (convertible into fiat). This $20,000 loan comes with say an interest rate of 5%. As long as you make payments and eventually return the total $20,000 you keep all of your bitcoins *and* you did not incur a taxable event. This is an enormous change for crypto as you’ve replaced the entire loan/banking system with code.

It is important to note, the *cost of making the loan* is practically nothing if you are using software code. Compare this to the banking system with 1) overhead, 2) square footage, 3) employee costs, 4) electrical costs etc.

Futuristic: In the future you can take any contract and put that into the same system. We are *likely* a few years away from this but it is the future. A good example of this is Tinlake. (Note, do not purchase or use this product for now, there are a lot of issues with it however it is the best easily clickable and accessible example for a free post)

Also. There is too much regulatory tape to cut through especially since we don’t even have proper US based Bitcoin ETF. For fun, since we’re optimists, take a look at the description from the website: “Asset Originators can responsibly bridge real-world assets into DeFi and access bankless liquidity. Investors can earn attractive yields on different tokenized real-world assets such as invoices, mortgages or streaming royalties. Tinlake’s smart contract platform coordinates the different parties required to structure, administer and finance collateralized pools of these real-world assets.” - LINK

Scaling NFTs/DeFi Converge: Since you’ve read this far, the final step is the important part in the bold above “streaming royalties”. This means any sort of financial contract can be constructed in a smart contract.

Imagine you can invest in the royalties/revenue stream of the next hit single (Kanye West, Ariana Grande, etc.). This benefits the artist as you cut out a bunch of middlemen. It also benefits Super-fans/Consumers as they can financially benefit if their favorite artist has a hit song/album. This also incentivizes the fan base to go and promote the artist (they own a small piece of the royalty stream)

Conclusion: If the above seemed like a lot to handle, that is fine! The real issue is that you’re going to interact with these types of products/software ecosystems in the future. If you remember when the internet came out, many people dismissed it and said they didn’t need it. Here we are now.

Also. From a fun standpoint. Everyone who adopted the internet early became fabulously rich. Anyone remember ring tones? Those $1-2 sales that are now worth nothing could have made a 16 year old a million dollars rapidly. This is not the “same” however, the opportunity set is comparable.