Welcome Avatar!

In 2014, every Icelandic citizen was airdropped a crypto token.

Iceland was hit hard by the 2008 Global Financial Crisis — its banking sector had collapsed, which led to a drastic devaluation of the Icelandic Króna.

To fight this, the government imposed strict capital controls to stabilize the currency and the economy, resulting in restricted capital movement and a sharp increase in inflation. This period marked a deep recession with a substantial impact on Iceland's GDP and unemployment rates. In classic crypto fashion, a pseudonymous developer decided “crypto fixes this” and founded Auroracoin, a cryptocurrency that was airdropped to all citizens of Iceland.

Its stated purpose was to provide an alternative currency free from the restrictions of capital controls, facilitating transactions both within and outside Iceland.

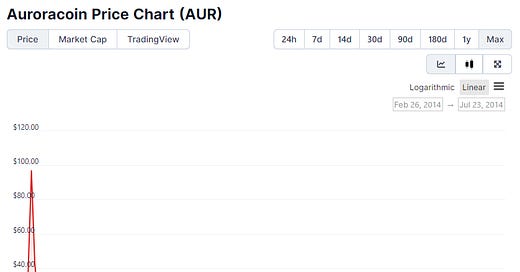

How’d it turn out? Well.. Not great.

Surprising no one who has since participated in an airdrop, anyone who received the coins largely cashed out.

Auroracoin was a complete and total dud. But. The idea was there.

If you give people “free money” you can get their attention.

Welcome to the Free Money Olympics

Regardless of how hard developers and founders try to resist, for one reason or another (capital, community pressure, competition, etc) popular projects end up having to launch tokens.

That means, generally speaking, projects that maintain an active social media presence, who are pre-token, will more likely than not end up launching a token (or risk dying in the process). There is often enough community pressure to push the team to give at least some tokens to early users. Is this the most economically sound or value maximizing outcome for crypto as a whole?

We don’t know.

What we do know is there is nothing like the thrill of thousands of dollars showing up in your wallet simply because you decided to try out some new projects in crypto.

Tokens are crypto’s “killer product.”

They can be deployed and exchanged for capital or labor, provided there is a counterparty willing to engage in this exchange. You can buy or earn tokens that have the potential to increase in value significantly. Combined with crypto’s pseudonymous, global, 24/7 distribution, it’s no wonder that there is such widespread interest in finding, farming, and trading tokens.

However, regulators are much less interested in the upside of tokens, and far more interested in how tokens fit into their archaic securities laws.

This creates challenges when it comes to founders looking to distribute tokens to their users, whether for a price or for free. In 2021 and 2022 we saw a mass proliferation of tokens being launched online and bought up by frenzied participants. This mass frenzy has all but died, and teams have obfuscated the token generation process through the introduction of “points” systems in an attempt to dodge falling victim to regulatory ambiguity.

This has led to strong criticism from many traders who feel that points are a way for the team to lead farmers on without rewarding them commensurately.

As always, there is a lot of nuance here, the situation varies case by case, and demonizing the construct (points) as opposed to how it is used is the wrong answer.

First, let’s establish a few key principles:

Founders/teams will not make decisions that are grossly uneconomical for them personally (i.e. they will not work for free or at a loss in the long run)

Teams typically earn from two ways when running their projects: 1) fees generated and 2) sale of their tokens (no different from profits and equity of a typical startup)

While fees can be highly profitable, tokens will always be the best way to generate obscene personal profits

Tokens are the primary user acquisition tool, and without tokens or the expectation of tokens many projects would have no users or liquidity

The planning, launch, and performance of the token is one of, if not the most, critical aspect of a project’s success

Once we take these principles into account, we can understand that from the perspective of the project’s builders, the token launch is a major event in the project’s history.

Points are a way for teams to get more control and oversight over this major event by having users engage in the same actions they would when farming the token, without having to be locked into a set of rigid tokenomics right away that cannot be easily changed.

Provide liquidity → earn points

Trade on the exchange → earn points

Stay engaged in the Discord —> earn points

That seems pretty harmless, right? The problem is that this process is ripe for exploitation through the following:

Long, extended points programs with excessively delayed token launch

Points are used to generate huge fees for the protocol, but the airdrop allocation is a paltry sum

Points program, but no token is launched at all (the worst of all)

Basically, points are a nod to farmers that a token is coming. If the token is not launched, the farmers have a right to feel bamboozled. Furthermore, points may tell you the actions a protocol values most, but that does not mean the tokens you eventually receive will be particularly valuable relative to your time/capital investment.

With all that said, points programs are not that different from a world with no points.

Prior to the proliferation of points programs, airdrop farming didn’t look all that different. The main difference was you would interact with a project blindly guessing at what actions they value. The only people who knew for sure were insiders, who would receive a massive advantage over farmers who had no clue where to spend their time and capital.

If anything, points actually help bridge the information gap and increase transparency.

We wrote about the HLP farm over at Hyperliquid early this month for paid subscribers. HLP earns substantially fewer points compared to actually trading on Hyperliquid. Points let us know that if we wanted to optimize for farming Hyperliquid points, we’d are likely better off trading than farming HLP. Without points? We’d never be able to make an accurate assessment of the tradeoffs!

Autist note: TVL has gone from $20 million when we wrote about it to nearly $60 million today. This creates two issues: 1) returns are now diluted (PnL split among wider base) and 2) it may become worthwhile for particularly astute whales to start picking off HLP. We have removed our capital from HLP as we no longer think the juice is worth the squeeze at this scale. We’ll take the ~8% return in one week during a choppy market though!

Could this transparency be achieved in other ways? Probably.

Teams could simply say “action X will receive more tokens than action Y” and scrap points entirely. However, it’s unlikely to yield the same impact as the gamified feeling of points. So, despite many peoples’ complaints, we don’t think points are going away this cycle.

The issue now is that people can clearly see that airdrops often favor those with the most capital.

This shouldn’t come as a surprise. Crypto is all about transactions, capital, and fees. We are strong proponents that those who contribute early should be rewarded more even at smaller size. But. You have to please the “whales” as well if you want your project to do well, especially in the context of two-sided marketplaces like exchanges that are reliant on deep liquidity for survival.

Our goal with this post is to give you more of an insider perspective on how people think at the project level. It’s often not nefarious — it’s likely in line with how most people would aim to build, scale, and profit through a project.

That doesn’t mean letting bad behavior slide, however. Projects that abuse points programs should see their TVL and transactions dwindle in favor of projects that can ship faster and deliver users what they want (tokens!). The token should be a shared profit event, not a lopsided windfall for the team who would do well anyway if the process is appropriately managed.

Healthy rewards lead to healthy ecosystems.

Appendix: Quick Background of Points Programs

If you’re new to crypto or don’t spend a ton of time on crypto twitter this section’s for you.

The current points “meta” was largely popularized by NFT marketplace Blur, who dethroned Opensea with their guerilla marketing strategies and use of points, airdrops, and seasonal rewards to incentivize relevant actions. Some may critique their approach, but none can deny the results — Blur is the leading NFT marketplace today and dethroned a company that was previously believed to have a monopoly on the NFT market.

Specifically, Blur makes use of:

Listing points: Highest risk listings earn most points

Bid points: Highest risk bids earn most points

Lending points: Points given for borrowing ETH against NFTs via Blur’s “Blend” lending protocol

Loyalty points: Community engagement, removing third party listings, etc.

Traders have sought ways to game Blur’s seasonal points programs to maximize their gains. This, among other things, has helped cement Blur as the leader in NFT markets and brought them a steady stream of user activity.

Concluding Thoughts

Whether we view points as a regulatory sidestep or a strategy for greater oversight pre-token launch, the “point” is the same: points can be good and bad.

Your job, as the astute crypto analyst/trader/investor/farmer is to seek ways to gamify points systems to your benefit. Sometimes, the tradeoff is quite simple. There’s no way to “game” the Hyperliquid points program in your favor (to our knowledge), so you can proceed to simply trade on there when you’d like with the knowledge that you’ll probably get less coins than the fees you’ll spend on there but since you’re trading anyway you don’t mind the rebate. Other times, you have to back into the expected value of points and all associated rewards (like NFTs) and determine how to maximize ROI.

There are really only two cases you should aggressively participate in points programs:

You like the project and team, so if even if you get less tokens than you want day one, you don’t mind since you’re bullish on the token longer term

Clear gamification aspect where you attempt to “solve” the game in your favor

Don’t just chase after points blindly because there’s a token coming.

If you like what you’ve read today, you’ll love our paid tier which comes with additional ongoing research content, our full backlog of paid content, and bi-weekly Q&As with the DeFi Education team.

We’ve created a course to get you up to speed on crypto. If you’re just getting started, there’s no better place to build a solid foundation (bonus points if you want to work in the space part-time or full-time). Check it out here.

Until next time..

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

We now have a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Has the team looked at any points market protocols yet? I only know of Whales, volume is super low rn but interesting idea https://twitter.com/WhalesMarket

Great post - easy for a noob like me to understand. FYI if you guys want to learn more or see another points program in action now. Blast. Same team as Blur. BTB has been talking about Blast for a couple months. 1 ETH = 1 spin per week. Blast indirectly encourages you to put in at least 1 ETH, otherwise it's not worth it as you can't spin and earn points - thus attracting people with capital. Invite code - blast.io/UUZ0J