Welcome Avatar!

Both last bull run and this time around, there are a number of blockchain “ecosystems” to choose from. What do we mean by ecosystem?

Any Layer 1 or Layer 2 (or even Layer 3!) on which applications are built. Smart contract chains are akin to nations — they have their own currency, their own economic activity, and their own unique cultures.

In today’s post we are kicking off a series on the entire onchain landscape. By the end, you will have all the information you need to decide where you want to be active with your time, attention, and capital based on an exploration of the projects and sectors in each ecosystem.

The goal? Becoming a master of a small handful of ecosystems. Instead of chasing trend after trend, you simply get exposure early then wait around and let the shifting trends work in your favor. Note - the goal is to be early, not FOMO in after influencers start talking about it and are looking for exit liquidity.

Today’s post is a birds eye view of Layer 2s (the first section will be review for many of our paid subs).

Layer 2s

Blockchain scaling is an area of intensive research and capital investment. The now-infamous “Scalability Trilemma” postulates that blockchain can only have two of the following three properties:

Potential solutions fall into two classes.

Allowing the blockchain to process more transactions and store more data is the Layer 1 solution. This requires faster hardware for validators, meaning that ordinary users with modest computing resources cannot participate in consensus. Leading Alternative layer 1 blockchains sacrificed decentralization for scale.

The second class of solution makes more efficient use of scarce blockchain space by moving data and computation off chain. The off-chain component is referred to as Layer 2.

Using math we can create a short representation of larger data. In computer science this is known as compression, and implies a trade off between storage space and processing time.

If you’ve ever “zipped up” a file on your computer to save space before sending it in an email, you’ve traded storage space for computing power. It takes computing power - energy - to calculate the math used in compression. This introduces a delay when working with compressed data. The majority of websites, photographs, music, and video files use sophisticated compression techniques.

What if blockchains could use compression? We can think of Layer 2 rollups as a compression scheme which trades storage space for computation. By running computation off-chain, we can compress transaction data so it consumes fewer resources on Ethereum.

A Layer-2 system consists of an Ethereum smart contract which processes deposits and withdrawals, and which receives, validates, and stores state updates on Layer-1.

In layer 2, a batch of transactions are processed off-chain by computer nodes known as “aggregators”. The full transaction data is stored off-chain by Layer 2 validators. Each batch is then “rolled up” into a condensed summary which is sent for final approval to a smart contract on Layer-1 Ethereum.

There are two types of rollups. An optimistic rollup publishes transactions, waits a period of time for anyone to dispute the accuracy of the transactions, and then finalizes them if no dispute occurs. A zero knowledge rollup verifies the correctness of the transactions with a cryptographic proof.

'Optimistic' means that the aggregators are assumed to be honest, operating without attempting to commit fraud.

Anyone has the ability to submit a proof of fraud, which means the system only needs a single honest participant to assure security. Malicious aggregators risk having their stakes slashed if they attempt fraud.

If nobody submits a fraud proof within the required time period, the transactions published by the aggregator are accepted as correct and the batch settles on layer 1.

Optimistic rollups are used by the two largest layer 2 solutions, Optimism and Arbitrum. As demand for layer 2 increases it is important to ensure that there are sufficient incentives for verifiers to monitor for fraud.

The main drawback of optimistic rollups is the withdrawal delay. The system waits 1 week between a layer 2 withdrawal request and settlement to allow time for the creation and verification of a fraud proof.

Instead of fraud proofs, zero knowledge rollups use validity proofs. In other words they automatically prove every transaction is valid instead of waiting for a third party to prove fraud. This removes the need to pay off chain verifiers and avoids the possible modes of failure of an optimistic rollup if a fraud proof is not created or its publication is censored.

Zero knowledge rollups have other important advantages over optimistic rollups. Transactions are private by default, withdrawals take a few minutes rather than weeks, and they have higher throughput.

Proving a complex Ethereum transaction is much harder than proving a simple token transfer, so it is likely that the zero knowledge rollups will be used just for transaction processing until the technology improves.

Remember that on blockchains, all data is public. It’s like going to a convenience store and swiping your credit card and everyone not only knows you swiped at that convenience store, they can see your entire transaction history by tracing it through the convenience store’s account.

As the transactions which occur on a zero knowledge rollup are private, there is the opportunity to reclaim privacy on the public blockchain.

If you’ve gone through the Academy you will already know this in-depth.

Ethereum is the number one chain by number of active protocols, stablecoins, and user activity. It’s the OG smart contract chain, and ETH has a market cap of over $450 billion as of the time of writing. ETH is an institutional grade asset, now on the path to having an ETF in a matter of months and receiving support from the world’s largest financial institutions like Blackrock.

Needless to say, Ethereum L2s are an area to focus on.

Ethereum Layer 2s - Lay of the Land

Ethereum Layer 2s are where the “degen” action has shifted to in the Ethereum ecosystem. Tokens worth 7 million ETH (~$27 billion at current prices) have have moved to L2s in the last 12 months.

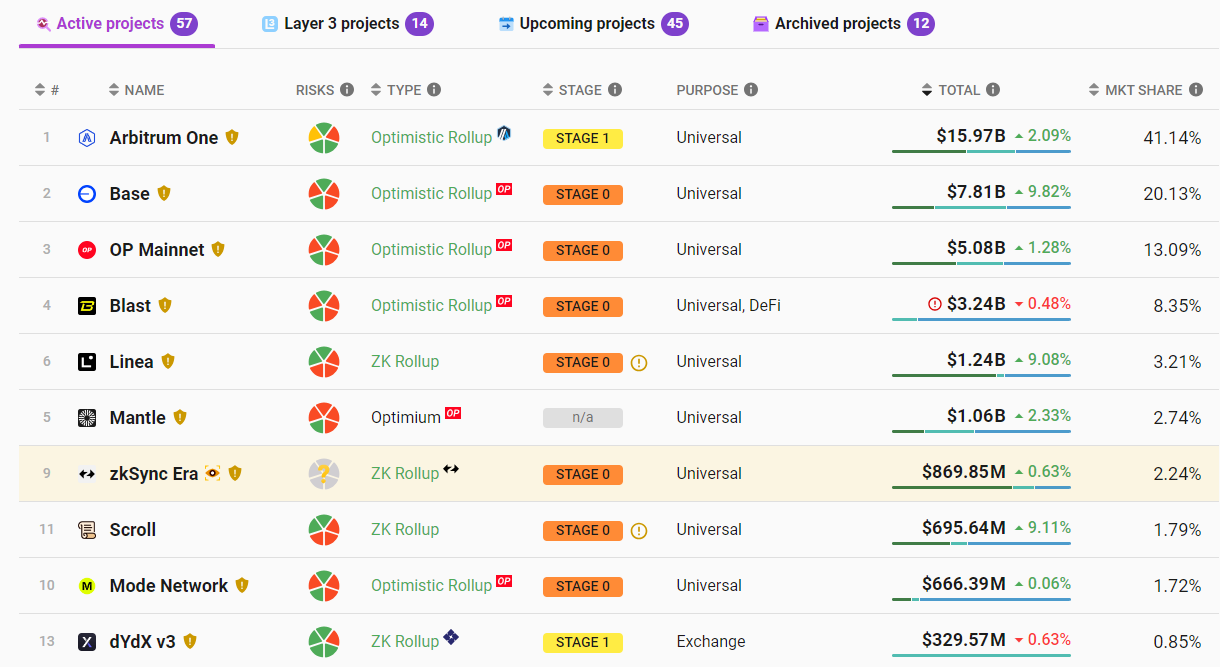

Base and Arbitrum have been leading the charge, with Base having shown the most growth in recent activity (34% increase in TPS in the last 7 days). A burgeoning memecoin ecosystem and hype around the Coinbase Smart Wallet which launched this week, along with the marketing firepower of crypto giant Coinbase are drivers of Base’s growth.

Base sports the second highest TVL onchain, although a chunk of that TVL comes from Coinbase migrating some of their customer USDC onchain. Arbitrum is the leading L2 by TVL, sitting at $16 billion.

Note: Numbers shown above are from L2beat.com and include the value of tokens on the L2, not just value used in applications. This is why TVL numbers are much larger than DeFi Llama’s.

The top three L2s (Arbitrum, Base, Optimism) hold ~74% of the TVL of all L2s. Blast sits at $3.2 billion, though this includes rehypothecation (releveraging of tokens).

Why is this important?

Well, more TVL and more activity means more fees for applications and the L2, which allows them to drive more growth into their ecosystem, which can increase the value of their tokens!

Picking the right L2 ecosystems to participate in can be make or break. If you accumulate tokens and social capital in L2s that never end up taking off, you’ll have missed the opportunity to use that capital elsewhere that was more profitable.

The easiest place to start is where the capital already is. We are active on Base and believe it to be a good place to focus all cycle, but are now branching out and will even hunt through the trenches of the “lower tier” ecosystems for gems.

The most money will splash around in the L2s that have the highest TVL (the winners are largely chosen, in our view), but understanding the differences in each ecosystem including their focus financially and culturally is critical to define your focus around where you have an edge.

In other words: not every L2 ecosystem is best suited for everyone. Some of you will perform better engaging in certain types of activities than others (DeFi, memes, jobs/consulting, etc.). Some activities won’t be worth your time if you have too much capital (and vice versa). The purpose of our ecosystem series is to give you the information for you to decide and specific projects to look at. Naturally, we’ll be available to answer questions as we progress through it.

Bonus: Layer 3

There is one more layer to know about.. and that’s layer 3s. L3s run on top of L2s and are customized around specific applications or use cases. Think of a L2’s primary purpose as being increased scalability and performance, while a L3’s primary purpose is providing more specific usability, interoperability, and application functionalities.

L3 apps can leverage the increased transaction throughput from L2s

L3s apps benefit from lower transaction fees of L2s

Faster transaction confirmation time of L2s

While L2s are far more cost effective than Ethereum L1, the daily gas cost for applications (depending on their complexity) can still be in the hundreds or thousands per day. To save on gas costs and increase throughput, applications often shift complex computations offchain, which compromises trustlessness and security. L3s do come with security tradeoffs, but these are arguably better than doing computations on a centralized database.

From an investment perspective, Layer 3s are still highly experimental and way further out the risk curve considering that most of them have little usage currently. That means one thing only: opportunity.

After spending years in crypto we’ve come to realize an important fact: it’s all about the people. If there are smart people building in certain areas we want to be there early — before there is a breakout success. Yes, that means you research some projects that result in dead ends. However, focusing on the edges are where you can turn small amounts of capital into large sums. That’s the fun of being in crypto after all.

Subscribe to our paid newsletter for our upcoming coverage on L1s/L2s/L3s.

Until next time, anon..

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

We now have a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Do you recommend investing in Arbitrum or is this article more in regards to the things you mentioned like jobs/consulting etc?

Do you still believe PYTH is a good hold? It's down a lot since token unlocking