Welcome, Avatar! We all know the most important thing to every crypto investor —money. What most people don’t know, however, is the most important thing about money — credit. Today we talk about the relationship between money, credit and the economy followed by key takeaways from a DeFi perspective.

Money and Credit Cycles

Money is a medium of exchange (among other things).

Banks (zeros) have the ability to create money. Banks, which originally used to store gold, one day realized that people probably wouldn’t redeem all of their gold at the same time. They started lending gold to make money, and eventually started issuing bank notes and IOUs. Eventually that meant the amount of money was greater than the amount of gold in their coffers.

This is what’s known as fractional reserve banking.

Today, banking is done digitally and almost all of the world’s money is digital deposits.

That also means new money, and new credit, can be created by banks digitally. Supply of money is entirely elastic and is controlled by central banks through money “printing” and setting interest rates. Higher interest rates means banks pass higher costs to borrowers, reducing borrowing and resulting in less new money (and vice versa).

Banks lend to make money and borrowers take out loans for consumption, investing, starting businesses, etc.

Borrowing lets people consume more than their economic production until the debt needs to be repaid.

Money lets you conduct transactions with the cash you have today. Credit on the other hand lets people borrow against their assets and productive capacity (income) to spend more than the cash they have today. When the economy is booming and credit is easily available, people borrow more and (ideally) increase their productive capacity. During these times, credit accelerates economic consumption and growth. Everyone wants to consume today and banks want to lend, so you have far more credit than money in the economy.

The U.S. today has $85 trillion in debt and $21 trillion in money (4.0x Debt to Money Supply).

Credit is the most important use case for money because it fuels production and consumption. Credit is money on steroids.

An economy without credit can only increase spending (and thereby the counterparty’s income) with more production. This may not sound so bad, but imagine you could only buy a house with 100% down, or couldn’t go to college if you didn’t already have a high income to pay for tuition. Credit can be healthy if used to increase production and income to repay debt in the future.

Credit is unhealthy when used towards overconsumption and can’t be repaid.

Borrowers deemed financially healthy by zero banks are considered creditworthy and find it easier to borrow money, while the opposite is true for unhealthy borrowers.

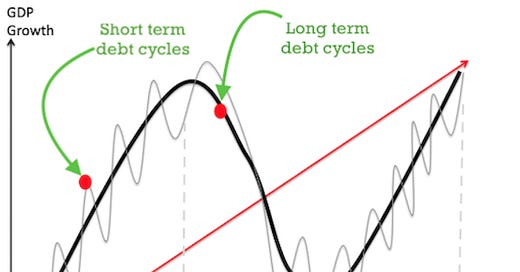

The relationship between credit, spending/income, productivity and human behavior creates debt cycles.

Economic boom and busts are often times credit boom and busts, where low interest rates and easy access to borrowing cause people and businesses to overextend relative to their production and ability to repay, which eventually creates a downward spiral. When debt repayments begin to outpace income, you have a reverse effect on the economy. Debt is a double edged sword.

Overleveraged borrowers need to reduce spending, which lowers consumption and drives down incomes which further exacerbates the impact of high debt repayments.

Too much to repay in debt causes people start to sell their assets, which drives down asset prices and makes everyone less creditworthy due to falling collateral values. If interest rates are already low, you can’t lower interest rates further to stimulate borrowing. The only thing central banks can do in this case is to print new money to buy financial assets and government bonds (i.e. inflation) which restores faith in financial markets and increases the value of financial assets.

Money printing, higher taxes and reduced spending can help ease the pain of a downturn if eventually they can drive income growth (challenging).

The point here is not to go into a discussion about macroeconomics. Rather, the point is to illustrate that the most important thing about money is credit.

So what does that mean for crypto?

Bitcoin and Ethereum are “crypto money”.

Regardless of what you might think about “real world” usage today, BTC and ETH are used as units of account, mediums of exchange and stores of value within the crypto-economy.

DeFi serves the crypto-economy and was invented to unlock the value of ETH. As highlighted in our history of DeFi article, MakerDAO was one of the pioneers of DeFi and allowed users to mint Dai stablecoins using ETH deposits. Put another way, DeFi exists to create credit using crypto money - Dai is actually credit.

Credit is the most important use case for money and DeFi is the most important use case for crypto-money.

DeFi today is extremely small in comparison to the money it uses.

ETH’s market cap is $350 billion meanwhile the market cap of all of DeFi is $110 billion. The market cap of ETH-collateralized or backed stablecoins Dai, Frax and Fei is a combined total of $13 billion. Now, we recognize that comparing total market cap of DeFi to ETH isn’t exactly apples to apples to Debt to Money Supply, but it is indicative of how small crypto money financial products and services are relative to the value of money they will unlock.

The primary difference is that crypto money, or at least Bitcoin, doesn’t have any monetary policy tools or changes to supply.

In that sense, crypto money today is reactionary to central banking policies globally.

At some point, central banks and global financial authorities will have to account for crypto money and cryptoassets when making monetary policy decisions. People no longer need to bend to the will of the currency of their country — they now have an exit beyond USD. Money printer go brrrr in the US? Banks freezing assets in Cyprus? You can exit to the open source, hard money financial system stock with its own set of tools, coded policies and yes, with its own credit.

Developing and growing the crypto money credit system is the most important part of crypto since the development of Bitcoin. One time for the people in the back: DeFi is the future of finance.

If you enjoyed learning about the The Most Important Thing About Money we’d appreciate if you could share this post.

And if you haven’t already, subscribe to DeFi Education below for more educational content and deep dives on DeFi protocols.

Until next time..

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

curious to hear your thoughts on whether the market cap of a protocol can ever exceed the market cap of the chain it's built upon (i.e could DeFi eventually dwarf the market cap of ETH?)

If fractional reserve banking in crypto looked like it did in the US during gold standard, what would the size of DeFi be?