Overview of Portfolio Construction & Risk Management - Owl and Iguana

Level 3 - DeFi Virgin Analyst

Welcome Avatar! We have had a lot of requests around how we, the DeFi team, think about managing our portfolios and our personal risk management frameworks. As we continue this golden bull run in the world of crypto, we think now is a good time as any to describe how we approach our personal portfolios. Since we all have our own goals, risk appetite and expertise, we will go over our portfolio management individually. This post should also help you to have a backdrop of how we think about our portfolios next time you read the “opinions and holdings” section in our protocol deep dives.

As a reminder, this is only a description of various strategies we have tried and not financial advice. We are simply a group of cartoon animals. Onward!

Owl Portfolio Management

When it comes to my crypto portfolio, there are three key variables:

Capital preservation (how to not lose a material sum of money)

Portfolio growth (how to achieve exponential gains – 20% a year is not enough reward for the risk taken in cryptoassets)

Managing my psychology (how to bet big on winners and ride them out, how to bet small on losers and cut them early)

The Case for Bitcoin and Ethereum

I will keep this section brief but it is as important as the other sections. If you have limited time due to other ventures and are not particularly interested in active management, you can go up to 100% in BTC and ETH. Ideally, you have accumulated below $60K / $4K, providing you with solid upside potential with zero additional time and energy invested. I place no limit as to what percentage of my portfolio can be BTC/ETH. All you have to do is keep up with Bowtiedbull’s substack and you will have all the important updates for those assets. Autist note: this is how I manage my BTC / ETH position – due to having limited time, I get my updates from the Bowtiedbull substack on these assets + macro, freeing up my time to focus on DeFi. Thanks Bull 😉

That said, you are here because you want to allocate to DeFi. When allocating to DeFi, I still would not go below ~50% of portfolio for Bitcoin and ETH unless you have an edge (been in crypto a while, have good understanding of markets and are an experienced investor) for purposes of capital preservation and portfolio growth. This approach goes against much of what is parroted on Cryptotwitter. Here’s my rationale: if BTC and ETH do a 3x+ in the next 6 months and 70% of your portfolio is in high risk alts with questionable tokenomics and lack of product market fit, you can get burned quite badly and risk missing out on the entire bull run. My BTC / ETH exposure combined does not go below 35-40% at any given time (currently close to 50%).

So, how do I manage the remaining 50%? There are a few ways to go about it and my approach has evolved as market dynamics and narratives have changed. One thing has stayed the same – I invest in fundamentally sound projects with minimum 5x potential and typically hold for months, not days or weeks.

Portfolio Management Strategy #1 – Owl’s Current Strategy

Depending on the size of your portfolio, you allocate your portfolio between 5 – 10 projects equally. Here is an example of what a portfolio might look like if you allocated among five projects outside of BTC/ETH:

Meaning, if I had a $200K portfolio, $100K is in BTC/ETH combined and $20K in each of the other tokens in the pie chart. We’ve shown five tokens in the pie chart for visual purposes but I prefer to have closer to 10 investments.

Important note: Please keep in mind that there is absolutely nothing wrong with sitting in ETH until a good opportunity comes along. No need to overtrade or pounce on every altcoin that looks good. Always manage psychological state and emotions. There are endless opportunities in this market. Sometimes staying in your coin is a better risk/reward play than trading into another one.

For this strategy, each of the investments should be in a token with minimum return potential of 5x from price of entry. This minimum return threshold is intended to ensure you outperform large caps and to improve ability to offset losses in other parts of a portfolio.

I believe making 10 fundamentally strong bets diversifies risk appropriately while still providing significant portfolio growth when a token performs. In general, I try to find protocols under $300 million in market cap but this is getting harder due to rising valuations and the speed at which the market is moving. $300 million is not a hard and fast rule and good 5x+ opportunities can still be found in the $300 million to $1 billion range.

Sometimes, buying fundamentally strong projects and holding means underperforming ETH for a period. For example, I got into Rari Capital ($RGT) when it was at ~$8. The token ranged from $10 - $20 for months and recently peaked at over $80 (now sitting around $50). When you are in a long consolidation / waiting period, it’s important to watch the fundamentals. For example. Rari’s TVL was growing at a rapid pace on a daily basis yet the token price was not moving. Eventually, the right narrative came along (DeFi 2.0) and the market could no longer ignore a fundamentally sound project.

Level of risk for this approach: High. Can prove to be successful as long as the bull market continues but if there is a market crash, this part of the portfolio can fall by 50-90% fairly quickly. Ideally want an above average understanding of DeFi to pick tokens reasonably well. For this reason, we only cover tokens in our substack backed by protocols with strong fundamentals.

Even with a good understanding of DeFi, you run the risk that some tokens lose 50 – 100% of their value. Always remember that for the vast majority of DeFi, we are investing in *early stage* ventures. Spreading risk across 10 investments might sound boomer to some degens but DeFi remains complex and even the best protocols suffer from hacks and exploits. Sometimes these protocols come out stronger and other times they simply do not make it.

Time investment: Significant and scales with number of investments. However, once you are in a long-term play, the time investment required goes down quite a bit and you only need to stay on top of major news events. For each investment, put each protocol’s main Twitter account on notifications, follow the founders / active team members and check in on any Medium posts and Discord once or twice a week.

Upside potential: Very high. If you’re picking them right, it’s not unreasonable to expect 1-3 of the alts being up at least a 5x. There are also 10-50x+ opportunities in crypto (Solana is up 100x YTD 2021), which offset all your losers.

When I invest 10-20% of my portfolio into something, I am not investing in brand new launches that could rug. I am usually looking at protocols that already have a high degree of adoption and some aspect of the protocol (growth potential, undervalued sector, earnings, etc.) is or overlooked by the market. I do allocate some portion of my portfolio (call it 5% in total) into investing in low market cap opportunities that have a high likelihood of going to zero but could provide 50-100x returns if they succeed. I mark these degen/microcap investments at zero and do not think about them at all until they become big enough to be relevant to my portfolio and warrant greater attention.

Portfolio Management Strategy #2 – Destination Degenistan, Home of the Apes

High concentration / all-in. Allocate to 1-3 extremely high conviction projects and HODL through a price discovery phase. Derisk after the token returns 100-300% (hang on to a small moonbag if desired) and roll it into the next position. Doing this consistently is difficult because you have to be good at either 1) picking the right project on day one and HODLing or 2) catching trends and rotating in and out in time. The potential for significant loss is also high (one rug or exploit can wipe you out due to portfolio concentration).

Would not recommend for 99% of people as it requires a lot of time (around the clock management / hunting for new coins and trends) and you risk losing it all if the market turns the other way unexpectedly. That said, this is certainly one way to try and grow a portfolio quickly and deserves to be covered. An example of how one might trade using this strategy using the same $200K total portfolio:

Buy $50K of $RGT

$RGT goes up 100% and is now worth $100K

Sell $25K of $RGT for ETH

Roll $75K of $RGT into $TOKE

Alternatively, keep $25K of $RGT and roll $50K into $TOKE

Rinse and repeat

You should have a general plan *before* buying a coin as to 1) what % return to take profits into ETH/BTC/native L1, 2) what percentage to keep as a moonbag (in case it keeps increasing in value) and 3) what percentage to rotate into a new coin. You only deviate from your plan after a review of updated fundamentals. Since you are investing in early stage ventures, even a team with the best intentions and talent may not achieve product market fit, could get exploited, burn out, get out competed, etc. That’s why if you have a significant portion of your portfolio in 1-2 investments, you want to derisk (sell into BTC/ETH) more quickly than you would in Option 1.

Portfolio Management Strategy #3 – Same as Option 1 with Some Rotating

This allocation would be 40-50% BTC/ETH, 30-40% set up as Option 1 and 10-20% as Option 2. Why am I covering option 3? Because I know some people simply cannot live with the fact that there are people making ridiculous returns on dog coins, scams, and the potential for asymmetric returns from investing in “the next big thing” at $2 million market cap. I can understand this. As such, I would recommend you allocate a fixed amount of your portfolio to satisfy this urge to play with trends and microcaps and do not deviate. My strategy was closer to option 3 during the NFT craze we had in Q3 2021 – I was trading in and out of high risk assets, minting random projects and flipping short term. Option 3 is a good way to continue to stay experimental, tinker with new projects and potentially catch rotations that can magnify returns while limiting risk to 10-20% of your portfolio at most. Note: 10-20% is a maximum not a target.

Owl’s Closing Thoughts

The strategies I’ve outlined are not set in stone. Instead, they should give you an idea of how I think about risk in crypto markets. My approach is definitely higher risk than most people. However, I am comfortable with this level of risk and have a desire to enhance my returns beyond BTC/ETH. At the same time, I maintain a large BTC/ETH portion at ~50% so I will not miss out on the bull run even if I get some investments wrong.

My biggest lesson this year has been consolidating smaller bets into larger ones and upsizing my investments with the growth of my portfolio. I had far too many small bets that initially represented 2-3% of my portfolio and as my portfolio became larger some of these bets became too insignificant to provide meaningful returns. Instead of hanging on to them, I should have consolidated earlier and rotated into my highest conviction bets. That’s part of the reason I arrived at my current strategy.

Overall, I believe my current strategy is the best fit for me in terms of maximizing my potential for outsized gains while still protecting my portfolio with a significant BTC/ETH allocation.

Iguana’s Quantitative Approach - Volatility Targeting

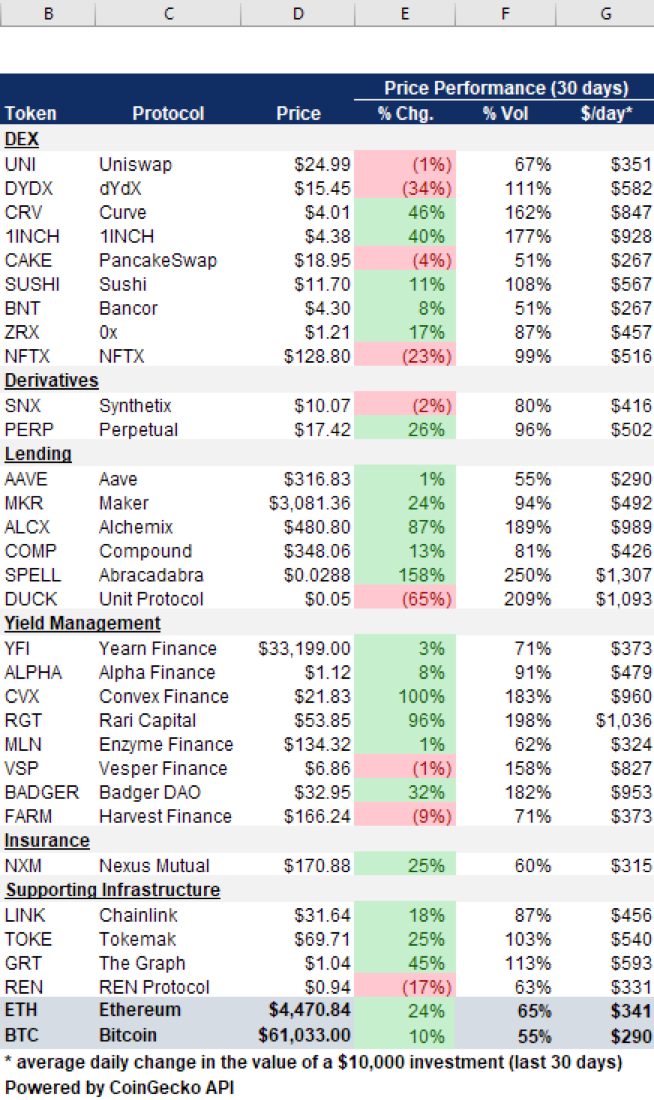

What is volatility? A formal definition would refer to the dispersion or variance of returns for an asset. Intuitively, we relate volatility to risk – how much does the market price of an asset change relative to some benchmark. It may be helpful to think of volatility as the *average* dollar value I am likely to be up (or down) per day on an investment of $10,000 (see Column G).

This allows you to compare similar investments (e.g. in a sub-sector) on a like for like basis.

Taking the DEX sub sector, we can see that a $10,000 investment in Uniswap would change by approximately $351 on an average day, and the same sized investment in Sushiswap would be nearly twice as “risky”, changing by $567 on an average day.

Note that in reality Sushiswap outperformed Uniswap during the period. Volatility is only part of the picture.

Our purpose for considering volatility is to ensure that the amount we invest reflects the risk we want to take relative the conviction we have in the token. These concepts and tools should be used in addition to your fundamental analysis, not as a replacement for it. Best used when you have decided to allocate to a token, or to help decide when to sell an investment.

Column F shows the annualized volatility of the token. This ranges from 51% a year to 250% a year, implying that some tokens (SPELL) are up to 5 times as “risky” as others (CAKE). If you had equal conviction in SPELL and CAKE it would be an error (from a volatility targeting perspective) to invest the same dollar amount in both tokens. (you would be substantially over allocated to SPELL relative to CAKE)

Turbo note: I am using the standard deviation of the recent 30 days of daily percentage returns multiplied by the square root of 365 (days in a year, crypto is a 24/7 market) to calculate annualized volatility. (Volatility is the square root of the variance). In TradFi, I would prefer to use the Implied Volatility from “at the money” options as this will price in the market’s forward-looking view on volatility (which would account for both fundamental data e.g. a forthcoming earnings report and trader sentiment). In crypto there are no liquid options except on Bitcoin (and Ethereum) so there is no choice but to use recent historical data to estimate volatility. This is accurate enough for position sizing purposes as recent volatility is highly correlated to future volatility.

Measuring Performance

The second use of volatility is to benchmark how your investments have performed. If two assets return 10%, but token A suffered a peak to trough drawdown of 3% during the year and token B had a significant drawdown of 30%, we would be pleased with the performance of token A and concerned that token B did not give us a sufficient return to compensate for the risk (volatility) – a bad risk. It is no coincidence that BTC and ETH exhibit lower volatilities than small cap tokens. As well as being safer investments according to a fundamental approach, they also merit a larger allocation because of their relatively lower volatility.

Column H shows the ratio of the recent 30 day total return to the volatility experienced in that period. This helps show how tokens have performed relative to their sector and the overall market. Ratios greater than 1 suggest outperformance in excess of the average volatility (green highlight). Ratios lower than 0.5 suggest that the investor may not be getting paid adequately for the risk assumed (yellow highlight). You can also use this metric to see which assets have outperformed BTC or ETH on a volatility-adjusted basis as well as a percentage basis. Tokemak should be considered to have underperformed ETH by this example. This does not mean it is a bad investment, volatility is only one factor. I personally believe that Tokemak can grow faster than ETH, but it did not in the recent 30 days.

ETH has had a very strong 30 days – comparing to GRT shows that The Graph didn’t outperform ETH very much in relative (risk adjusted) terms despite being up 45% vs ETH’s 24%. In an average month, you’d expect GRT to have a higher beta, with approximately double the volatility of ETH.

If I held GRT, I would use this data point to help me decide whether to re-balance (sell some GRT back to ETH) even if my conviction in GRT was unchanged. Note this is not the same as profit taking, the motive is to keep my level of risk constant relative to my conviction and the expected volatility of the asset. It is not related to my cost basis on the position.

Transaction Costs, Investment Size, and Rotation Frequency

The purpose of this section is to answer two popular questions:

what is the minimum investment which makes sense given transaction costs (especially gas on Ethereum)?

how often should I rebalance or rotate my portfolio?

The following table considers Uniswap trades at a gas price of ~110 gwei, and assumes 0.5% slippage. The trade cost in US Trash Token is calculated in Column I, this includes the estimated cost to buy and sell. The investment size required to have an average daily volatility of $500 is calculated in Column H. We can combine these to create a standardized ratio of trading cost to product volatility. Intuitively we know that it would be cheaper to allocate to a more volatile token due to the fixed costs (gas) and variable costs (slippage).

Autist note: slippage may be higher for large trades and / or illiquid tokens. Also, these volatility calculations are historical and cannot exactly predict future volatility.

The cheapest token to trade is SPELL. You access $500/day of average volatility risk with an investment of only ~$4,000 costing ~$170 in trading fees. The most expensive token is Bancor, you must invest nearly ~$20,000 to access the same daily risk with costs estimated at ~$320.

So should you invest in SPELL?

Key point: I’d encourage readers to think in terms of market cap rather than token price, to avoid unit bias and to make meaningful comparisons with similar protocols. This also helps when considering how much growth is realistic over your investment horizon.

Note: it is usually better to use Fully Diluted Value when the majority of tokens aren’t yet circulating, and also pay attention to unlock schedules.

How do you use FDV and volatility to help decide whether it makes sense to invest in SPELL at this valuation? Let’s compare the current FDV with a bull case which assumes that the token rises by its annualized volatility (to make a volatility-risk adjusted comparison). Columns G&H:

Is it going to be easier for Alchemix to add $2b to its FDV or Abracadabra to add $15bn? Using the recent volatility metric in isolation, it suggests you need a far greater increase in FDV for SPELL to maintain relative performance to ALCX considering the volatility risk of holding each token. Perhaps a time to trim your SPELL position or exit it completely unless you have a thesis for why the market cap should continue to increase rapidly, not a time to be considering an entry!

Another recent example using market cap was the SHIB cap approaching DOGE – it wouldn’t make sense for the knockoff coin to “flip” the original meme. Degens could have avoided “aping in” to SHIB by asking whether a doubling of the market cap required to double their investment was likely, and therefore avoid paying too much for the token. A trade idea would have been to borrow SHIB (assuming you could borrow, otherwise use a perpetual derivative) and sell it to buy DOGE.

Points to Consider When Buying a Token

Consider the market cap / FDV of the token to determine whether a significant price increase would be realistic given your fundamental model. Compare to other opportunities to find the best risk-adjusted returns.

Consider the maturity of the protocol – later stage investments may be lower risk but are less likely to see significant price appreciation. “Lower risk” is relative, AAVE has a similar volatility to Bitcoin but is a far riskier investment.

If you are buying the token to stake you’ll need to estimate the cash flows from staking (and the staking/unstaking gas costs) to arrive at an estimated total return.

Consider the volatility of the token relative to lower risk base layer asset and to other higher risk opportunities. If you are investing smaller amounts (around $5-15k) you might prefer tokens with higher volatility as trading costs are comparatively smaller to achieve the same exposure. If you have a small degen pot - $20-30k for higher risk plays and you diversify into 5 assets you could be paying as much as 20% in trading costs per year if you rotate twice, meaning your picks need to beat BTC/ETH by much more than 20% to compensate your additional risk.

Degen Strategy

For aggressive apes, especially those with smaller portfolios, it may make sense (potential return per unit of time invested) to concentrate in small cap markets if you have an edge.

Examples of an edge would include 1) *scraping* important news faster than most other people (tweets, medium posts, regulatory announcements, lawsuits, etc) and having a nuanced understanding of which types of news will be impactful; 2) understanding a DAO’s governance to predict significant actions e.g. a buyback and burn of tokens which would impact the market price (see our analysis of Nexus Mutual for a recent example); or 3) analysis of on-chain data (many caveats).

There are other edges, but the general rule is you ought to have a clear reason to believe that you will be faster or better informed than the rest of the market to justify taking on concentrated risk. You may have 2-4 highly concentrated positions and rotate them often. Exiting early to roll a gain into another promising opportunity or back into ETH or BTC is critical. It is dangerous to remain exposed to a token which has performed very well recently and is now exhibiting high volatility relative to other opportunities. Especially if the market cap means further aggressive growth is unlikely in the short term. There is always another good opportunity to research.

Summary

I’ve shown you three concepts relating to how I personally think about risk.

Comparing prices in terms of market cap to avoid unit bias, make comparisons with other assets, and consider whether the expected growth is realistic

Standardizing risk and returns in units of volatility to judge how much to allocate and to measure performance relative to risk.

How I measure trading costs to reduce the risk of trading too frequently vs portfolio size and expected returns. As crypto matures this will become a more important component, this bull market has been kind to apes.

Disclaimer: None of this is to be deemed legal or financial advice in any way shape or form. You are reading opinions from an anonymous group of Wall Street and Tech Engineers in Cartoon format.

Iguana just exploded heads all over substack.....any chance we can get the formulas on those columns sir?

I can't tell if that's horrible opsec that Owl posted his home address (Destination Degenistan, Home of the Apes)....or maybe he is such an Apex Predator he DNGAF if someone shows up at his place?