Welcome Avatar! The purpose of the DeFi Education substack is to teach a process for assessing opportunities in DeFi to make appropriate decisions for your individual goals and risk tolerance.

Today we take you through the thought process Iguana used with a recent investment. This case study is a great opportunity to recap some of the principles we have explained over the last four months.

Reminder: we are early. This means that the market is not efficient today and is largely driven by *emotion* and *attention*. There is value in digging deep into protocols which could solve an important problem in DeFi but may not be receiving a lot of attention.

Insurance isn’t “sexy” but most of the world uses insurance products. Decentralization of insurance is a huge opportunity in our opinion, and mostly overlooked due to the propensity of market participants to pursue opportunities with the best short term ponzinomics. Please read our *free* overview of the insurance sector to size the opportunity.

Enter Nexus Mutual

Nexus Mutual is a corporation authorized and regulated entity in the United Kingdom that provides an insurance-like cover product on the Ethereum blockchain. Members can pay a premium to transfer smart contract risk to the mutual, and the mutual has the power to reimburse members for losses suffered due to protocol hacks or smart contract bugs.

Uniquely among major DeFi protocols, token holders are recognized as having legal status (members of the corporation) and the DAO governance structure is enshrined in the corporate charter. The DAO’s advisory board is doxxed and legally accountable to members and the financial regulator. Nexus Mutual’s core team consists of experienced insurance and finance professionals that have made themselves accessible to the community through a weekly conference call and regular discord communication. This information is important as ‘rug risk’ and strength of the management team are two key factors when deciding how much to invest.

While many coins have pumped, Nexus Mutual has been largely ignored by speculators and its token has underperformed ETH all year, falling from 0.03 to 0.02 YTD.

The protocol has been successful at selling covers but less successful at attracting capital. As a result, the funds in the capital pool are fully employed backing risks underwritten by the mutual. In a healthy market, the capital pool would have a slight surplus sufficient to allow any smaller investor to liquidate his NXM position at will.

The ETH-NXM market is priced on a bonding curve, and redemptions of NXM to ETH are suspended when the capital pool is below a threshold judged to be the minimum safe amount of reserves to hold against the liability to pay claims (known as then Minimum Capital Requirement - MCR). If members were permitted to take their capital out at will, there may not be sufficient funds to pay claims. For most of 2022 there has been insufficient liquidity for investors to exit.

The solution to bypass KYC and provide liquidity – Wrapped NXM

NXM can be ‘wrapped’ at a 1:1 ratio to WNXM, a permissionless token which is freely traded on decentralized exchanges. This tokenized NXM share allows 1) speculators to obtain exposure to the performance of the mutual without passing KYC; and 2) investors to liquidate their positions without reducing the capital pool. As you might imagine, the illiquidity of the NXM token leads to WNXM trading at a discount due to ‘liquidity premium’.

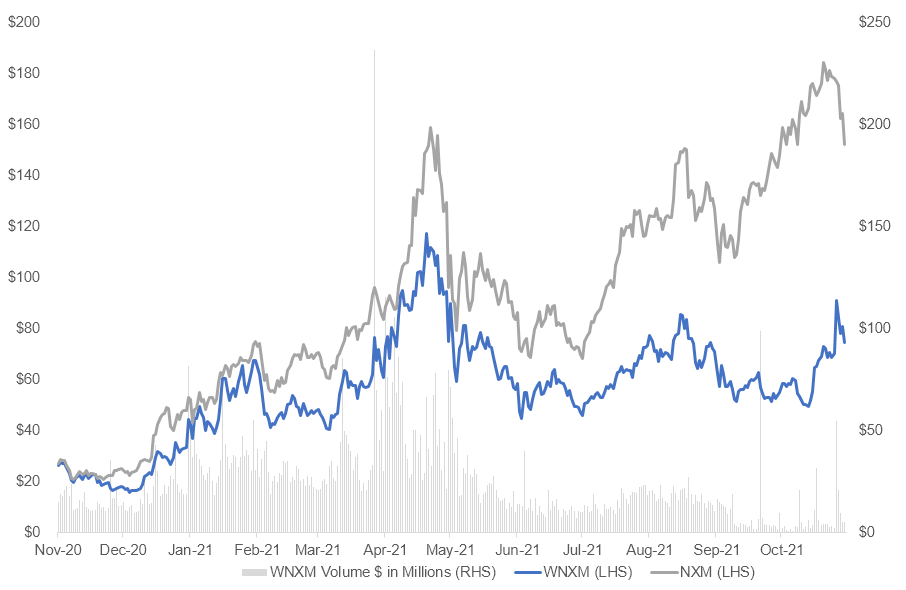

This chart shows YTD performance of WNXM vs NXM and it is clear the discount was becoming more pronounced going into Q4.

A profitable strategy would therefore be to purchase WNXM below book value, wrap to NXM 1:1, and then redeem the NXM for ETH when there was sufficient capacity in the capital pool to permit redemptions. We proposed this strategy in our paid article published October 1. Of course, this is a speed game and the fastest bot to notice when MCR% is above 100% captures the profit.

The context for a trade opportunity

You’d expect WNXM to trade at a discount to NXM, but how much of a discount is reasonable? Nexus Mutual takes in investments (risk capital) plus premiums and invests the funds. This means the key valuation metric is the Price to Book ratio. (please read our detailed valuation of Nexus to understand this trade in full)

Unlike DBDC protocols which are backed by a treasury valued at 20% or less of their market cap, Wrapped Nexus Mutual can be purchased at a discount to the book value of the Mutual. The situation recently became bizarre when the Cream hacker dumped WNXM tokens at market, creating the opportunity for a savvy speculator to buy into the Mutual at fifty cents on the dollar. Note that a high profile hack is bullish for NXM – Nexus paid claims in connection with the Cream exploit and this results in an increased demand for cover – WNXM can be used to buy cover at a discount.

In addition to the core team, Nexus Mutual has a small but dedicated group of ‘mutants’ working to improve the protocol. A community member realized that repurchasing WNXM using treasury funds would be accretive to the Mutual and benefit future investment by providing a credible price floor for WNXM. On November 8, discussions began in earnest on the forums and the WNXM/ETH price was 0.014929 (Coingecko) against a book value of 0.0235. Book value calculated as total ETH in capital pool divided by circulating supply of NXM, 162,358 / 6,898,123 = 0.0235.

Governance Proposal 159 would authorize the Mutual to spend up to 8,000 ETH ($35M US Trash Token) to purchase WNXM on the market at prices below book value. This would be done by providing liquidity on Uniswap at a bid price of 0.0235 ETH per NXM. The average daily volume of WNXM is $24M (Coingecko) and there is around $250k liquidity within 2% of the prices across CEX and Uniswap, Binance, and OKEx.

Important: this information gives you a time horizon for the trade. Rather than tie up capital for a long period of time hoping that the market will reprice towards book value naturally (historically this has not performed well in WNXM), you now have a catalyst which should give a near term price reaction if your analysis is correct. This means you can allocate more aggressively, with a plan to reduce your exposure if the market does not swiftly confirm your thesis. We don’t trade actively, but it is good to be aware of arb type opportunities which can juice investment returns with very little risk.

Readers of BowTiedBull will be familiar with intelligence being classified under numerics, synthesis, and intent. Animals strong on intent will want to bet on their understanding of whether the idea will be implemented. The risk averse will want to wait for more confirmation.

If you have decided that the mutual will follow through on the purchase, and that it will have a market impact rewarding you for owning WNXM at an undervalue, this is the time to put on the trade with a plan to exit near book value. This is a trade based on a market mispricing, not a long-term investment in the mutual. (The DeFi team’s long term positions in NXM were disclosed in our first article)

Remember that when the proposal is passed, members looking to sell their stake in NXM are more likely to hold off until they can do so at par, rather than accepting a deep discount to sell WNXM. This will take supply off the market.

How Iguana traded this opportunity

· Immediately took action upon noticing the proposal: this could be a low-risk high return arbitrage-type trade opportunity which merits a very large position size (at least 20x the size of a speculative/degen play)

· Reasoned through an upper bound on position size considering rug risk (low), market liquidity and slippage risk (significant issue with WNXM), and correlation to other investments (this is basically ETH at a discount)

· Double digit percent of portfolio allocated immediately, betting on ‘intent’ skill that the mutual would swiftly implement the proposal and the market would start to price this in

· Continued to add aggressively on each significant step in the governance journey: example when the proposal was discussed positively by the core team, listed for vote, etc.

· Orders split up (roughly $10k chunks) and across both CEX and DEX so not to suffer much slippage

· (Optional step) used limit orders on CEX to make a spread around estimate of short term fair value, increasing position size at a greater discount to book value and taking some risk off (back to BTC) as the position approached book value – ebbs are flows in the market are expected until the 8,000 ETH is deployed.

Results

Average buy price is at 0.154 and the market is currently at 0.0209 for a ROI of 35% in two weeks with further upside potential until 0.0235. It is important to recognise the risk adjusted return of this trade. By understanding the underlying dynamics of the protocol in depth, Iguana generated a sizeable gain with *very low risk* compared to an altcoin gamble.

This was an opportunity to buy ETH at a discount through a vehicle which has a very low rug risk (regulated, trustworthy team). A conservative allocation of 20% (Iguana went higher) bought at 0.015 and closed at 0.022 is a 9.2% return on total portfolio.

Iguana has taken some risk off (went super heavy) and awaits a move to ~ 0.023 to liquidate the remaining position.

The Swap Operator contract which will be completing the Mutual’s trades on Uniswap is at 0xcafea4E03B98873B842D83ed368F6F1A49F58Ee7

Sources:

Book value: Nexus Tracker + Coingecko

Decentralizing the Insurance Industry

Nexus Mutual the Crypto Insurance Project (Part 1)

Nexus Mutual (Part 2) - Valuation

Thanks for reading! If you’re reading this and haven’t subscribed, join our community of DeFi Turbo Autists. 👇

Disclaimer: None of this is to be deemed legal or financial advice in any way shape or form. You are reading opinions from an anonymous group of Wall Street and Tech Engineers in Cartoon format.

This is great content, v impressive all round

Congrats on the trade

The proposal is brilliant. Just stating that they are buying drove speculators to close the gap. In the end, they will spend even less than anticipated!

WNXN sitting at .0198 now from a high of .021 on Saturday... there is still a potential 16% to 0.023 - why do you think is that?

Another question related to finding similar asymmetric bets: is watching DeFi projects proposals a good way to stay on top of things and find opportunities (do you think of checking regularly as a process), or was this pure luck as you were researching NXM?