Welcome Avatar!

Crypto continues its path to achieving mainstream adoption. Everyone has heard of crypto now. And yet, the vast majority of people still don’t “get it.”

Something as simple sounding to the avid crypto reader like “tokenized equities” is entirely foreign to most of the broader population.

If you tell someone in you’re in crypto (something we advise against for security reasons), you’ll get responses along the line of:

“Oh you must be rich”

“Isn’t that a scam?”

“I have some Bitcoin but I don’t know what it is”

“I’ve heard about it but it doesn’t make sense to me”

There is no excuse not to understand crypto in 2025.

To successfully build a framework for crypto research and capitalize on the massively asymmetric opportunities the crypto market awards you need to build a good foundation.

In today’s post we’ll provide you a roadmap for building a foundation in crypto that will accelerate your learning curve and make sure you don’t spend time spinning your wheels on the things that don’t move the needle.

Sidenote: More and more people think they are now “too late” to crypto. This couldn’t be further from the truth. There is a new multi-billion dollar protocol created every year. The market values real value generation now more than ever. The crypto market and the “traditional” market will continue to merge. You’re still early enough, so take the time to learn the ins and outs properly.

Our suggested path of learning will be based on our goals at DeFi Education and how our newsletter is structured. An emphasis is placed on:

Learning to analyze projects (tokenomics, key drivers, etc.)

Frameworks for aspiring investors, traders, research analysts

Understanding security best practices and risk

Basics of markets, positioning, and risk management

We advocate for a “bottom up” approach that builds your education from first principles. If you understand the how and why behind crypto projects, your pattern recognition improves over time and you will be able to hit the home run trades and investments that result in life changing gains.

Life changing opportunities in crypto come up multiple times a year. Get involved and change your life.

Where to Start

Our approach to crypto markets is heavily driven by the research we do on specific protocols and their tokens and informed by our backgrounds in Wall Street/Software.

We push for a two-pronged approach that involves developing expertise in both the technology and the markets side of crypto.

The Basics / “Must Haves”

Bitcoin

Bitcoin has continued to outperform every crypto asset ever created, offers the most liquid market in crypto and has the most institutional adoption as an investment. The performance of all your other coins is highly correlated to the performance of Bitcoin. Read the whitepaper, understand why Bitcoin has value, develop your own convition around the upside potential of this asset and you’ll quickly find yourself ahead of the average person.

Smart contracts (Ethereum, Solana)

Layer 1 blockchain tokens capture huge premiums on the market as they are competing to be the future homes of financial markets, among other things. Understand the basics of blockchains, why people build on them, the use cases that are most popular (DeFi, stablecoins, etc.) and the nuances of the ecosystems (e.g. Ethereum L2s, Hyperliquid, etc.).

Stablecoins

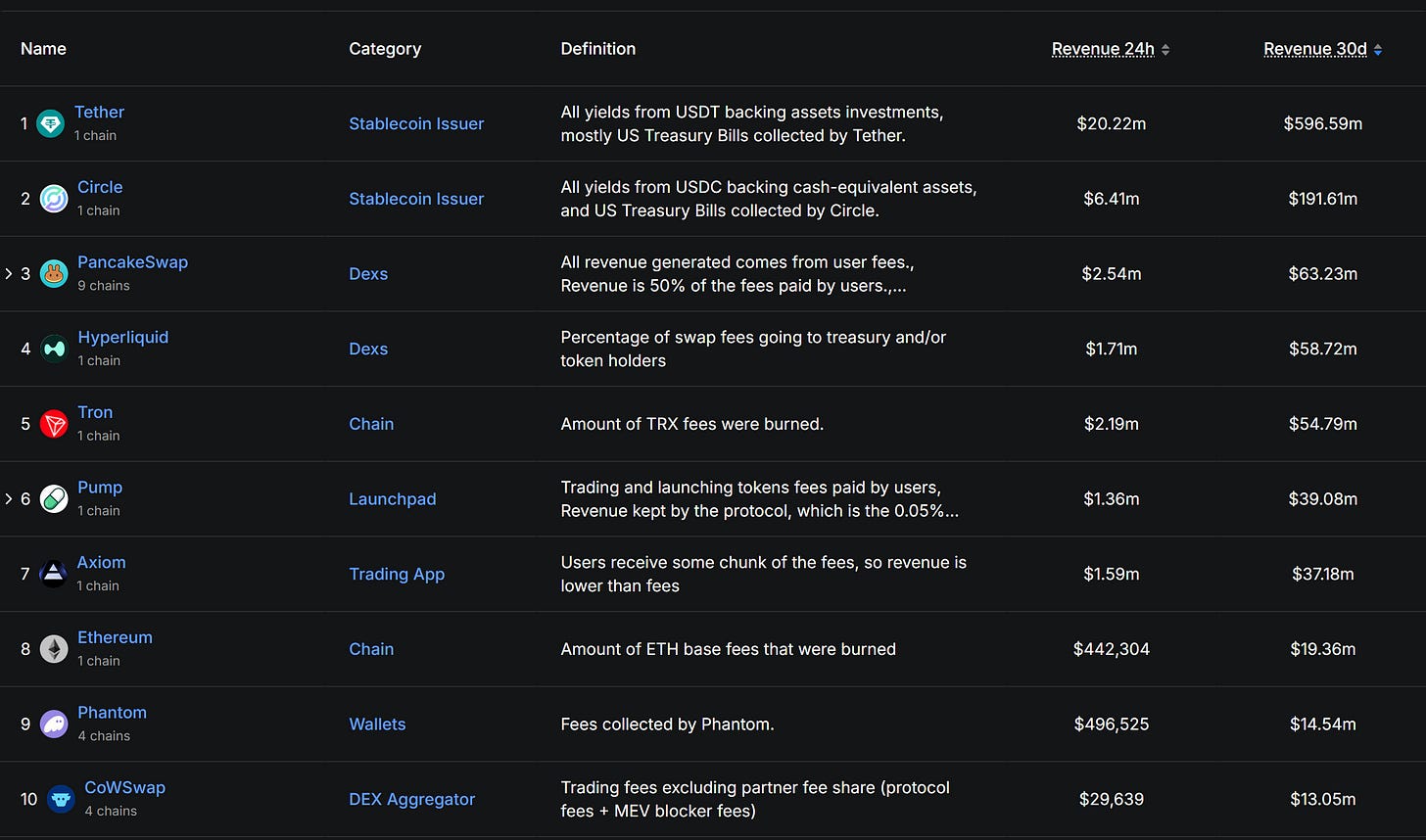

Stablecoins have become one of the largest asset classes in crypto, not only capturing significant market cap but also creating value for applications and companies built around them. Tether, the issuer of the USDT stablecoin, reported $13 billion in net profit in 2024 as a result of the assets it holds in its reserves. Circle, the company behind USDC, recently IPO’d and sits at a market cap of over $40 billion. We expect stablecoins to change the nature of how we transact in our day to day lives. Read our recent coverage of Maker/Sky to understand how we use knowledge about how stablecoins work to make investment decisions.

Intermediate Knowledge

After developing to an intermediate knowledge level you can start to generate some return on your time. By now you should have wallets set up on Ethereum/Solana, understand basic wallet / private key security, and understand the major crypto assets at a high level.

DeFi and Other Protocols

We advocate for a fundamentally driven approach to understanding DeFi and other crypto protocols/applications. How many people sold HYPE immediately at launch without considering its valuation prospects? Or refused to understand BTC / ETH in their early days? You want to start with the leading DeFi applications as these provide an actual service used by onchain participants and generate real (often significant) revenues like any other tech company — except they do so entirely permissionlessly. Even in 2025 the average person does not know that there are crypto applications generating millions of dollars in cash flows.

Tokenomics

A token is simply a digital unit of value on a blockchain. Tokenomics are the supply, demand, utility, and value transferrability factors that make up a token. Tokens can be programmed to have very different features. Understanding how a token you buy is going to gain or lose value in the eyes of other market participants is a key part of having an edge in crypto markets. Tokenomics as a field continues to evolve, and we have been one of the leading voices in the industry on the subject. We’ll be putting out a refresh of our tokenomics primer and our latest thoughts on token values for paid subscribers soon.

Spot positioning

Covered in more depth in a recent DeFi Education post, spot positioning is the strategy everyone should first get involved with crypto. Ignore shorting, futures, options, etc. There is more than enough volatility and upside in the crypto industry to make money on a long only strategy buying spot assets and waiting for your thesis to play out. Spot lets you ignore the noise and focus on your thesis.

Airdrop Farming

The larger your portfolio the more “advanced” you want to be when looking at farming airdrops. Airdrop farming is not a free lunch, but it’s one of the few ways to make outsized gains for those will smaller portfolios. Alpha: We believe airdrops are structurally underfarmed right now. There is a lot of “junk” out there to farm but for those who have the time to hunt for opportunities there are likely to be gems out there. You want to farm during chop and during more bearish markets when no one is paying attention, people are off on summer vacations, and there is less capital in farms for you to compete with.

Advanced Knowledge

Portfolio Management

As the numbers get bigger it is essential to operate a more systematic approach. Instead of operating mainly using your gut with sums you can afford to lose, you’ll begin to draw on tools created in the world of professional finance to help you manage risk. Although crypto can be a risky (and lucrative) industry you don’t want to lose much of your hard earned profits simply to discover the reasons why risk management frameworks, diversification, portfolio volatility targeting etc were created. Better to apply the existing tools and adapt them as needed for crypto.

Remember that you cannot control the returns of a portfolio but you do have a degree of control over the risks you assume. And you need to have a framework to validate that you’re potentially going to be paid well enough to assume those risks.

Markets and Trading

All roads lead to Rome. Unless you start a Company/protocol/DAO and sell tokens, your highest ROI on your skillset will eventually come from trading and investing.

Even if you’re a very well paid smart contract developer, after a few years you’ll find that most of your money came not from being paid to code but from equity you negotiated in projects, by buying tokens of good projects you heard about early, and by being so ‘plugged in’ to the industry you can spot peaks in euphoria and despair and adjust your portfolio accordingly.

Depending on your risk profile, investments in crypto can return 3-10x in under a year, and the market offers up quality projects at 40-50% discount to recent prices surprisingly often. Aside from building, learning about markets and trading is probably your best path to getting rich in crypto. Provided that you learn correctly, not the “technical analysis” nonsense you see on Youtube or gambling on which of the ten thousand “memecoins” created today will be worth more in 3 months time. Leave that for the wannabes.

Several times a year in crypto there are “free money” opportunities created by the mistakes of others - arbitrages, mispricings, excessive demand for borrowing - which savvy participants can take advantage of to create high returns.

Cybersecurity and Personal Security

At the advanced level you’ll be starting to manage more of your capital on-chain. Although you might have previously risked an ‘experimental’ amount of money to find a niche - an amount small enough that getting hacked would be unfortunate but not life changing - you are now approaching the point where it makes sense to have years of savings or double digit percentages of net worth on the blockchain. Losing this money to sophisticated / state sponsored hackers would set you back significantly.

At this level of risk, just buying a hardware wallet and thinking you’re protected is reckless. You need to educated yourself about the various proven strategies criminals use to access your assets. You’ll learn that you are potentially your own worst enemy.

Many smart, successful, rich people have been tricked into signing away their digital assets. It doesn’t matter whether you’re a billionaire investor getting started in cryptoor the founder of a successful DeFi protocol, your money is fair game for any criminal with an Internet connection. Awareness, education, and discipline are your defenses.

In addition to basic training on phishing and social engineering scams, you’ll need to be informed about increasingly sophisticated malware frauds, including crime rings who pose as legitimate companies or recruiters. You’ll be manipulated into downloading a fake version of Zoom for a video call, giving attackers full access to your PC files and your screen in real time. They can then work out what assets you have and how to best target you.

Even if you’re able to spot scams (“I’d never fall for that”), could you spot if a crypto website you use had been taken over by criminals before you enter your password or sign a transaction? Unless you’ve had special training, you can’t. No matter how reputable the DeFi protocol or how well the smart contract software is written, it’s relatively easy to hijack a website. Ask the operations team at ByBit who lost over a billion dollars signing a transaction created by a fake version of the Gnosis Safe app.

One of the reasons why the rewards are so high in crypto is the risk and complexity involved. This keeps smart but risk-averse competitors at bay. However, there is no point spending years running up the score to lose it all because you didn’t invest the time to learn security correctly. At the advanced level you should be able to:

operate a separate, security hardened device only for your crypto activities

own multiple brands of hardware wallet and have your assets split up between a multi-signature “cold storage” solution and as many individual accounts as your activity requires

know never to blind sign, and have the skillset to decode before signing to ensure that you never approve a fraudulent transaction

assess and mitigate your risk of crypto-motivated robbery, kidnap, and extortion in real life - discretion is key, but higher risk profiles will need to hire professional help

Looking to Save Time and Avoid Expensive Mistakes?

If you understand all these concepts in-depth you will be well ahead of most of the world when it comes to crypto. The rest of your expertise will come through application of your knowledge, ongoing research and day to day upkeep with the industry.

We estimate this roadmap will take 3 months to get through if you were to research everything yourself. If you have a lot of time and low funds (i.e. a high school student) then this is absolutely the path we’d recommend. There is some benefit to this approach, since you’ll stumble into interesting pieces of information here and there that may lead you down rabbit holes. But you’ll probably also go down a lot of rabbit holes that are either a waste of time, or worse, wrong.

If you’re looking to cut this learning roadmap from 3 months to about 2-3 weeks, we’d recommend joining the academy, a video course with over 40 lessons that covers what we’ve listed above and more. Hundreds of people have joined and the feedback so far has been great.

Either way, the roadmap to crypto is now in your hands - so no excuses!

This is a free post - feel free to share it with anyone who might find it helpful.

If you haven’t already, sign up to our paid substack.

Until next time..

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

We now have a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Outside of Felix what are farms that you think are interesting. Not asking for an endorsement just stuff you guys think could warrant a more intense look