Welcome Avatar!

The United States government has finally pivoted away from (ab)using the legal system to restrict and suppress Decentralized Finance.

If you’re new here, DeFi is the Internet for the financial system. If you’ve interacted with the legacy banking system, you’re probably unhappy with high fees, delays, paperwork, and other inefficiencies.

The War on DeFi over the last few years created a major perception problem. Clunky user experiences, the involvement of shady characters, and disapproval from regulators made DeFi not only a career risk, but a personal legal risk for builders.

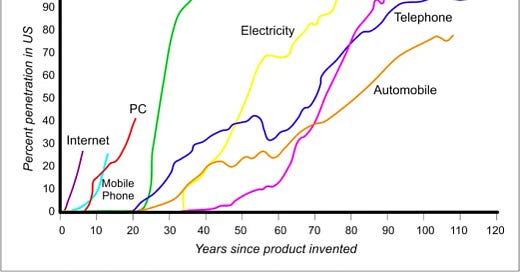

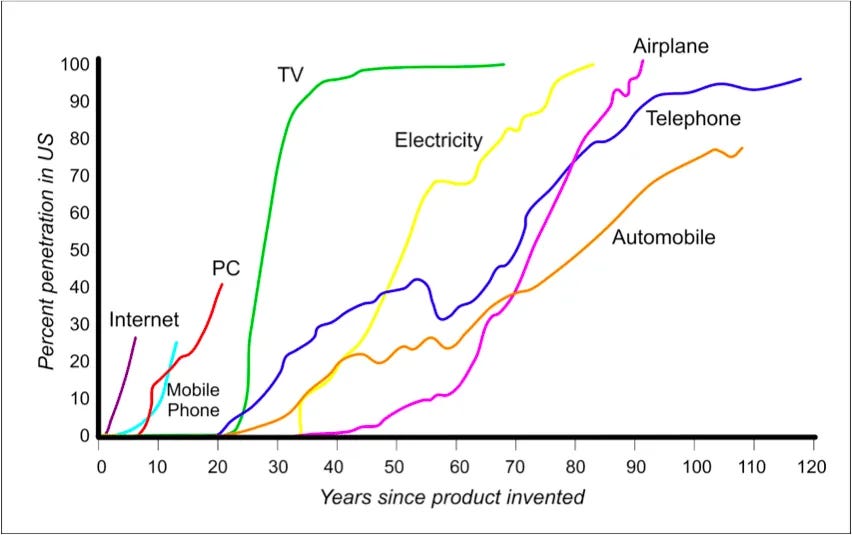

But. Like all major advances in technology, there is a lag until mass adoption.

We are heading towards mass adoption of DeFi as shown by mainstream institutional investors committing capital, human resources and acceptance by the political and regulatory establishment.

This adoption process will eventually make the landscape more efficient. For now? Still lots of opportunity to get ahead of the unthinking masses who still believe DeFi is "just another crypto scam.”

Today, the universe of investable DeFi tokens with strong underlying use cases and fundamentals remains limited. In the current crypto market environment, this is a good thing. Fewer tokens means less competition for capital for the higher quality assets (exact opposite of the problem facing memecoins and flavor of the month coins). As we wrote on last year, the case for memecoins and other utterly valueless coins would become much weaker if regulations improved. With the regulatory changes now being pushed through, we anticipate a resurgence, and eventual boom, in DeFi innovation.

This coincides with a structural change and outperformance in ETH, the home for most DeFi capital today. Crypto participants are exhausted by playing the same old extraction games. Hyperliquid has been a key beneficiary of this trend and remains one of our favorite coins (though not without its risks, as discussed in previous posts).

The success of HYPE and the death of most memecoins has demonstrated that after many years of speculating on “vapor”, crypto market participants finally want tokens with real users, business models and revenues. The positive impact of this trend will likely take a few years to play out, but the end result will be a much larger universe of investable crypto assets.

This in turn will lead to larger, institutional players becoming more interested in crypto assets.

Prediction: the next “cycle” will be dominated by crypto assets that have found crypto native or real world use cases with strong underlying business models and value distribution to tokenholders.

With Bitcoin ETFs being the most successful ETF launches in history and IPOs like Circle outperforming out of the gate, we expect growing institutional and retail interest in crypto across the board. This will result in further adoption of crypto by financial institutions (brokerages, etc.), creating a positive flywheel that gives founders more upside for creating actually valuable projects instead of short-term extraction.

Now let’s dive into the specifics of the most recent updates on DeFi regulations.

Background: US Government War On Crypto

We’ve covered this at length on the paid stack, but for those who don’t know how bad it was

A developer of a DeFi protocol faces 45 years in jail and goes on trial next month

The new SEC Chair has completely denounced the actions of his predecessor

Successful crypto founder explains your odds vs the government

1) Tornado Cash Developer Faces Jail

New York prosecutors have charged crypto founder Roman Storm with conspiracy to operate an unlicensed money transmitter, conspiracy to launder money, and conspiracy to evade sanctions, all stemming from his role in developing Tornado Cash, an open-source DeFi privacy protocol. If convicted, Roman could face up to 45 years in prison. The trial begins next month and Roman is raising a legal defense fund.

2) New SEC Chair Speaks Out

In the words of incoming Securities and Exchange Commission Chair Paul Atkins, previous US administrations have “discouraged Americans from participating in [DeFi]…through lawsuits, speeches, regulation, and threatened regulatory action…”.

3) Successful Crypto Founder vs The Government

The consequences of threatened regulatory actions is best summed up by Jesse Powell, Founder of the Kraken exchange, a company who were essentially forced to settle with regulators, paying a huge fine and withdrawing a basic staking service:

The investigation is the punishment. Just being under investigation puts you in the crosshairs of many other agencies, and makes you radioactive to business partners. A fight with the SEC could cost you $100m if you win and 10x that if you lose.

We had a gun to our head. (source)

The New SEC: “DeFi and the American Spirit”

We’re confident that the US government - no matter which party is in charge - will not return to the bad old days of persecuting the DeFi industry.

Official language is (intentionally) changing to frame Decentralized Finance as a matter of essential liberty, representing freedom, property rights, and American Values. A clever move to brand crypto in a non-partisan way and so head off a potential roll back of crypto reforms by the other party in the future.

There are now pragmatic reasons for all politicians to support DeFi.

Demand for USD stablecoins - one of the most prominent examples of “product market fit” in crypto - supports the US banking system and provides liquidity to the US Treasury market. The crypto industry now spends significant sums to lobby politicians on both sides of the aisle, has minted several publicly traded companies, and is a large employer & payer of taxes.

Previous SEC lawsuits against the industry have asserted the preposterous:

all crypto tokens are securities and all exchanges need to register with the SEC

offering staking services is illegal

software applications (wallets) are brokers, devs must register as broker-dealers

Incoming SEC Chair Atkins has made it clear that his agency is committed to reversing those mistakes. The SEC v Coinbase lawsuit has been dismissed. And there’s a clear three point plan for reform.

First the new Chair recognizes that the SEC will need to promulgate rules which give legally binding effect to the current opinion of SEC staffers that voluntary participation in a proof-of-work or proof-of-stake network as a “miner,” “validator,” or “staking-as-a-service” provider is not within the scope of the federal securities laws.

(staff views on staking can be read here)

Second, Chair Atkins have directed staff to design a proposed “conditional exemption relief framework” which would allow crypto products to be brought to market before the SEC has concluded its full crypto rulemaking efforts. This will provide welcome legal and commercial certainty to industry participants.

Finally, the new Chair has committed to investigate which guidance and rulemaking is necessary to address gaps in how securities rules and regulations are applied to crypto products.

It’s reassuring to hear government officials speak in such positive tones about our industry:

American values of economic liberty, private property rights, and innovation are in the DNA of the DeFi, or Decentralized Finance, movement

It’s also true. Interestingly the SEC roundtable was actually titled “DeFi and the American Spirit”. Our technology was described fairly: blockchains described as “shared databases that enable ownership…of property…without an intermediary”, staking pools are “free market systems”, and the “core feature” of our DeFi technology is “the ability to have self-custody of crypto assets” which is then explicitly linked to “custody of one’s private property…a foundational American value”.

DeFi Ed Future Vision

We started DeFi Education in 2021 based on the thesis that fundamentals would eventually matter as the industry matured, participants became sharper, and more founders choose to build in crypto. Now, the DeFi sector is on the cusp of a major turning point.

Proactive regulatory support is the final piece of the puzzle that unlocks the onchain economy. With a clear, productive framework for protocols that takes into account the technical capabilities of blockchains, token value capture can be solved. Integration with real world assets is tougher, and is unlikely to be solved in the near term, but we remain optimistic.

In a post later this week for paid subscribers we will be doing a deep dive into the DeFi ecosystem and diving into the underlying fundamentals of the leading projects in DeFi. To get this in your inbox along with additional emails every week sign up below.

Until next time, anon..

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

We now have a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Thank you for the write up guys. I have to ask, has recent market performance changed your view on participating in the short term? If your thesis still stands that the most likely outcome is a significant drop over summer then this might be a good moment to cash out? Wait untill the end of June to cash out?

Congrats guys!