Welcome Avatar! If you are an early DeFi Education subscriber or an avid Crypto Twitter-er, you’ve no doubt come across Curve Finance.

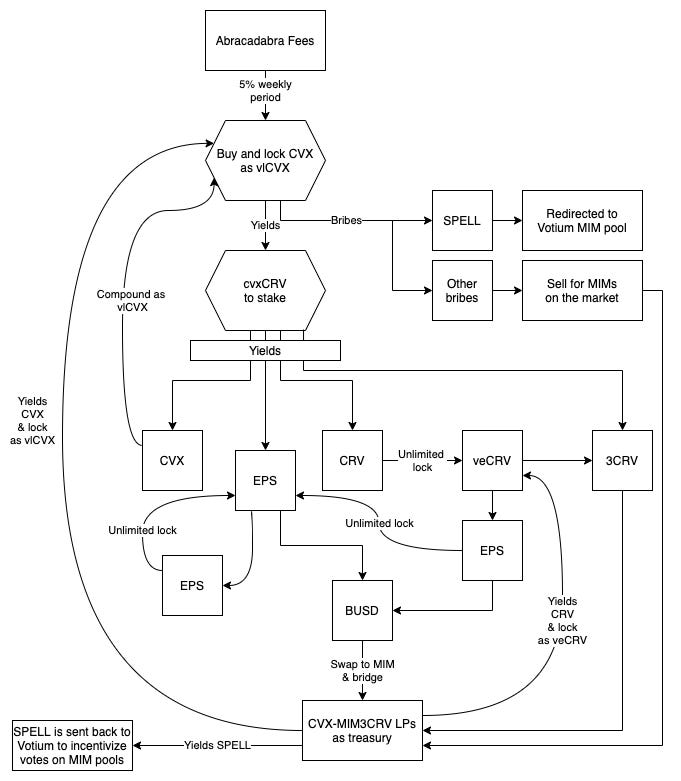

Our Chief Meme Officer @DgenFren recently released a work of art below that depicts the Curve War situation.

If you know what’s going on in this artwork, you can probably skip this article.

For everyone else, lets dive in.

Highlights

Curve Finance - A DeFi Utility

Governance Land Grab

The Great Curve Wars

Token Discussion

Curve Finance - A DeFi Utility

Curve is an Automated Market Maker (“AMM”) that specializes in swaps for price-stable assets (e.g. USDC, USDT, etc.). OG readers will remember our Overview and Valuation published in August.

Curve’s token (“CRV”) serves as a token for yield farming rewards for liquidity providers as well as for locking for governance. The protocol incentivizes locking of CRV tokens by allowing holders of its vote-locked CRV (“veCRV”) to vote on distributing CRV rewards and adding new gauges.

The price-stable AMM and CRV emissions incentivizes yield farming thereby improving liquidity depth for pools on Curve, allowing for stablecoins to improve their ability to maintain peg.

More liquidity for your pool on Curve means more buy/sell volume is required before the price moves. For example, that means a sound USD stablecoin will have smaller oscillations around $1 (e.g. between 0.99 to 1.01 instead of 0.97 to 1.04). This is important as the slippage when trading a stablecoin represents a cost to the user – using protocol funds to increase liquidity can be thought of as a subsidy paid to users.

The same way an electric utility enables electricity, Curve is a DeFi utility that enables stablecoin stability and yield across the ecosystem.

Governance Land Grab

Curve’s governance token is veCRV, which is CRV locked for up to 4 years. The longer CRV is locked, the more voting power you have. As your lock period goes down over time, so does your voting power.

Key takeaway: to keep maximum voting power, you must continuously lock your CRV for 4 years.

One of the major powers given to veCRV holders is the ability to change “gauge weights”. Gauge weights determine the amount of CRV rewards allocated to each pool on Curve.

CRV is an important component of the yield other protocols provide to their own stakeholders, so protocols that want to maximize APY from CRV are incentivized to accumulate veCRV and direct rewards in a manner that benefits them most.

Simply put, accumulation of veCRV is a total land grab.

From the earliest days of organized warfare, there were soldiers who served an empire and there were soldiers who fought for money instead of political affiliation - mercenaries.

The Curve War has its own form of mercenaries, veCRV holders who vote based on CRV bribes. CRV bribes (via bribe.crv.finance) allow protocols to issue rewards to veCRV holders that vote for their pool. CVX bribes are possible via Votium.

For example, allocating votes to the MIM 3Pool allows you to earn bribes in SPELL (native token of abracadabra.money - think of Abracadabra as a multichain MakerDAO). SPELL was the second largest participant in the latest Votium round by total bribe paid ($969k).

The Great Curve Wars

Convex Finance

Convex is a DeFi protocol with the aim of maximizing the locking of CRV tokens. CRV holders can stake their token for cvxCRV (as opposed to veCRV). In exchange, cvxCRV holders earn proportionate trading fees and CRV rewards. Rewards are earned in cvxCRV.

Note that CRV staked for cvxCRV cannot be withdrawn, but cvxCRV can be traded.

Convex unbundles Curve’s governance and economics. cvxCRV holders give up their Curve governance rights to Convex while maintaining the other veCRV benefits (trading fees and yield) and also earning CVX rewards.

CVX is Convex’s governance token. Locking CVX (vlCVX) lets you vote on governance decisions pertaining to Convex’s veCRV. Currently, there are 142 million cvxCRV and 23 million CVX locked. That means 1 CVX equals ~6.2 CRV. At the same time, price of CVX is $21.18 and CRV is $3.77, implying a $CVX:$CRV ratio of 5.6x.

Key takeaway: At the ratios outlined, each dollar of CVX buys more CRV voting power than buying CRV outright. Buying CVX instead is value accretive.

CVX is quite clever because its emission schedule is determined by the CRV locked. The maximum circulating supply of CVX is 100 million, which will be reached when 500 million CRV has been locked which increases the voting power of each CVX thereafter.

Key takeaway: Every marginal CRV token acquired by CVX after CVX emissions end increases the CVX:CRV ratio, meaning every 1 CVX will have a rising claim on CRV voting.

If all these tokens are getting confusing, don’t worry. The point of all of this is still the same: they want to acquire the most veCRV.

Yearn Finance

Yearn is a yield aggregator that is dependent on Curve’s CRV boosts to sustain yields for depositors. In our article on Yearn early this year, we highlighted Yearn as a place to farm Curve finance stablepools due to 1) its large amount of staked CRV and 2) the “backscratcher” program which enables Yearn users to earn Curve boosts.

Yearn vaults provide liquidity into Curve pools and earn CRV rewards. 10% of all CRV rewards are locked into the backscratcher to obtain more CRV. The remaining 90% are typically used to compound returns for the LP tokens for that strategy.

Recently, Yearn delegated all their veCRV to Convex to increase yields for their factory pools. Note that this delegation does not delegate their voting to CVX.

The Thunderbolt of Zeus

The Ohmies are aware of the strategic importance of Curve and are the most recent entrant to the Curve Wars. Olympus DAO governance proposal OIP-43 proposes launching CVX bonds for the DAO to start accumulating CVX. As they aptly pointed out in their proposal, being an early mover to CVX is an advantage. The CVX emission rate (which is tied to CRV farmed) reduces over time, potentially making it far more expensive to acquire the same percentage of voting control in future.

Their intentions are to use voting power to enhance yields on Ohm’s treasury assets and to achieve significant governance over the Curve ecosystem. The proposal passed and Olympus DAO already owns 317,343 CVX tokens valued at $6.9M. Ohm, with an $850 million treasury and $2-3 million in bonding revenue per day has the potential to be a serious player in the Curve wars.

BadgerDAO

Badger is a Bitcoin focused DAO and recognised the strategic importance of Curve due to low yields on DeFi Bitcoin. There is over $2.5 billion in liquidity for Bitcoin pegged assets on Curve, but prior to Badger entering the Wars, BTC-pegged assets were receiving less than 2% of CRV rewards. Badger launched a CVX vault (uncapped on October 5) which now has 1,214,108 CVX locked to vote for higher Curve emissions for the underlying liquidity pools of Badger Setts. This strategy is working - BadgerDAO TVL increased from 215k ETH at launch to 275k ETH on November 22. (we are quoting TVL in ETH terms to remove fluctuations caused by Crypto/USD fluctuations rather than liquidity growth.)

Stablecoin protocols

Deep liquidity is critical for reducing transaction costs when holders of Abracadabra’s Magic Internet Money MIM or Frax’ stablecoin swap for another asset. These stablecoin projects are in the top 3 Votium bribers, paying $2.23M and $0.97M respectively in a recent round. Alchemix is second place splitting $1.3M in bribes between alETH and alUSD stablecoin pools.

A contract linked to the Frax deployer* also locked 704,887 CVX.

Abracadabra has allocated 5% of weekly protocol fees towards buying and locking CVX. The following diagram produced for Abracadabra’s governance proposal explains their strategy in detail (credit @Clonescody).

Mochi Governance Attack

Wars come with their own generally accepted rules and strategic affiliations. Dog-coin-meets-DeFi-stablecoin-protocol “Mochi Inu” was blocked from receiving CRV token emissions by the Curve Emergency DAO, who characterized Mochi’s aggressive purchase and locking of a large number of Convex Finance (CVX) tokens as a “governance attack”.

After promoting USDM as an asset backed stablecoin and incentivizing LPs to join its curve pool, Mochi used an infinite mint attack to create $46m of USDM for free (backed with worthless Mochi token collateral). It used this USDM to drain the USDM-3pool of DAI, rugging LPs, and used the proceeds to buy CVX.

USDM functions as if MakerDAO’s DAI was backed by MKR tokens instead of ETH or other tokens. Since Mochi can continue to be minted, more USDM can be created at will with no real backing.

The intent appears to have been to control a large stake in Convex to incentivize LPs in the USDM-3pool, creating a flywheel effect. The mint resulted in the USDM stable becoming significantly undercollateralized and the peg failed, causing substantial losses.

Blockchain data shows a Mochi wallet executing 7 transactions, swapping minimum 1,000 WETH for CVX via the 0x router. These trades cleared out the liquidity in the Sushiswap AMM between $31/CVX and $48/CVX, achieving a purchase of 862,611 CVX tokens at a cost basis of 7,100 ETH – an average price of $38.13. The worst fill on a 1,000 ETH tranche was $46.56/CVX – the price just 15 minutes prior was at $31.26.

Mochi secured the CVX bag but overpaid by $5.4 million. DeFi whale Tetranode is the main CVX market maker and so won most of the money that Mochi lost by sloppy trade execution.

Why is this event controversial? Well, Mochi was kicked out for being a “malicious actor” and many considered this to be an action of a group of large holders and whales. For many, this action goes against the principles of decentralization.

Mochi still controls around 1 million CVX tokens. The Convex DAO, likely at the behest of whales and to deter any future governance attacks, removed the voting rights from Mochi’s vlCVX which will prevent Mochi earning Votium bribes.

Despite no longer having a Curve gauge for USDM, Mochi can expect to earn significant income in the form of cvxCRV rewards.

Curve’s Competitive Moat

Unlike battlefields in the real world, the blockchain space has, in theory, unlimited land. Why is everyone laying siege to Curve’s castle walls when they can build their own castle anywhere?

It’s quite simple - you can build your own castle but it may not have a competitive moat. Curve does. Curve’s unique AMM structure and large liquidity is very difficult to replicate.

The proof is in the pudding: no Curve fork has been able to scale and compete.

Furthermore, large capital allocators are incentivized to stay within the Curve ecosystem because they are locked up for an extended period of time. On average, CRV is vote locked for *3.65 years*. Hence, the protocols and whales that control Convex/Curve are locked in and incentivized to support the protocol whether directly through CRV or indirectly via CVX and bribes.

Token Discussion

Okay anon, you’ve read our CRV overview and you made it through The Great Curve Wars post. We know what you’re thinking. “Wen token?”

In our opinion, CVX is the most important token in the CRV wars currently. Large protocols and whales are accumulating CVX to control CRV rewards. Abracadabra, OlympusDAO, BadgerDAO, etc. are no small players.

Recently, KeeperDAO (ROOK) passed a proposal to purchase up to $40 million of CVX at prices up to $40 (Current price of CVX: ~$22) before the end of 2021. KeeperDAO is implying they view CVX as being value accretive for them at up to 1.8x the current price.

Autist note: this is one of the drawbacks of open source. Protocols have to openly state their buying intentions through governance proposals *including* their max bid, which puts them at a strategic disadvantage and loses the element of surprise. Another recent example we covered: the Nexus Mutual protocol is currently committed to purchase 8,000 ETH of WNXM up to a market price of 0.0235 ETH and hasn’t started executing yet. (LINK)

From a token fundamentals perspective, we prefer CVX to CRV for the following reasons:

Long-term supply emission tailwinds - As CVX emissions slow to a halt, the intrinsic value of each CVX as a vote control mechanism rises which should translate to a higher valuation per CVX *if* Curve remains a critical utility

CRV leviathan - Convex controls 39% of locked CRV, making it the clear leader in the Curve Wars

Proxy for discounted CRV - As outlined above, one CVX = 6.2 CRV and $CVX:$CRV = 5.6x. CVX is value accretive as a CRV proxy.

Multiple reward incentives and simpler mechanics - Locked CVX and staked cvxCRV can earn you 50% APR each

Liquidity - cvxCRV is liquid and can be traded (unlike veCRV)

For the reasons outlined, we think CVX has a better risk:reward profile than CRV.

Closing Thoughts

With its stable asset trading AMM, unique vote locking mechanic and yield boosting capabilities, Curve has become a critical DeFi utility. There is an ongoing fight for control of the utility fueled by whales and protocol treasuries. As the key player, the Curve Wars are also, by proxy, the Convex Wars.

Who is the real winner here? Are the Curve Wars really what CRV was meant to be used for?

Let us know your thoughts in the comments below.

Sources:

Votium Bribes - Llama Airforce

Protocol TVL - DeFi Llama

Convex Finance - Dune Analytics, snapshot revoking Mochi’s votes

Abracadabra diagram - governance proposal

Frax contract* - 0x7038c406e7e2c9f81571557190d26704bb39b8f3 deployed from the Frax Utility Contract Maker

Thanks for reading! If you’re reading this and haven’t subscribed, join our community of DeFi Turbo Autists. 👇

Disclaimer: None of this is to be deemed legal or financial advice in any way shape or form. You are reading opinions from an anonymous group of Wall Street and Tech Engineers in Cartoon format.

Are you concerned about how many layers of indirection there are between actual revenue vs claims on possible future revenue? Hint: CVX does not create more revenue, just more claims

Reading this hurts my head but nice write-up!