Welcome Avatar!

Today we bring you the first in a multi part series comparing the top decentralized derivatives exchanges (“DDEX”). We’ll examine features, fees, liquidity, risks, and token performance. This will help you decide where to trade post FTX collapse. And. Which tokens to buy if you want exposure to this DeFi sub-segment.

Let’s dig in.

What is a DDEX and why use one?

Quick reminder: a decentralized derivatives exchange allows you to access perpetuals, futures, or options without providing KYC information or giving up custody of your funds.

The main reason to use a DDEX is to avoid loss of funds (custody risk) and loss of privacy from providing KYC information to a CEX.

Instead of trusting a Bank Man not to gamble with your deposited funds, you trust a security auditor to certify that the smart contract can only spend your funds to deduct trading losses you incurred, and you always have the option to withdraw your available balance immediately.

Although CEXes are trying to reassure customers using Proof of Reserves, this does not and cannot guarantee that every customer can withdraw their funds on demand. Examples:

Regulations are passed limiting withdrawals to “unhosted wallets” unless the wallet owner complies with some KYC procedure

Your account is mistakenly flagged by compliance, delaying withdrawals

You need to download an app and perform face verification (new requirement) but there’s some sort of bug in the app and customer service takes a few days to unblock your money

Your account is drained via a compromised API key

You live in Russia / are a Russian and it suddenly becomes illegal for the exchange to cash you out due to sanctions

Someone dusts your deposit address with Tornado Cash or other tainted funds triggering a lengthy compliance review before you can withdraw

Somebody sues you and your bank, brokerage, and CEX accounts get frozen - you need to ask permission from the Court to withdraw basic living expenses (e.g. Canadian protestors)

Most of the above problems relate to KYC. Although there are a few non-KYC CEX remaining, they aren’t considered safe from a custody perspective (you won’t be able to buy insurance).

Many consider Binance to be the safest CEX (the best of a bad bunch) but it requires intrusive KYC. This isn’t just for account opening, but also for basic actions like withdrawals. We’ve heard of a cluster of cases where withdrawals were suspended pending further facial ID recognition. Problem: the Binance app didn’t work, so customers were stuck unable to withdraw for a few days before the issue spontaneously resolved.

Bottom line: if you don’t like scanning your face with buggy phone apps, don’t want to ask permission to withdraw your own funds, and don’t want your name and assets to end up in court documents you’ll want to use a DDEX. The challenge is that anyone trading with size is pretty much forced on to CEX today, partly why Binance remains massively popular.

Why consider a DDEX investment?

Now that everyone is aware of CEX drawbacks, you might be wondering how many other people will move all their trading volume to DDEXes.

Until now, DDEXes have been relatively obscure, not well marketed and hard for regular users to access (DeFi is still considered complicated). But when it isn’t safe to use a CEX, or when regulations make it harder for an average person to access CEX, DDEXes shine. We see the DDEX sub-sector as anti-fragile - it benefits from tighter regulation of CEX which is likely due to fallout from FTX.

Exchanges earn income from trading fees, so the more people trading on DDEXes the better for valuations in the sector. And some governance tokens have a value capture mechanism so even the expectation of improved trading volumes in future can lead to a near term appreciation in token price.

Monopoly Status

Finally, exchanges are natural monopolies: the most liquid exchange will have the lowest trading costs (slippage/market impact) and therefore attract the most trade which will increase liquidity further driving down trading costs. In the European and American derivatives markets, the only exchanges of significance are CME and ICE. In spot DeFi, the Uniswap DEX has captured two thirds of swap volume.

Whichever DDEX becomes the winner can likely extract rent from its quasi-monopoly status and this surplus can flow to governance token holders. An example. A fledgling exchange like dYdX is forced to pay out governance tokens to attract liquidity providers to its exchange. Liquidity providers on a dominant exchange need to pay to play. Liquidity providers wishing to ‘join’ the CME as a corporate member to access the lowest trading fees must buy or borrow millions of dollars worth of CME stock and also buy out the membership interest of individuals/firms which joined this exclusive club earlier. In a future where dYdX becomes the monopoly, it might require market makers to hold millions of DYDX tokens to benefit from the lowest trading fees.

Comparison Metrics

For traders, we think the following metrics are important

Safety of funds

Transaction fees

Product access

UI/UX

Safety of funds has several factors. Are customers required to hold deposits in a centralized stablecoin which can blacklist addresses? Does the protocol run on a credibly neutral base layer like Ethereum, or do customers need to trust the security of validators on a separate appchain? Is the code battle tested, formally verified, or repeatedly audited? Are there economic design weaknesses which could result in the protocol losing customer funds (e.g. Mango Markets).

Transaction fees are straightforward to assess, we simply look at network/gas fees plus protocol transaction fees. And product access includes current token coverage and the ease for onboarding new products (while avoiding systemic risks).

Finally, a DDEX needs to have a smooth user experience. This can include mobile apps, a well documented public API to enable third party trading platforms, and all the features active traders would expect (clear display of leverage, P&L, open orders, various order types, charting, etc).

Investors also need to evaluate token value accrual. We’re skeptical of exchanges which are still incentivizing liquidity, as the dollar value of the dumped rewards can exceed the dollar value earned in fees - in other words the protocol is unprofitable without this creative (and unsustainable!) accounting.

Finally we’ll look at market cap to filter out tokens where investment success is unlikely even if they grow into their current valuations. Serum DEX reached a peak valuation of $120b, nearly a guaranteed loss for investors even if it became the only crypto DEX in the world (CME group valuation is ~$65b, a ~25x multiple).

How does trade execution happen?

Every trade needs a buyer and a seller. The role of the exchange is to decide which buy orders will trade with which sell orders. In other words, they “match” orders. There are two popular ways to run a decentralized derivative exchange.

Limit Order Books allow customers to trade with each other. Participants specify the price of their order to buy or sell. As market prices update regularly as a result of news or trading activity, participants update or cancel their limit orders frequently. Liquidity providers on a limit order book exchange are professional market making firms like Wintermute. A trade is executed when a customer buy order matches another customer’s sell order. A limit order book can be credibly neutral.

A “B-Book” model means that customers trade against the broker / exchange. A capital pool is set up - in crypto this will be done using staked tokens - to take the other side of customer positions. An external oracle is used to determine the fair price for a trade, since there is no active market maker updating price quotes or limit orders.

If customers lose, as they are expected to, the trading book makes a profit. If customers all trade in the same direction and happen to be right, the trade book can take a loss.

In TradFi the “B-Book” model is associated with shady retail foreign exchange dealers. To run a profitable B Book exchange the operator should impose costs (like fees, delays, and hidden risk) to deter professional traders and arbitrageurs and do everything possible to attract retail gamblers (uninformed flow). If there is balanced trade (roughly equal buyers and sellers), the book should be profitable. If the majority of traders have a strong market bias (long or short) then the trade book can acquire risk which needs to be hedged off or otherwise limited to guard against losses.

In TradFi a team will hedge excess exposure manually but will aim to trade infrequently to avoid incurring costs. This team will also spot large or successful traders and pass their deal flow through to the underlying market instead of booking it. These deals are put in the “A Book” - the firm will try to make a small profit by instantly hedging these client positions at a slightly better price, on average.

A DDEX doesn’t have a team to manually control risks. Automated alternatives include charging funding on imbalanced positions and cap open interest.

A “B-Book” can introduce a conflict of interest between customers and the liquidity provider. And, if not prudently managed, a B-Book could become insolvent.

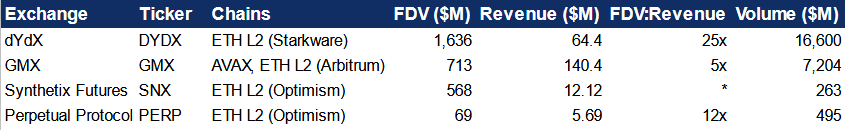

DDEX Comps

Price Performance

Over the most recent two months only DYDX and GMX have outperformed Ethereum.

This free post gives an overview of the factors to consider when investing in or using a DDEX. The next instalments for *paid subscribers* will be a deep dive of specific DDEXes, and will include the DeFi team’s opinion on safety, tokenomics, valuation, and more.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

We now have a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

As someone ignorant to how the inner details of the finance, trading, and markets operate, these are really insightful answers to questions I didn't even know I had. Thank you!

Thanks for this! What would be the best way to onramp into crypto now without a CEX? For example, is https://ramp.network/ recommended?