Welcome Avatar!

Less than one month ago, Bitcoin was trading below $28,000.

Then Cointelegraph broke news the SEC approved Blackrock’s iShares BTC ETF.

Although this story turned out to be false, it shifted market sentiment. Participants likely realized that spot ETFs will almost certainly be approved by January 2024. And. The next Bitcoin halvening is April 2024.

We covered this in depth in our last market update - and we are now taking a slightly contrarian view. Today we’ll cover:

update on COIN performance since our call on October 28

why we’ve stopped buying Bitcoin

other assets to invest in (Ethereum, DeFi, NFTs)

Coinbase Stock Update

If you back crypto for the long term and want to invest on the CEX/institutional side, COIN looks good.

Since we published this on October 28, COIN has risen from $70.76 to $89.49, a gain of 26% in 7 trading days. The Nasdaq 100 index is up ~9% over the same period and Bitcoin has gained 3%.

This has been another great entry to COIN and we’re well positioned to ride out any *short term volatility* as we believe COIN is a core holding for the next cycle. We recently covered Q3 earnings and Coinbase is financially healthy with plenty of cash. This gives them enough runway to figure out the rest.

Circle (USDC issuer) is reportedly mulling an IPO in 2024 - also good for Coinbase as the exchange recently acquired 3.5% of Circle equity

Bitcoin Update

We’re done buying Bitcoin and have sold a little this week.

Some might consider this a hot take. What’s our reasoning?

First, we think the Bitcoin ETF approval news is mostly priced in now.

Consensus is that Bitcoin must now go up and we’re wary of consensus and tend to fade it. People buying now were sidelined a month ago and nothing has changed except price. With perhaps a few months to go until approval, then some more time until launch, everyone will have heard about Bitcoin ETFs by the time they trade.

Some investors focus on assets which have outperformed recently. This can work in highly autocorrelated markets, but often the old leader becomes the laggard (mean reversion). When this happens, investors who chase trends underperform.

We’d like to level set expectations for a sec. We are moving a lot faster now—we are matching the pace of the market. You do not have to match our pace and rotations, particularly if you are a long-term investor. We are simply letting you know what we are doing.

*And we are not calling a top - there is still aggressive new buying of Bitcoin every single day.*

Second, Bitcoin has doubled in a year since we bought last November.

Remember the “sell half at a double” advice by BowTiedBull?

Third, in a bull market there are better investments than Bitcoin.

We’ll always own some Bitcoin and don’t recommend that anyone go to a zero allocation. But. If Bitcoin can double its market cap (+$750 billion) on the back of ETF-linked inflows it will only be trading around $70,000, close to the high from the prior cycle. That’s not enough of a return to be interesting to us - we’ve just done that and will allocate the proceeds to (potentially) higher reward crypto investments.

We’re going to be researching investments we believe can outperform BTC. Coinbase stock and Ethereum are examples we’ve discussed before, but consider also:

NFTs

social tokens

DeFi

Good projects in these verticals should crush Bitcoin’s performance. We’ll be bringing you research updates on potential future winners from each sub-segment.

Again we are simply stating what we are doing with profits made from buying and holding Bitcoin since last November - if you’re new to crypto we’d suggest something safer like dollar cost averaging into ETH and buying more on days the market is down big - rather than taking on NFTs and DeFi tokens as a beginner. With our experience we’re going to run it hot with a more volatile portfolio.

Fourth, it’s a mature market now.

Consider that the top holders will soon be:

The US government (from asset seizures)

A US corporation (MSTR)

US based ETFs and trusts (GBTC)

Controversial states like North Korea

Is this a realistic candidate for a credible international currency?

Executive Order 6102 - the US Government once passed a law requiring citizens to deliver their gold to the state - private ownership was banned. With a flick of a legislator’s pen, all the Bitcoin in *US corporate custody* (not your personal) could belong to the state.

We’ve reached the point of absurdity where self-proclaimed “crypto” investors are excited about Bitcoin because they’ll be allowed to buy it in their brokerage account and have it custodied by a third party.

And with ETFs, creation/redemption arbitrage, derivatives trading high volumes on CME…Bitcoin joins other TradFi products as a *highly competitive* asset class. We’ll be at the on-chain casino to extract greater edge from softer participants. You can feel free go up against Citadel if you’d like.

The main positives for the BTC ETF are

giving attention (and perceived legitimacy) to crypto again

wealth effect from Bitcoin whales who bought in the bear market

The wealth effect manifests in crypto as rotations into riskier sub-segments. Spot Bitcoin holders increase their wealth as the market moves up, leading to them taking positions in less liquid, higher beta altcoins. Finally, as a speculative mania takes over, the richest participants compete to buy Veblen goods. Last cycle this included a crypto native hedge funds paying over $5mm for a single NFT token (Artblocks). JPEG pictures of grey rocks and Crypto Punk profile pictures with rare traits frequently changed hands for over $1 million / unit.

It’s too early to call the Veblen goods of the next cycle but we’ll be researching.

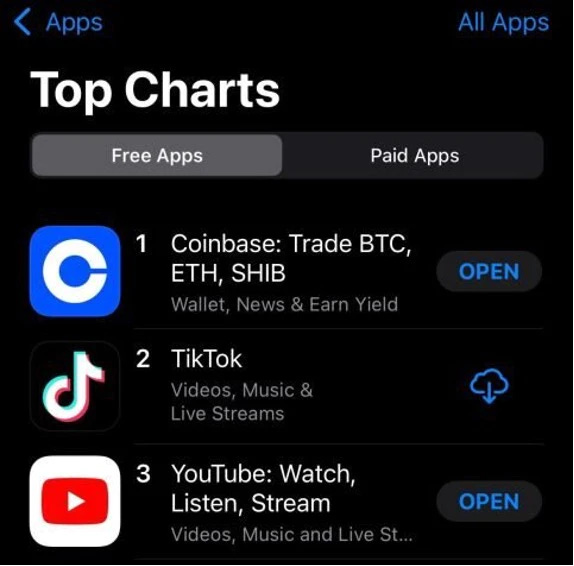

Speaking of attention, at the last bull market peak (October 28, 2021) the Coinbase app topped Apple’s app store chart, briefly flipping TikTok and Youtube.

Below: the top 16 tokens by market cap at the peak of the bull market

ETH/BTC Rotation

We’re looking to rebalance around the 0.05 ETH/BTC ratio (starting this week) and will be allocating more to ETH going forward.

ETH/BTC ratio has improved a little since October 28th and we continue to rotate.

The thesis in a nutshell is that it takes less net capital inflows to get a 4x in ETH compared to a 2x in BTC. Ethereum has better tokenomics (lower emissions than legacy Proof of Work and becomes deflationary under high demand).

Ethereum-compatible smart contracts have the highest TVL: they’re home to ~$75b of the ~$125b stablecoin market and an additional ~$40b of DeFi TVL.

Some US regulators believe that Ethereum is a commodity and once a Bitcoin spot ETF is approved we think an Ethereum spot ETF is then only a matter of time. The market doesn’t seem to be pricing this in yet!

One of the best trades in the 2021 bull market was selling Bitcoin for Ethereum. The last time the ratio was 0.04 was April 2021, and in a 4 week period this had doubled to 0.08. We’re not calling for a doubling to 0.10 overnight, but we do note the pattern of crypto markets to compress most of their volatility into a few weeks. For an obvious example consider the recent move from $28k to $36k in Bitcoin which took…2 weeks.

Last summer, the ratio moved from 0.05 to 0.08 in only 10 weeks.

NFT Stimulus Check

While we don’t typically cover NFTs, we used to trade them quite a bit last bull run. We’re starting to pay attention to them again (haven’t bought anything material) so we’re getting up the curve quickly.

BAYC co-founder Wylie Aronow (“Gordon Goner”) bought a Zombie Cryptopunk for 600 ETH ($1.1 million) and plowed a bunch more into various NFT projects. With how badly NFTs have gotten crushed (and how illiquid they have become), this served as a much needed stimmy check for the space.

NFT marketplace Blur has also seen a sharp uptick in trading volume in recent days. The token has doubled in 2.5 weeks.

NFTs were featured on an episode of The Simpsons last week. Right around this time in 2021 (peak bull run), Disney launched their “Golden Moments” NFT, so the foray into NFTs isn’t exactly new. Still, the recent attention comes at an opportune time.

Note that Blur has held onto its market share gains since last year. Opensea seems to be bleeding out, having recently let go of 50% of its staff. They are down to a skeleton crew of about 100 people. Hedge fund Coatue Management has reportedly cut the valuation of their stake in Opensea by 90%.

TradFi players have gotten taken to the cleaners in NFTs overall. The largest marketplace currently is on-chain and has a token. They’re unlikely to get involved in a big way on-chain due to the continued lack of regulatory clarity and issues with custody + tax. In the next bull they will likely once again look to back the “winners” they can invest equity into.

Art Blocks Back?

Not exactly. However, there was an Art Blocks mint today that ended up trading above the mint price. Traders seem to be flocking to the “known brands” as they re-enter the NFT market. 1st tier NFTs like BAYC and Punks will of course get attention, but we are seeing 2nd/3rd tier NFT projects (e.g. CrypToadz) get a lift as well.

Mini glossary as we are assuming many people have completely forgotten about NFTs!

Art Blocks: Largest generative NFT art platform of the last bull run. The way it works is artists upload their algos to Art Blocks, which include random elements to ensure each piece is unique. Once a piece is purchased, it’s minted in real-time as an ERC-721 NFT and sent to the buyer's wallet. They have different collections (curated, presents, collaborations, etc)

Cryptopunks: launched in June 2017 by Larva Labs, CryptoPunks are one of the first NFT collections and have played a pivotal role in the NFT and crypto art movement. The collection consists of 10,000 unique algorithmically generated characters. Rights bought by Yuga Labs, the creator of Bored Ape Yacht Club.

Bored Ape Yacht Club: Created by Yuga Labs, BAYC launched in April 2021 and features 10,000 procedurally generated cartoon ape NFTs. BAYC kicked off the generated “profile picture” NFTs in the last bull run.

Blur Marketplace: Blur is an NFT marketplace designed for NFT traders. Founded by an anonymous individual known as PacmanBlur (identity now known), Blur “vampire attacked” OpenSea shortly after its launch.

Opensea: NFT marketplace founded in 2017 that allows users to buy, sell, and auction NFTs. It was at the center of the NFT action last bull run, but has since seen its volumes overtaken by Blur. Will Opensea mount a comeback or become a relic of the past? Frankly, we think it has the brand name to come back, but we’re not sure the company is headed in a good direction. Wen token?

That’s all for now! We have more research ideas coming soon. We’ll be hosting a Q&A on Saturday for paid subs.

Quick update the response on DeFi Academy has been awesome and we are really excited to see what the new members get up to in the months to come. Most of the seats are now filled so grab one of the last ones by clicking here and use the code defi100 at checkout for $100 off. Sale ends tonight at 10pm EST.

Until next time..

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

We now have a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Great stuff! Would love an article dedicated to SOL ecosystem. Lot happening there atm

I am not an America citizen, but I have come across this Executive Order 6102 that forced Americans to surrender their Gold bars or face heavy penalties like jail terms. After everyone surrendered their physical gold assets, prices moved 40% up and never came back down. This is a horrible conspiracy that played out by the elites! I am very suspicious of KYC and what Ledger is doing to their customers.

Is there anyway to protect owners of bitcoin in the event that similar event played out globally? It is clear that the elites are coming in to attack and rob people of their bitcoins, perhaps one day. What is the best and easy way to protect ordinary bitcoin owners (worldwide)? I followed your advice and found the Bisq Network attractive but have not figured out the best a way to fund it, or to move BTC anonymously in such a way that it is impossible to link it back to my past wallets.