Welcome Avatar!

If you’re just joining us: DeFi is the Internet, but for the financial system. Powered by crypto and blockchains, it allows for decentralized, permissionless, and secure financial applications to be accessed over the Internet by anyone in the world without going through an intermediary (bank or other institution).

Sound exciting? If you’ve interacted with the legacy banking system, you’re probably unhappy with high fees, delays, paperwork, and other inefficiencies.

We still cringe when we visit our bank branch to send an international wire.

Having spent several years working full time in the sector and producing DeFi Education (and the best course on starting a career in crypto), we’re enthusiastic with a vision of what DeFi will become now that financial institutions and governments are getting on board.

But DeFi has a perception problem.

the technology seems difficult to understand

it’s associated with hackers and scammers - remember FTX?

politicians and regulators have opposed it in the past - but now they’ll support it!

There’s also the issue of expectations. When crypto was new, it had huge potential for rapid price appreciation, making early adopters rich. During the birth of DeFi, four summers ago, early adopters could earn yields of thousands of percent per year and some DeFi tokens saw price appreciation of 20-50x in only 1 year. These are not usual or sustainable returns, but were rather the result of each of the 4 core DeFi inventions:

“Smart Contracts” = programmable money (Ethereum and compatible chains)

smart contract powered money markets, allowing anyone to borrow and lend assets on the blockchain, cutting out banks (e.g. Compound, Aave)

Automated Market Makers, facilitating pooled liquidity and allowing anyone to swap assets on-chain, providing an alternative to legacy brokers and stock exchanges (e.g. Uniswap)

stablecoins, crypto assets pegged to the value of the US dollar without requiring an intermediary (MakerDAO’s DAI) - for the first time anyone could have a dollar based bank account on the Internet without paperwork or permission, and without exposure to the price volatility of crypto

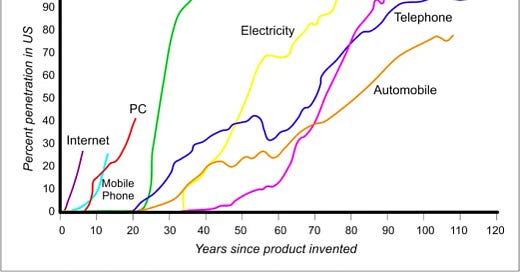

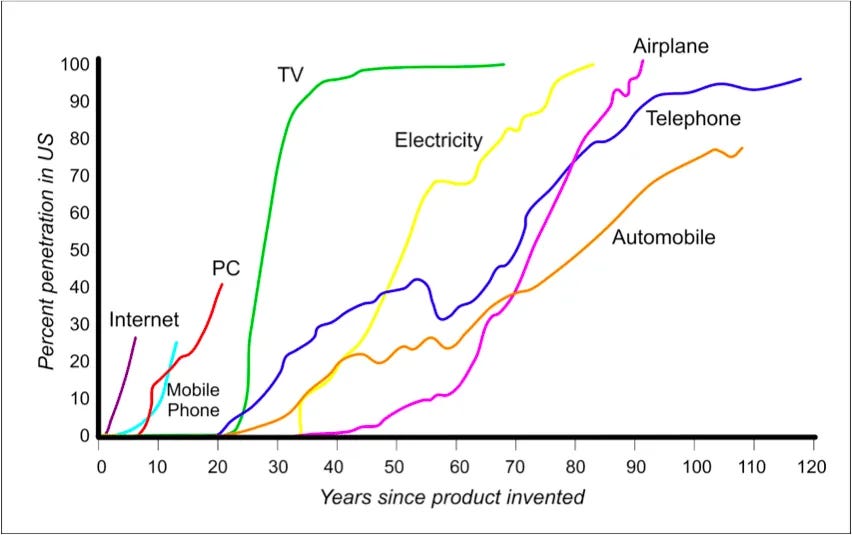

Like all major advances in technology, there is a lag until mass adoption.

We are heading towards mass adoption of DeFi as shown by mainstream institutional investors committing significant capital, and acceptance by the political and regulatory establishment. However, some people remain unconvinced of future potential, including those who have invested some time in research.

In our last Q&A a few longtime readers of DeFi Education expressed concerns about the perceived lack of actual value in DeFi. This sentiment is important to address, and this report will explore these concerns, clarify common misconceptions, and provide an overview of value generation and capture in DeFi.

First of all: DeFi protocols are doing what they're designed to do, serving as essential onchain financial infrastructure. Billions of dollars are traded daily through decentralized exchanges, and over $10 billion in loans are currently open across just two major protocols. The value DeFi brings to users and the broader crypto market is absolute.

There are two key issues:

The difference between "value" and "value capture."

DeFi protocols generate a lot of value for users, but the way this value is captured and distributed through tokens is still lacking.

DeFi connection to real world value

DeFi primarily serves crypto tokens and stablecoins

Value vs. Value Capture

Many DeFi tokens don't effectively capture or distribute the value generated by their protocols. In traditional finance, things like fee shares, dividends, and buybacks are common practices that boost investor returns. Without these mechanisms, there's a gap between the protocol's usage and the token's value appreciation.

Investors are often reluctant to hold DeFi tokens that don't capture value well. Institutional investors are unlikely to take on the added risk of potentially never receiving distributions and the lack of regulatory investor protections. Retail investors, who primarily seek high returns, find these value capture-less tokens as as useful as a memecoin.

Real World Value

DeFi is a circular, reflexive ecosystem. When there is high speculative demand onchain for various types of tokens, DeFi protocols see a lot of demand and earn higher revenue. This higher revenue fuels speculation for their own tokens, creating a reflexive economy. Limited access to “real” assets makes DeFi highly volatile and unstable, making their tokens even riskier.

The Solution

The DeFi sector is on the cusp of a major turning point.

Proactive regulatory support is the final piece of the puzzle that unlocks the onchain economy. With a clear, productive framework for tokens that take into account the technical capabilities of blockchains, token value capture is easily solved. Integration with real world assets is tougher, and is unlikely to be solved in the near term. However, with large institutions such as Blackrock and Goldman Sachs moving forward with onchain tokenized funds, we may see regulations that integrate real assets faster than we think.

The key point is: there is nothing at a technical level that prevents DeFi from serving as decentralized financial infrastructure for the rest of the financial market. Yes, DeFi can still get faster, cheaper, and less fragmented. However, it can already perform the core financial services of money transmission, borrowing/lending and swapping assets permissionlessly, and has done so for years.

Trump Doubles Down On Crypto With VP Pick

There is a lot of buzz in crypto about what the industry could accomplish under a pro-crypto administration. Trump’s running mate J.D. Vance is a 39 year old ex-VC. What we know about J.D. Vance’s crypto views:

Reported to hold between $100,000 to $250,000 of Bitcoin personally

In August 2021, Vance issued a statement opposing Biden’s infrastructure bill for regulating cryptocurrencies

As recently as last month, Vance distributed a draft bill on crypto regulations that are supposedly industry-friendly

Was a silicon valley early-stage tech VC

A vocal proponent of crypto’s censorship resistance

Trump’s pro-crypto stance is likely not just lip service. This VP pick demonstrates that the Trump campaign considers crypto an important part of their policy work and the crypto sector is a key constituent.

In a recent podcast, the founders of a16z Ben Horowitz and Marc Andreesen mentioned that they had tried repeatedly to get in touch with Gary Gensler to discuss crypto and they were shunned. With a16z being the world’s largest crypto investment fund, it highlights the stance the current SEC and the FDIC have taken towards crypto.

Specifically, Ben Horowitz highlights that:

The SEC has sued 30 (!) crypto companies and issued Wells Notices

They are losing many of these lawsuits, but this deters or kills cash-strapped startups

The FDIC has threatened banks who bank crypto companies

Regulators refuse to issue guidance on what are crypto asset securities

The source is alleged to be Elizabeth Warren, who has been anti-crypto for as long as we can remember. With the political tide changing many have abandoned the anti-crypto warship for safer seas. Jamie Dimon, the CEO of JPM who has been anti-crypto for years, has “changed his tune” on Bitcoin according to Donald Trump.

Meanwhile some inside of the crypto camp are urging the industry to focus on things beyond purely crypto assets when considering politics. We disagree with this, as US crypto (the source of most startups) is fighting for its survival in this election. Another four years of attacks on the crypto industry through subversion of the law as we’ve experienced under the current administration would deliver a deathblow to crypto innovation. The industry has been backed into a corner, leaving single-issue voting as the only logical option this time around.

What’s Next For DeFi

To recap the changing regulatory environment: the SEC recently capitulated to legal pressure from the crypto industry and reversed its refusal to allow spot crypto ETFs to be listed. Coinbase has already won a significant point in its lawsuit against the SEC. Industry is joining forces with well funded advocacy groups like the DeFi Education Fund to fight back against heavy handed and possibly unlawful actions by regulators.

Under a Trump administration we’d expect dramatic changes to ensure that the US regulatory environment is friendly to crypto innovation. Otherwise this lucrative sector could move abroad, something which Trump has already spoken about.

On our wish list for reform:

change of leadership at the SEC

fixing rules to allow banks to provide custody and execution for crypto

administrative rulemaking or new legislation to clarify the permitted business models in crypto and any registration requirements, to replace the presumption that many crypto tokens need to be registered as securities

explicit permission for certain types of value capture to allow capital formation in crypto and support the growth of the industry in the US

We’d also expect a Trump administration to be tough on some of the well known negative aspects of crypto: unregulated, offshore crypto exchanges serving US customers (good for Coinbase); crypto theft being used to fund rogue states (national security issue); and use of crypto to evade sanctions (Russia, Iran).

In addition to beefing up the existing counter terrorist financing, anti money laundering, and sanctions rules to apply more directly to crypto, we’d expect the government to take some hand in developing security standards specifically tailored to crypto. Tasking the Cybersecurity and Infrastructure Security Agency with publishing best practices for custodians, exchanges, staking providers, and DeFi protocols would be a good start.

The establishment recognizing crypto as a legitimate industry will also allow young talent to consider it a viable career, bringing a new generation of software engineering and cybersecurity professionals directly to crypto. If you’re part of the crypto community you might underestimate how difficult it is for young graduates from top schools to turn down job offers from FAANG to work at a crypto startup, when the industry is considered in many circles to be “a scam”. Trump could fix this.

The Biggest Finance Brands Are Seriously On Board

There isn’t space in this newsletter to list all the recent examples of the most significant financial companies in the world embracing DeFi technology and crypto.

This recent article in Fortune is representative of the consensus: a fundamental change to how financial business will be conducted in the future.

“There’s no point doing it just for the sake of it. The definite feedback is, this is something that actually will change the nature of how they can invest.”

- Mathew McDermott, Global Head of Digital Assets, Goldman Sachs

Why Learn DeFi Today?

DeFi isn’t going away. Although the industry does need to improve its level of professionalism and security posture, the technology is proven. Today any proficient DeFi user can:

Raise capital globally

Obtain loans (USD or other currencies/assets) against their crypto portfolio

Trade almost any asset any time of the day from anywhere in the world

Invest in any number of technology projects or investment funds

Earn yield by providing liquidity in the DeFi ecosystem

Use multisigs, vaults, time lock contracts and other innovations for secure or shared custody of funds, estate/succession planning, etc.

Non-US users can access an interest bearing USD denominated “bank account” without any paperwork or restrictions

It’s worth learning even if you have no immediate need to do all of the tasks above. In the coming years we predict that DeFi will become an important part of the financial system: institutional investors will purchase DeFi linked tokens like Ether, and smart contract and blockchain technology will be used to improve the back office of traditional banks and brokerage houses. DeFi has a bright future and more people will have to use it eventually. If you want to skip ahead in the learning curve you can check out the course we made on crypto.

To stay on top of crypto, access our DeFi research, market updates, and participate in Q&A sessions twice a month by becoming a paid subscriber today.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

We now have a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Thanks for the article!

Do you think it's worth spending the time to try to make a career out of crypto?

About me: I'm 40 years old, background in finance and then an ecommerce business that is failing, so I need to figure out the next thing. Very minimal experience in crypto apart from the last 4-5 months consuming articles from you and BowTied Bull and investing a bit into ETH. I guess the question would be am I too old and lack any real experience? Thanks!