Understanding Hyperliquid's Expansion

Level 3 - Virgin DeFi Analyst

Welcome Avatar!

Hyperliquid Improvement Proposals (“HIP”) are a mechanism for upgrading the core protocol and introduce new financial primitives. Unlike past use of DAO governance that has often created bottlenecks around use of treasury funds, each HIP has been aimed at step function improvements to the Hyperliquid protocol.

Most recently, Hyperliquid is introducing collateralized binary contracts for prediction markets through HIP-4 (HYPE +7% on the news). HIP-4 is live on testnet as of Feb 3, 2026.

Here’s a breakdown of other HIPs

HIP-1 “Native token standard”: HIP-1’s major addition was the introduction of onchain spot orderbooks, which enabled the launch of the PURR memecoin for stress testing purposes. HIP-1 introduced a formal standard for fungible tokens on HL, similar to what ERC-20 did for Ethereum

HIP-2 “Hyperliquidity”: HIP-2 introduced automated liquidity for HIP-1 tokens. It moved Hyperliquid forward by providing predictability around liquidity for new spot assets which made newer listings more viable.

HIP-3 “Builder-deployed perpetuals”: HIP-3 allows any builder who stakes 500,000 HYPE to launch their own perp markets (crypto, stocks, commodities) with their own oracles and fee structures. HIP-3 markets recently hit a record $1 billion in open interest and $4.8 billion in 24H volume.

In today’s post we’ll talk about the Hyperliquid protocol and product. Note that we covered the drivers of Hyperliquid’s recent price action in Saturday’s DeFi Roundup.

HIP-3 a Game Changer?

While BTC and ETH remain the single largest assets by individual open interest, collectively, the HIP-3 markets now represent a massive portion of the platform’s total ecosystem.

HIP-3 OI recently hit a peak of $1.84 billion, a 200% growth MoM

HIP-3 trading volume hit $1B in daily volume for consecutive days in Jan 2026

HIP-3’s success has been driven by:

XYZ100, a composite equity index that has done nearly $13B in cumulative volume

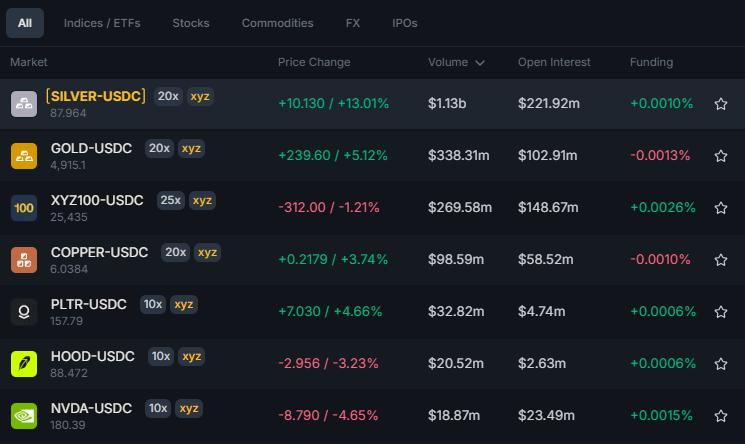

The Silver commodity perp is doing ~$3B weekly volume and recently flipped SOL and XRP in volume on HL

The Gold commodity perp is doing ~$700 million weekly volume and HL has the deepest onchain liquidity for gold perps

The NVDA equity perp has done $1.2B in cumulative volume

The above markets account for ~90% of builder deployed volume. This is being facilitated by TradeXYZ.

Understanding TradeXYZ

TradeXYZ is essentially a “sub-exchange” that uses the Hyperliquid L1. It uses HL’s orderbook but manage its own listings and oracle. The flagship product is XYZ100 which is an onchain Nasdaq 100, but Silver has recently taken over as the most traded tokenized asset on TradeXYZ.

TradeXYZ uses a custom oracle for prices after market hours. During market hours, it tracks live feeds (like Pyth). When the market closes, it switches to a continuous-time smoothing mechanism that lets users trade based on global sentiment and weekend news. Prices snap back to spot when the opening bell rings.

TradeXYZ recently generated over $2 billion in 24H volume. Every trade on TradeXYZ generates a fee which is split 50/50 between Hyperliquid and the TradeXYZ team.

What it all means

In our Deep Dive Report on Coinbase we talked about the strategic shift exchanges are pursuing, going from hyperscaling user numbers (gets expensive!) to prioritizing increasing value of their existing userbases. TradeXYZ allows Hyperliquid to take the onchain trader userbase it has and provide a slew of new products via HIP-3 and soon HIP-4.

Below are a few net effects we anticipate from this.

Hyperliquid becomes more resistant to crypto’s speculative boom and bust cycles

In a pure cryptoeconomy, volumes and DeFi revenues spike when speculative activity spikes. This is the boom and bust problem that has plagued the industry since inception, and has been written about at DeFi Education for years. Now that markets are starting to pull in indices, commodities, and equities, crypto is giving users more reasons to trade and participate onchain. Cyclicality can exist but this makes onchain markets more diversified and less insulated to crypto. Gold does not need an altseason (this word will be erased from the crypto collective conscious). Silver does not need a memecoin mania. If the platform’s highest velocity markets are no longer all correlated to risk-on crypto beta, the aggregate fees become smoother and potentially more stable. This would justify a valuation premium above and beyond other crypto protocols which remain stuck in the crypto closed loop.

More capital stays onchain and potentially even ports over

If a trader can run a book that includes crypto majors, an equity index, and commodity hedges without wiring to a centralized exchange, less collateral needs to move around. Moving collateral is friction and friction is where users leak. Expanding to tradfi markets increases user stickiness.

Crypto is competing with the real players now, a huge step forward compared to the closed loop world of DeFi from just a couple years ago

The old DeFi loop was closed. You traded tokens that were native to the same ecosystem, priced against the same risk factors, with the same participants recycling the same capital. That was fine for early DeFi but it is not a credible end state. Now that major tradfi firms are integrating and adopting crypto/tokenized assets, we’ll see faster progress and likely more institutional capital. This further opens crypto to broader markets.

Revenue per trader

As an extension of the points above, an expanded product suite should drive an increase in revenue per trader as more products mean more reasons to trade at different hours, exposure to more catalysts, etc.

Chairman Selig and Project Crypto

CFTC Chairman Michael Selig recently gave his first public remarks and crypto was a key focus. He told the market that the CFTC wants crypto derivatives, event contracts, and tokenized collateral to exist onshore under clear rules. He stated that the prior administration failed to create a pathway for perpetual derivatives in the US, and he wants a workable framework so perps can “flourish” across centralized and decentralized markets with safeguards. In translation, perps exchanges are not being treated as a thing that must live offshore forever. This creates both opportunity andrisk. When regulators write rules they also define who has to register and what activities are prohibited.

Notably, Selig is open to safe harbors or innovation exemptions for software developers and users, and he acknowledges a spectrum of decentralization. The more Hyperliquid can credibly position components as non-custodial, programmatic, and not discretionary intermediaries, the better.

He furthers the shift in posture since the last administration and says “regulation by enforcement is dead.” The CFTC is actually partnering with the SEC on “Project Crypto” to work on clearer rules of the road in crypto.

Selig views tokenized collateral as improving liquidity and market resilience, and enabling more automated risk management. He also directs staff to draft new event contracts (prediction markets) rulemaking to establish clearer standards because the existing framework has been hard to apply.

All in all, the statement from Chairman Selig is positive for crypto as a whole. The net effect on Hyperliquid will depend on the specifics of the rules. We would anticipate Hyperliquid is likely to play a material role (whether as an insider or outsider) in how these rules are framed and considered given its market dominance and its entry into the “gray area” with tokenized asset perps.

HL’s Legal Strategy

This section is our speculation on Hyperliquid’s legal strategy - only the team and their professional advisers know their exact plans.

We would expect Hyperliquid, represented by the Foundation or Labs, to argue that it operates in a software development role for a truly decentralized and permissionless Layer 1 blockchain. Writing code, not operating an exchange. The exchange is non-custodial and self executing. Evidence for this argument includes Hyperliquid the chain operating under a decentralized proof of stake consensus similar to Ethereum.

A potential weak point here is that the Foundation operated validators represent a majority of the HYPE staked, and that the team and foundation control a substantial share of the HYPE supply. However the decision to give away the majority of the supply between airdrop, future community allocation/incentives, and the foundation could be a strong argument that the team no longer exercise effective control.

If the L1 blockchain is considered decentralized, what about the interfaces and the software deployed on it?

The main frontend is operated by the Hyperliquid Corp. under the hyperliquid.xyz domain and relevant subdomains. These assets are geofenced to exclude US-linked IP addresses with the intention of excluding US residents. Further, users must sign terms and conditions which state that no US users are permitted.

We don’t know if regulators will deem that the exchange has made reasonable efforts to exclude US investors and is therefore not liable in respect of US persons who trade on the exchange via a VPN, or if other efforts should have been made (such as KYC).

As for the tokens deployed on the exchange, including those linked to US securities like TSLA and NVDA, stock index futures like the Nasdaq 100, and commodities like gold and silver we’d expect the Hyperliquid core team and foundation to simply argue that these assets were deployed by third parties for which they have no responsibility.

Michael Selig has acknowledged the geofencing but pointed to the fact that 25% of traffic on offshore high performance DEXs (he didn’t name HL specifically but it’s implied) still comes from the U.S. via VPNs. Regardlesss of which side of the argument you fall on, it’s clear that Selig wants to hook HL into U.S. jurisdiction so we anticipate HL will have to “play ball” at some point.

That’s the update on HL for today!

Paid subscribers get access to:

All of our past posts

Weekly Deep Dive Report

A comprehensive bi-weekly DeFi Roundup

Bi-weekly Q&A sessions with our team

Until next time..

P.S. If you’re having a hard time keeping up, join the Academy to understand the core frameworks we use in our research process at a fundamental level.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

We now have a full course on crypto that will get you up to speed (Click Here)

We offer the Prediction Markets module on a standalone basis (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)