Welcome Avatar!

With all that’s happened recently, it’s time to take a step back and reset. Today we have a brief high level overview of DeFi for beginners, followed by additional details on what happened with the Curve Finance founder’s DeFi debt position this week, and opportunities to profit from it.

Long term readers will remember we covered the last attempt at hunting Egorov’s liquidation price:

If you studied this post 9 months ago, you probably got paid well this week.

Decentralized Finance or “DeFi” is an ongoing experiment to find out if the banking system can be replaced with software.

Traditional banking has a problem.

Banks make risky loans and fail.

Then government bails them out.

During the 2023 banking crisis, four US banks failed completely and were taken over by the government insurance program FDIC. The banks held $368 billion in deposits.

Bitcoin was created nearly 15 years ago following the 2008 banking crisis.

Bitcoin’s first transaction contained this message:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banksa reference to the largest state aid given to banks in human history.

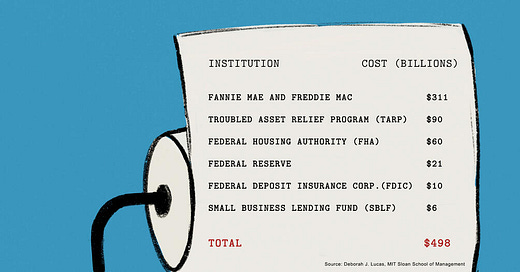

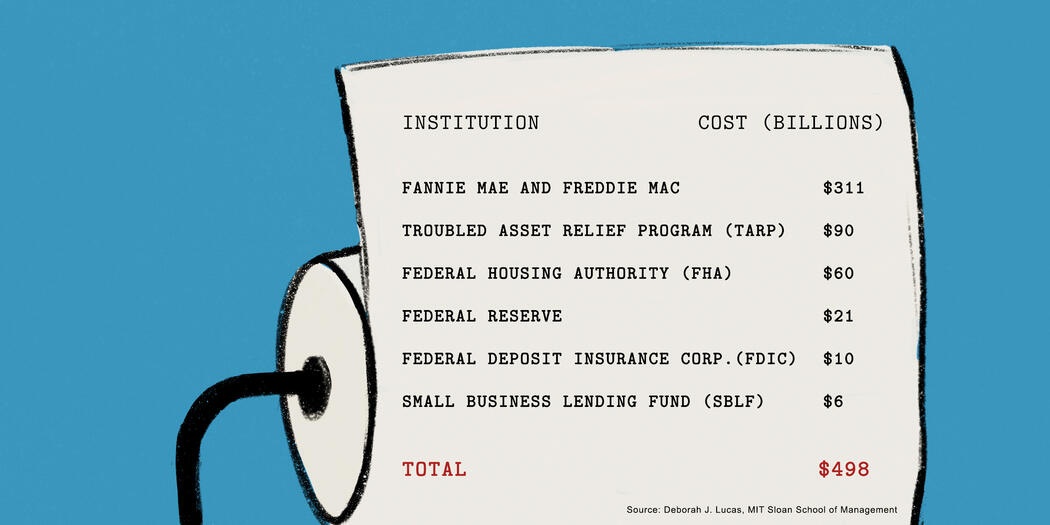

How large? “Too big to fail” turned out to be too big to measure.

Academic estimates range from half a trillion to twenty nine trillion dollars

(just in the US - other countries also received massive state bailouts)

Software enthusiasts created cryptocurrencies as an alternative to government created currencies. The first, best known, and most successful was Bitcoin.

But Bitcoin doesn’t have the financial services we need to make money useful. Borrowing, lending, and investing are the bedrock of finance.

Ethereum’s smart contracts made it possible to recreate the financial system on the blockchain. DeFi was created to fill this need, initially allowing users to finance the three major crypto assets: Bitcoin, Ethereum, and tokenized US dollars (stablecoins).

Does DeFi Work, Or Is It A Passing Fad (And How Can I Make Money)?

Our criteria for DeFi “working” is simple - can it provide better financial services?

A key element in “better” is avoiding major blowups, systemic risk, and the need for large lenders to be bailed out but the government.

DeFi runs on public blockchains which means anyone can look at “the books” of a DeFi bank and decide whether it is making prudent or risky lending choices. Lenders can then choose whether to deposit into the bank, or not, based on their own analysis of risk vs reward. This transparency is a key virtue of DeFi.

There’s no central bank or regulatory supervision in DeFi - instead, holders of governance tokens vote on key decisions such as acceptable collateral and risk limits. Although governance started as direct democracy, it has evolved towards something resembling a representative democracy crossed with a corporation. Managers are appointed, token holders delegate voting power to protocol politicians, and subject matter experts are hired to provide formal analysis and advice to decision makers.

It’s clear that the quality of DeFi banks is going to vary according to expertise, judgement, risk tolerance, and capitalization just like in the real world. So we’ll focus back on DeFi as a whole.

What Works

Smart contracts work: Software code powers on-chain replacements for the borrowing, lending, and trading services offered by banks, brokers, and stock exchanges in traditional finance.

You’re not forced to trust government: everyone should be paying attention. Whether your bank accounts are suspended for political activity, or you’re forced to flee a war, natural disaster, or pandemic - DeFi provides the solution to keeping a portion of your assets intact and under your control - even if crossing borders.

There’s no bank run: Look at Alameda Research as an example. SBF was able to get away with a wide range of illegal activity. However, even his team was not allowed to “by pass code” - debts due to DeFi protocols were either repaid in full, or liquidated

And DeFi is growing! Despite existing for only a few years, DeFi has $146 billion Total Value Locked and settles over a billion dollars everyday.

Despite the bear market which saw valuations reduce by 80% or more, there are still ten key DeFi protocols valued at over a billion dollars:

Chainlink ($7.6b) - a technology company which provides real world data (such as crop reports, weather data, flight arrival times, and financial market data) securely to smart contracts, enabling a diverse range of financial apps

Uniswap ($6.6b) - a decentralized exchange allowing swaps between any two assets

dYdX ($2b) - a derivatives exchange for speculation and hedging using futures, avoiding the embezzlement issues which can occur on centralized exchanges (FTX)

Lido ($1.9b with $14.9b TVL) - an innovative solution to allow people with little technical knowledge to secure the Ethereum network and earn crypto’s risk-free rate (~5.5%). This is the first crypto-native yield source which doesn’t depend on fees generated by borrowing. Service fees to stakers accrue from users who pay to use the Ethereum network.

MakerDAO ($1.3b) - crypto’s first bank, issues notes (DAI) pegged to the US dollar and backed by collateral - Ethereum, other crypto assets, and now Real World Assets like US treasury bonds.

The Graph ($1.1b) - Google for Crypto: The Graph is a computer protocol for organizing and accessing blockchain data.

Aave ($1b) - a borrowing / lending platform which takes a cut of the interest paid by borrowers

What Doesn’t Work

Software Security: if you’ve heard about DeFi, you’ve probably heard of various hacks totaling billions of dollars, proceeds which are alleged to fund serious crime and the ballistic missile program of North Korea. This will be fixed. We are making advances in security, this is still a very early technology. Early computing wasn’t secure - encryption existed but it was de facto banned for the public and for export during the 1990s - now all your banking and credit card purchases are online protected by high tech security. The DeFi Education team includes a software security expert to explain best practices and highlight insecure projects.

Human Behavior: this is a joke point meant to highlight that we can’t expect technology to solve human problems, like the famous principal-agent problem. It’s true that some features of blockchain - particularly the ability to control and remit any value anonymously - can make fraud and other bad behavior easier. But. Those are problems of financial systems, not problems of decentralization. The legacy system is no better. For proof, check out $200 Billion in Bank Scams

Now it’s time to make your own call on whether DeFi is a passing fad or whether it solves real problems at scale. We think its better to use a system which can’t be meddled with than put your trust in the hands of any individual. This was the original purpose of crypto and its achievable today for anyone who will put in the time to learn.

The other question is if you think adoption will grow 3, 5, 10 years from now (not tomorrow or next week).

Conviction is what matters.

How To Make Money

Depending on your skillset, capital and time investment there’s many possible paths.

DeFi Education has something for everyone. Try a subscription if you’re interested in

providing services to DeFi organizations (called DAOs)

includes advisory work (tokenomics and mechanism design, incentives, strategy & legal), marketing, software engineering (smart contract or frontend)

we created the best course on how to work in DeFi and web3 here

putting capital to work as a lender, long term investor, yield farmer, or trader

starting a business in the sector

Subscribed

The Paid Stack

Our paid subscribers had a heads up on the Curve trade on Sunday and we’ve previously done a deep dive into the founder’s risky debt position. To be clear, we are not a “trading” group and have no plans to be. However, we do share our highest conviction investment ideas with paid subscribers a few times a year as they come up. Recent highlights include buying BTC and ETH near the lows last November, and Coinbase stock below $50 despite the consensus that the SEC case was bearish.

DeFi’s Debt Crisis

Today’s paid post is a high level overview of what happened with Curve, how we made money trading it, and the implications for DeFi now that the crisis has been (temporarily?) resolved.