Welcome Avatar! Today we cover a topic from the world of tradfi valuation - the risk free rate. We’ll go over what it is, why it’s used and what, if any, relevancy it has in the world of DeFi.

Wat mean?

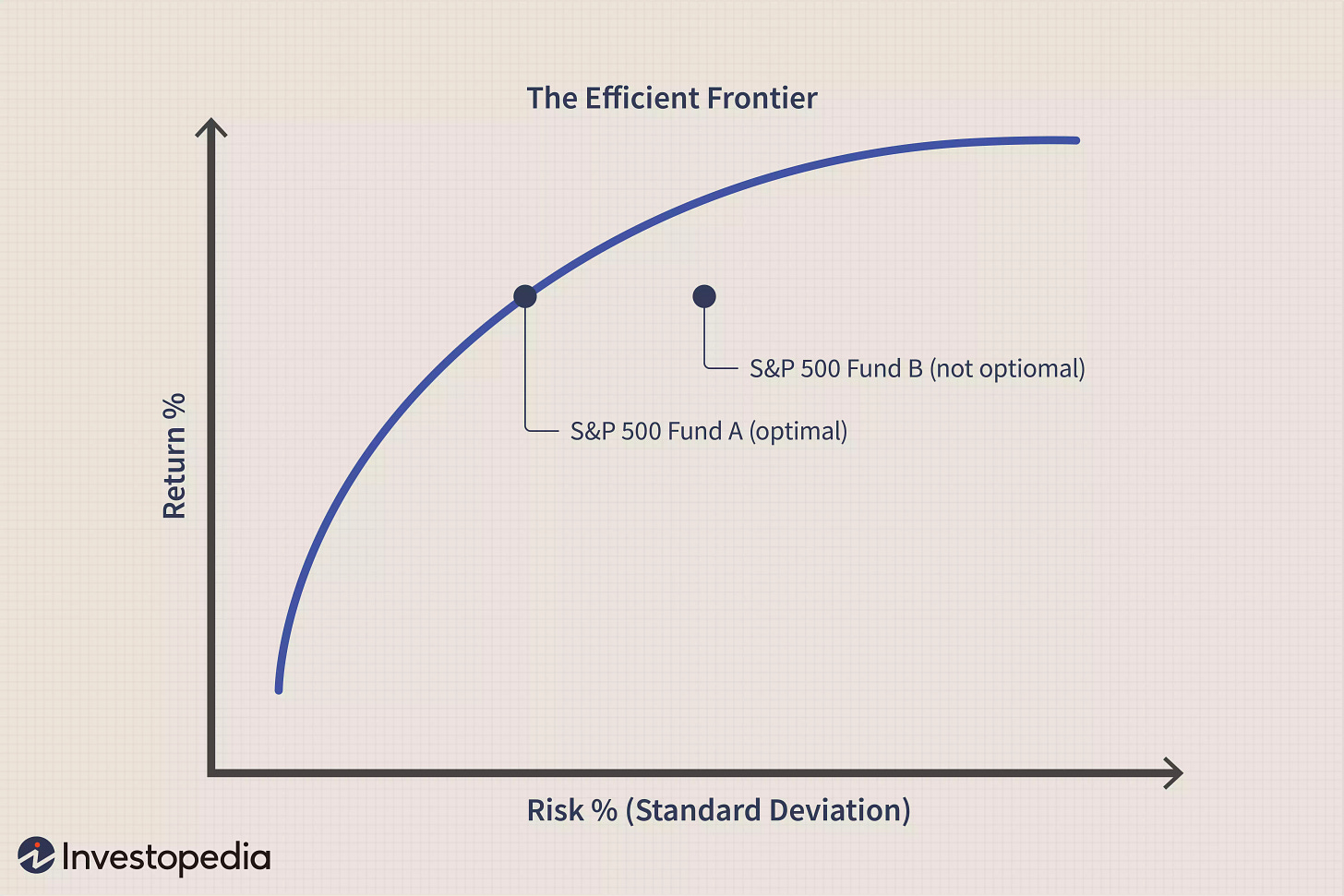

The risk free rate is the rate of return on a riskless asset. One way to think about it is as the rate of return investors want on an investment that has essentially zero risk of default. Remember the relationship between risk and return. More risk = higher expected return. A simplified illustration below:

The risk free rate most commonly used is 10-year US treasury bonds but you can use 3-month T-Bills or 30 year bonds as well. The basic idea is that the market widely agrees the US will *never* default on its obligations meaning it’s long-term debt is riskless.

Currently, the US 10-year treasury has a yield of ~1.6%.

Yes, we know what you’re thinking: “what is this a return for ants?” Stick with us, we’re going somewhere with this.

Why should you care?

The risk free rate prices risk across the spectrum. Since the risk free rate has no risk, anything that does have risk should give you a higher rate of return (greater than 1.6%, for example).

Intuitively, people understand this relationship. Would you ape into a brand new stablecoin’s farm on BSC for 4% APR? Hopefully not. Would you ape into the same farm for 300% APR? More likely.

Your rate of return is your compensation for providing your capital (money). The higher the perceived risk, the more return you as an investor will demand. Since the risk free rate is the rate of return on a riskless asset, you can think of it as the “floor” expected return. That means if the risk free rate increases, people expect higher returns on all riskier assets as well.

We repeat, higher risk free rate means cost of capital for *all assets* goes up.

Example (made-up numbers): Let’s say 10-year treasury yields are 2% and corporate bonds are 4%. Then, treasury yields increase to 4%. All else being equal, would you rather buy risk free treasury bonds and get 4% or take on corporate bond risk for the same return? That means corporate bonds need to offer a higher rate to incentivize you to lend your capital.

We know what you’re thinking. “This sounds like it’s for boomers.”

What does it mean for DeFi?

Participating in DeFi at all is already higher risk than equities (in our opinion). People don’t come to DeFi looking for 10% or even 20% returns on altcoins. People are hunting for 5-10x returns. The expected return on DeFi broadly is far higher than traditional markets.

Does a risk free return exist? And if it does, is it even relevant? Let’s explore some options.

CeFi USD Stablecoin Yields

CeFi yields are 8%-10% on stablecoins. There is some risk involved, however, as you are taking on counterparty risk with BlockFi, Celsius, etc.

DeFi USD Stablecoin Yields

The yields on stablecoins on the largest money markets like Compound and Aave. This yield is ~ 2 - 4%. Main risk here is smart contract risk. If it costs ~1% to insure smart contract risk on Nexus Mutual, the risk free rate is more like 1 - 3% which is about in line with US treasury yields.

Futures Premium Yield

This is the yield which could theoretically be earned by using USD capital to buy a cryptoasset (BTC, ETH) and immediately selling a futures contract on the same asset at a premium to the spot price. This structure is not risk free, but has low risk if properly managed. You are buying an asset now and immediately agreeing to sell it in the future at a higher price. This gives an indication of the rates speculators are willing to borrow at to obtain leverage. Current premium is around 11% annualized on both BTC and ETH.

ETH2 Staking Return (5-6%)

To us, this feels like the closest analog to the traditional risk free rate. Ethereum is the largest, most decentralized and most lindy chain with DeFi. ETH staking returns come from providing capital to secure the chain (similar in nature to government bonds). And. 1 ETH = 1 ETH.

In our view, the risk free rate is not about finding the lowest return (e.g. yields on Compound), but rather finding a risk free return that is also representative of the ecosystem. We think ETH2 staking returns are the best representation.

Downsides to this approach? The only one would be that people don’t really think in ETH terms. Only crypto natives do. However, crypto natives and funds are the largest market participants so we think ETH2 staking makes the most sense.

Degen Spartan has had some good takes on risk free rates in DeFi in the past. See below.

Risk Premium in DeFi

One thing to consider in traditional risk free rates is what to use in international valuations. For example, if I am valuing a company in a third world country should I really be using a US risk free rate as my “floor” expected rate of return? A company that operates in Kenya, for example, has a different risk profile than the US. One potential solution in that circumstance is using the local rate equivalent. For example, if Kenya is offering 10% for its treasury bonds then we can use that to account for the higher risk. (Counterargument is that it’s technically not “risk free”, however this is the best way to account for it in our opinion.)

Applying that to crypto, you could add a risk premium to something like Avalanche.

For example:

Risk free rate on ETH2 = 6%

AVAX risk premium = 9%

AVAX risk free rate = 15%

Don’t get too attached to the specific numbers (they’re made up). Instead, think of it as a way to frame risk. L1 coins are less risky than the Dapps on top of them. Riskier or less tested ecosystems should have a higher “floor” risk free rate than ETH today. This makes sense intuitively - you wouldn’t buy a bunch of AVAX unless you thought it might outperform ETH.

The logic behind how we think about risk premium complements how we think about pairs:

ETH DeFi is more risky than ETH. Other L1s are more risky than ETH. Other L1s are also more risky than BTC. DeFi on other L1s is more risky than the native L1. DeFi between other L1s and ETH DeFi is more subjective and case-by-case.

We hope you enjoyed our thoughts on risk free rates in DeFi! We’re in the process of wrapping up our overview of the long awaited Frog Nation ecosystem (SPELL, ICE, TIME) and look forward to covering that in our next post.

If you’re reading this and you haven’t subscribed already, join our community below to learn more about DeFi.

Disclaimer: None of this is to be deemed legal or financial advice of any kind and the information is provided by a group of anonymous cartoon animals with backgrounds in Wall Street and Software.

Excellent as always. Would add gas fees and possibility of user error (send ETH to a BTC address etc) to current DeFi premium.

Got into crypto April 2021. Sold S&P 500 etf. Incurred capital gains taxes. Purchased corn and defi 1.0. Achieved negative return. S&P 500 has 30% return.

IM CRYINF SO HARD RN