Welcome Avatar!

The topic of tokenomics, fair distribution, and broader dynamics between founders, private market investors, and public market investors in crypto is an area of keen interest for us.

Our team lives across the spectrum (no pun intended) and so we believe we have a unique opportunity to both understand and broadly disseminate how things are, how they should be in an ideal world, and how they are actually likely to play out in reality.

If you’re a long-time reader you probably already know our general philosophy behind tokens, but it’ll be helpful to refresh and go through our updated thoughts as the market has evolved over the last few months.

We have seen an influx of new readers over the last month - this one’s for you!

The Many Faces of Crypto

If you’re new to crypto, you should understand that the industry is facing a war on many fronts.

U.S. regulators, especially the current SEC leadership, have taken a combative stance against crypto. This has made it difficult for founders to comfortably launch tokens and certain types of protocols, among other issues. Historically over half of crypto startups came from the U.S.

Traditional financial institutions are aware of the threat crypto presents and many have an active interest in sandbagging its growth (e.g. banks closing accounts of crypto users). The approval of Bitcoin ETFs in 2024 has changed the tone somewhat as large financial institutions are now financially incentivized to align with crypto. While bad for decentralization, the institutionalization of crypto is underway.

Retail investors have been scammed/rugged for large sums of money in previous cycles (avoid presales). However, some have also made life changing returns since crypto’s inception in a way that cannot be replicated in traditional financial markets where retail is often at a much greater disadvantage. This is because 1) old school investors and institutions did not understand crypto (and most still don’t) and 2) you were able to find projects at low valuations which is not doable in traditional markets.

Crypto institutions such as VCs are frequently at odds with retail investors, as there is a limited pool of quality projects and most projects take in VC investment to fund their operations while building. There is a palpable “anti-VC” sentiment present in crypto among retail users. VCs play an important although controversial role in the ecosystem today.

In response to regulations being tough on genuinely innovative projects, and a distaste for having to purchase tokens at high valuations from projects that are heavily VC funded, crypto native retail has migrated to trading memecoins. Why? You can get in near zero, and make huge gains if you’re right. It’s really that simple. People would rather speculate on making / buying a memecoin than buying a $3 billion FDV token for crypto infrastructure that also has no real utility.

Coupled with broader societal trends, crypto’s perception has trended towards heavily financialized and gambling-like behaviors. Some claim crypto has strayed from its “original promise.”

So what does this all have to do with tokens?

What Tokens Are

Tokens are one of crypto’s killer use cases. They are simply programmed code that represent value. This value can be exchanged for “real money” with just a few steps. Tokens can also have functional features that have nothing to do with money, such as storage for computing.

Software protocols specify the characteristics of a token and its guidelines within the limitations of the blockchain. The existence of the token could mean something important like providing security to a network, but it could also mean something silly like a funny meme.

Examples of what tokens can represent include:

Medium of exchange

Utility for certain functionalities

Financial rights

Voting/governance rights

“Real world” assets (real estate, commodities, financial contracts, etc.)

Identification / access rights

Art, music, and other collectibles (NFTs)

Intellectual property (royalties)

You think of something new!

By the way - a token can represent more than one of the above.

This allows tokens to be used for things like:

Raising capital

Decentralizing governance and oversight of a protocol

Incentivizing new users

Compensation for teams and contributors

Permissionless borrowing/lending

The list goes on. If someone will accept it for payment, the token can be used.

Traditional financial institutions like Blackrock have a keen interest in tokenization. Blackrock’s BUIDL fund is a tokenized fund that invests in cash, U.S. Treasury bills, and repurchase agreements.

It’s big news for crypto, but not what we would consider a good thing. This is a completely permissioned, regulated tokenized fund that requires $5 million minimum to invest and pre-approval. So while U.S. regulators are freely attacking apps and tokens that are used by and are available to retail, the compliance process is only feasible for mega-institutions with tens of millions of dollars to burn on fees and decades of experience navigating regulatory processes.

Part of democratizing finance is allowing anyone to participate on an equal playing field regardless of how much money they have, where they’re located, and personal characteristics. That means being able to invest in projects at an early stage, access all the same financial products, and the ability to build permissionlessly.

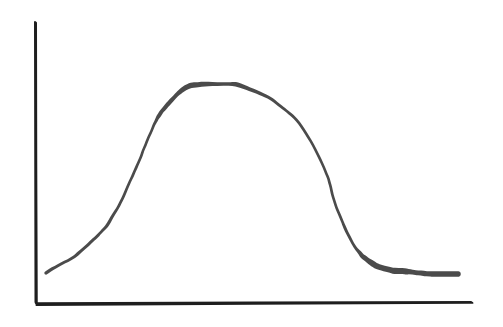

This is one of the main value propositions of tokens: anyone can buy from the beginning. Over the years this value proposition has warped (in part due to regulations), making a playing field that generally favors VCs, angel investors, and soon institutions over the average retail participant. This is partly why crypto-native retail has migrated to memecoins, the last remaining bastion where you can get into a coin at basically zero (or make your own) and the “insider advantages” are relatively well understood. The downside of course is that memecoins don’t have any fundamental value and the vast majority look something like this:

Still, that doesn’t stop people from speculating on how high they could go, and whether or not a memecoin could one day make it into the elusive top 10-15 (the memecoins that are likely to hit the billions). Memecoins are doing over $4 billion in spot trading volume per day currently, and while speculative activity has slowed since March it remains an active sector.

What Tokens Are Not

Tokens are not traditional financial instruments, though they can represent them.

Specifically, tokens are not equity and do not represent “ownership” in the traditional sense. Equity is a legal concept that defines your ownership of shares in an asset. Tokens typically don’t promise you any legal rights and don’t come with regulatory protections - only regulatory risk. Tokens are not a way to avoid laws entirely though, as has been demonstrated in the Mango Markets case.

We continue to be in a limbo sort of phase as it pertains to what tokens are from a legal and regulatory standpoint. We look forward to the day tokens can freely distribute value in any form, opening the floodgates to bringing the entire financial world onchain.

The Pendulum

Crypto is both cyclical and iterative. Meaning, it has cyclical aspects to it (BTC halving, speculative booms and busts, re-versioned narratives, etc) and is also iterating new tech advancements and changes in the landscape (L1s, L2s, retail vs institutional sources of capital, zk proofs, DAOs, etc.). It’s critical to stay alert in crypto because just as memecoins seemingly came out of nowhere, so too will the next big trend that hasn’t caught fire yet.

Memecoins are undoubtedly the star of the bull cycle so far. We anticipate they’ll be a key part of the crypto industry permanently (onchain is the new online after all, and what is the online world without memes?). But, the pendulum will inevitably swing back to projects that generate real value provided tokens are worth owning.

In fact, our view is that memecoins will actively help bring forward a fairer, better ecosystem. The conversation every team and VC in crypto was forced to have in the last few months is the following:

“How can I get people to use my project or buy my token when all they want to do is trade memecoins?”

The answer is quite simple: build fairer ecosystems for crypto retail. That means better structured tokens at better valuations. Tokens can’t be unnecessary - they have to confer some sort of value that investors want.

Governance rights do work if its an important protocol. They work because teams and investors need to defend the value of the underlying protocol by owning enough to keep it safe. It’s the same reason a health profitably public company is unlikely to be sold for pennies on the dollar - someone will come in to defend against stink bids.

Retail has no such goals, and does not care for governance whatsoever. Retail users either want their problem solved, or they want to generate a return (make money). That’s why crypto projects often end up in this recursive loop of raising VC funding to create value that can then be used to pay for retail users, which can then increase valuations and allow for more funding.

You job as the astute investor at this stage in the market is to narrow your focus.

You can’t be a master of memecoins, airdrops, infrastructure, VC investing, DeFi, on every L1 and every L2 all on your own. Become exceptional in one or two areas and then barter alpha with others in crypto.

PSA: Memecoin Monitor & OnlyApes

Owl here -

If you’re following along on Twitter you’ll have noticed me talk about www.memecoinmonitor.com quite a bit.

It’s been a lot of fun working on it and I got so caught up that I realized I never fully explained it to DeFi Ed readers.

Memecoin Monitor is a project I co-founded with a fren shortly after we published the post “Memecoins Can No Longer Be Ignored.” I went deep on the memecoin market quickly thereafter and after trading across all sizes on different chains, it hit me that memecoins are not only not going anywhere, they will be a deeply powerful force in crypto for years to come.

Memecoin Monitor was built to track memecoins, pretty simple! As we worked on the project we quickly realized it could be much more. Imagine a suite of products uniquely suited to serve every side of the memecoin market (there’s more to it but that’s all I can publicly share for now).

This inevitably led to our most recent product: OnlyApes on Base L2.

The TLDR of it is that anyone can launch a memecoin on OnlyApes with an image, a name, and a description without needing to fund initial liquidity. Once all tokens have been purchased from the bonding curve, a portion of liquidity is permanently burned and listed on Uniswap. People can buy or sell any time, including prior to listing.

OnlyApes is basically as degen as it gets as it’s a launchpad for memecoins. That means just as you would with any other onchain activities, it’s up to you to be a vigilant market participant if you use it. It’s an open platform where we can’t govern what tokens are launched or by who.

None of the coins are endorsed by me, the OnlyApes team, DeFi Ed, BTB, etc. even if people tag us in them. This includes any coins that have our images on them.

Hopefully that clarifies what it’s all about! See you in the trenches.

Until next time, anon…

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

We now have a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Iguana, are u still selling the LizardOS? The website says sold out. If so, any new hardware specs for the laptop or the same?

Great post, thank you!

Two questions about "Narrow your focus":

1) How narrow to go? E.g. is airdrops on EVM L2s narrow enough or is it too broad?

2) How would you ago about bartering for alpha? Just sharing in small group chats? I'm wary of being exit liquidity or fomoing late when people shill their ref links