DeFi: In Simple Photos and How to Make Your First Transaction!

Definitely NGMI - Level 1

Welcome Avatar! Now that we’re all on the same page regarding the future of DeFi and finance (Big Picture - LINK), we have to learn how to use these protocols to generate yield/return in excess of your local bank offering 0.5% interest. The good news? There is a lot of opportunity in DeFi! You can certainly generate yields in excess of what you see in typical real estate investments (REITs) and in the bond market.

Before doing the walk through we have to explain “Why” this exists and why we think it will be successful over the long-term. Some of this is already covered in the high-level overview. And. It will be a useful reference point to see the direct step by step going from “I know nothing” to “Bank -> Coinbase -> DEX -> DeFi -> Use DeFi” in a single post!

Part 1: Liquidity Pools What Is It?

Ah yes, more annoying financial terms. Fancy wording that just means “a bunch of money, stocks or coins in one spot”. That is a “pool”.

We can start with a simple example of fund raising, or an Initial Public Offering (IPO).

If you have a large company and you need to raise money, you have to go to a bank. This is *generally* the only option to raise a lot of money. Sure. You could crowd source some money, find rich friends etc. However. Banks are essentially “liquidity pools”. They know where all the money is and have access to all the rich clients.

How it works in steps: 1) you need to sell shares of your company, 2) you need to find people to invest in your company, 3) you go to a bank and they help you sell the stock with a massive 7% fee and 4) the final most important part they hold the shares and distribute.

Think the last two parts through. If you wanted to buy say 1,000 apples, you’d need to find a centralized source for apples (grocery store, apple farm etc.). Now. If you wanted to buy 1,000 shares of say New Company A, your options are quite limited! Why in the world is this system set up like this? It shouldn’t be. It should be more decentralized.

Final step. Apply this to crypto. If you want to buy BTC you really have two choices. You have to go to a centralized exchange or you have to go and find a way to do it peer to peer. By creating a *Decentralized Exchange* with a large liquidity pool, we can avoid a massive monopoly

Part 2: Use A Decentralized Exchange To Create the Pool Without the Banks

We noticed that simple photos are popular so please look at the below. What is happening? Usually you have to go to a bank or exchange to get your stocks, coins or money. Instead of over complicating this, we’re going to use crypto to explain it.

If you want some BTC you go to an exchange like Coinbase in the USA. Easy enough. You click buy and you have your coins. You can then send it to a wallet. OR. You can go and use a Decentralized Exchange (right side). Since stocks and coins change hands every second, you put them into a pool run by software code. This way, you are trading peer to peer with software code in-between (matching buyers and sellers)!

Part 3: Begin Replacing Wall Street Functions

Some geniuses said: “Hold up, if we already have a decentralized exchange of pooled coins, can’t we just do the same stuff a bank does like loan money out?”. This is exactly what happened. Now that you have a pool of coins and agreements can be made with smart contracts… you can match buyers and sellers of *loans* as well.

Benefits of This New System: Well if you are using Coinbase, everyone at Coinbase has to get paid: 1) the CEO needs to get paid, 2) those servers cost money, 3) customer support needs their money, 4) office space needs to be paid for, 5) regulatory costs - being compliant and avoiding fraudulent coins, and 6) anything else we forgot from HR departments to office furniture to VPNs to marketing and of course all the engineers that work there. All those 1% fees need to pay the entire staff, otherwise they would go out of business.

Compare this to the other options. A team of ~20 guys grinding it out focused solely on the code. Look at the results! Revenue per employee is $5.86M. That is impressive to say the least.

“With 21 mostly pseudonymous team members, Yearn currently spent $133,716 in salaries throughout April as per YFIStats. In contrast roboadvisors Betterment and Wealthfront have 293 and 231 employees, while Blackrock — the World’s largest asset manager — employs 16,500.

This means that Yearn is orders of magnitude more efficient in terms of dollars generated per employee, projecting a whopping $5.86 million per team member for this year.” (LINK Full Overview)

Now The Bad News: There are a ton of scams. In the end, you’re going to lose some money due to scams (even Mark Cuban got scammed when TITAN went from $60 to $0 (LINK). No need to be hard on yourself if you end up testing a few high risk pools and lose some money on it. We’ve been scammed before as well and it will happen again no doubt. If Cuban is not shooting 100% don’t expect to shoot 100% yourself!

All Wall Street functions are being replaced by code. However. Since all of this is new the software systems (the pool and the developers working on this) could *steal* the funds. This is a major risk when dealing with DeFi.

How to Avoid a Scam? A scam (also called a “rug” in crypto terms), is pulled off in a few ways: 1) claim that the funds were suddenly “stolen” from the pool when the developers really just took it and ran, 2) an actual hack occurs that steals the funds and 3) have a questionable stable coin that is actually valued way below $1 so people think they are earning say 20% returns but if the stable trades at $0.70 they are actually losing money and 4) token issuance schedule is also a big factor.

Simple ways to try and avoid it: 1) if you’re new, only use established protocols that have been around for a long period of time, 2) try to do your own digging and figure out if the project is being run by people who have started other *successful* projects and 3) tag some of the larger wallets and use that as a proxy for something being legitimate or illegitimate. The third part is extremely dicey. What we mean by this is the VCs have strange incentives. If they were early on a coin like “Insane Clown Ponzi” (Not DeFi just an example), you want to avoid it. If they invest in a decentralized coin (with *fair* token launch) you probably want to take a look as it means they did work on the software code .

Oh and by the way… There are so many crazy projects out there many of them don’t even make money while others are making millions. So. You have to do the work to figure out which ones you think will be successful long-term.

Part 4: How to Use DeFi

Now that you understand the basics below is a NGMI way to use DeFi. It’s actually quite easy but you’ll find that there are millions of options. Instead of going through those right now we’ll just show a simple example.

Fastest Way to Just Get Up and Running:

Step 1: The first thing you should get is a Metamask wallet (LINK) once you have this wallet you can then send and receive crypto assets. To keep it simple say you have some Ethereum in the Wallet so it looks something like this:

Hilariously a short time ago 1.29 ETH was only $228 US Tokens!

Step 2: For this example we’ll use Sushi. You can start with any protocol, however these screenshots are from Sushi. Go to Sushi App (LINK) and you will *connect* your Metamask Wallet to the application. For the exhibit below we clicked on the liquidity tab but if you’re looking to swap you simply click the swap tab and connect your wallet at the bottom.

Step 3: Now you have to decide “what do *you* want to add to the pool”. This is where hours and hours and hours of research come in. Depending on what you put into the pool (see part 2), you will get different returns on your assets. If you’re adding liquidity for some dangerous potential scam coin, you’ll probably see eye popping yields of 100%, or even 1,000%+ for taking on that much risk.

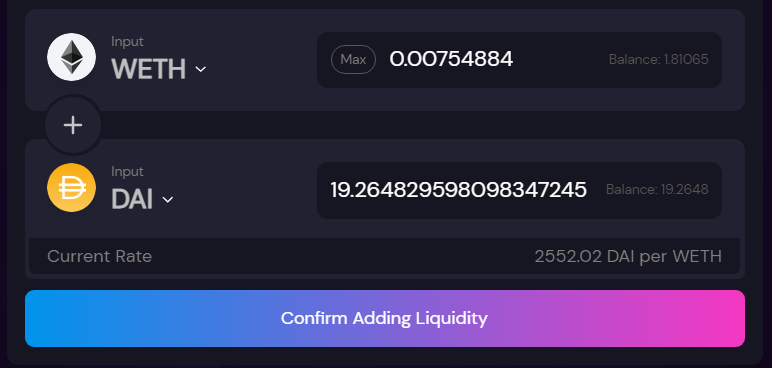

If you’re trying to add BTC/ETH the returns will be lower. For the below say you want to put in $20 worth of Dai, you would then match this $20 “worth” of Ethereum today, that would be about 0.01 ETH (below is an example of what it would roughly look like after you put in the liquidity).

Step 4: People screw this up *all* the time. After you deposit, you’re not done. After confirming add liquidity you will have Sushi Swap Liquidity Tokens (called SLP). You must *stake* this which effectively confirms you are locking your DAI and WETH into the pool. See below. If you forget to click approve here you’re earning nothing, once you click approve and stake, you will see the ability to “un-stake”. For extra caution, check the rewards you earned by the end of the day to make sure you did it correctly (you should be accruing rewards slowly through the day).

Step 5: Congrats! Your first taste of DeFi is complete. You definitely won’t get rich with your first ever pool (unless ultra lucky + talented) but you will learn a lot from your first attempt. You will see the gas fees/total costs to do all these transactions and you’ll have an “aha” moment on why it is the future. While many think they are late, they are not. We’re extremely early and this is a good thing.

Addendum: If you want to get out of the liquidity pool you simply click remove liquidity by clicking unstake (on the right the button will function since you will have SLP staked). Click unstake and go backward and move your coins back to your metamask wallet.

Just like the Internet and the Computer, you can say “I don’t have time to learn this” but in the long-run you’ll use it anyway so may as well learn the basics now.

Great intro!

Curious about staking the SLP.

For example, with JPEG and ETH I received SLP tokens. Are the SLP tokens accruing value from the fees that the pool takes in? (I've forgotten what that percentage is)

Am I simply gaining more SLP tokens from staking the SLP token after providing liquidity? (And therefore getting a little bit more yield on my initial liquidity offering)