Understanding How Economic Models Break Down (and a Highly Profitable Trading Strategy!)

Level 1 - NGMI

Welcome Avatar!

Crypto protocols all rely on the flow of money to exist.

Aave needs you to lend and borrow.

Uniswap and Curve need you to provide liquidity and make trades.

Maker needs you to mint and hold DAI.

NFTs need you to ignore how bad they look and hold them (kidding, kind of).

In a shrinking market, everyone is competing for the capital of the same few users. For one reason or another, there are large sums of capital on-chain that will not (or cannot) leave, which means they will be forced to use on-chain services.

The advancement of crypto is not purely technological. In fact, the economics of crypto applications are one of the most fascinating parts.

In today’s post, we’ll talk about the basics of crypto economics and how you can use this information to improve your crypto analysis.

It’s still about supply and demand

Most protocols are multi-sided marketplaces.

For example, the Maker protocol involves depositors/DAI minters, users of DAI, LPs of DAI, and liquidators. Each of these stakeholders faces their own supply and demand dynamics.

New DAI will be created when there’s demand for leverage, which increases in bullish conditions as users want to be levered long ETH.

Liquidity providers for DAI help keep the value of DAI’s peg stable.

If there’s a significant selloff in ETH and liquidations occur, the protocol holds an auction to sell off the collateral.

For the protocol to function properly, there has to be enough supply and demand at any given time, otherwise there is a risk that it could break.

Maker is battle tested and has proven out its economic model over the years. Maker is a rare example of a protocol which does not directly pay for supply or demand. Liquidation fees an auctioned collateral along with specific risk parameters allow Maker to incentivize liquidators and manage downside risk.

People generally trust DAI’s stability (although that may change). There is enough attention on the protocol to monitor for liquidations. And people continue to demand DAI for any number of reasons.

Why things break

In an economic sense, things in crypto break when there isn’t enough supply of capital to meet demand where it’s needed.

Developers try to “improve” upon systems by changing parameters of existing protocols or trying to reimagine economics entirely.

Let’s think about an imaginary protocol called “Taker” that aims to be functionally the same as Maker.

You deposit an asset and mint a stablecoin called “TAI”.

Taker wants to takeover Maker and become the dominant stablecoin. DAI is for boomers - you need a 150% collateralization ratio which makes it “capital inefficient” and you don’t get free MKR tokens for using it.

Taker gives you 150% APY for depositing your ETH, borrowing TAI and then depositing the TAI in some farm. Like Maker, if there is a system shortfall Taker will issue TKR tokens to cover it.

This works well, for some time. But gaining ground on DAI is hard. These so-called “whales” seem to prefer DAI. The Taker team gets a novel idea - why not relax some of the risk parameters?

150% collateralization.. Taker could probably handle 120%. 13% liquidation fee is quite high, let’s give back to our customers and cut this to 5%.

Maker is the king of the ETH market, let’s expand to Solana and accept SOL tokens as collateral.

Now you can entice some degens that aren’t subscribed to DeFi Education.

"It’s safe, we have a gigabrain dev team and we are confident the protocol can handle it.”

In most cases, it’s “heads we win, tails you lose.” Protocol risk affects all users, but it may not necessarily affect the team if they don’t have significant funds deployed in it. Relaxing risk parameters may provide some juice on the growth side of things but results in an ever increasing push towards risk taking until things blow up.

Even functioning economic models break if you change the risk profile.

What about models that are fundamentally broken?

Fundamentally broken models

A now well-known example is algorithmic stablecoins (Empty Set Dollar, Beanstalk, UST, etc).

Any protocol that relies on its own token to backstop the value of its stablecoin is fundamentally broken. It’s a confidence game that requires an ever increasing supply of believers otherwise it completely breaks down.

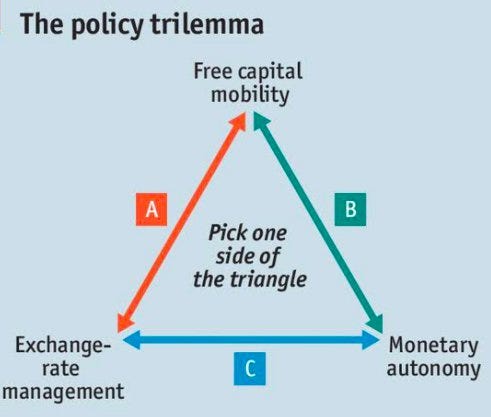

The Impossible Trinity theory in international economics states that an economy cannot maintain a fixed foreign exchange rate (stablecoin peg) and an independent monetary policy (ability to set interest rates) in the absence of capital controls.

A stablecoin designed to use interest rate policy to balance supply and demand violates this theory and is likely to fail. The Mexican Peso crisis and the Asian financial crisis were foreseeable in the context of this theory.