Welcome Avatar!

Today we’re taking a closer look at Ethena, the protocol offering a high yield “Internet Bond” based on Ethereum (ETH).

What Problem Does Ethena Solve?

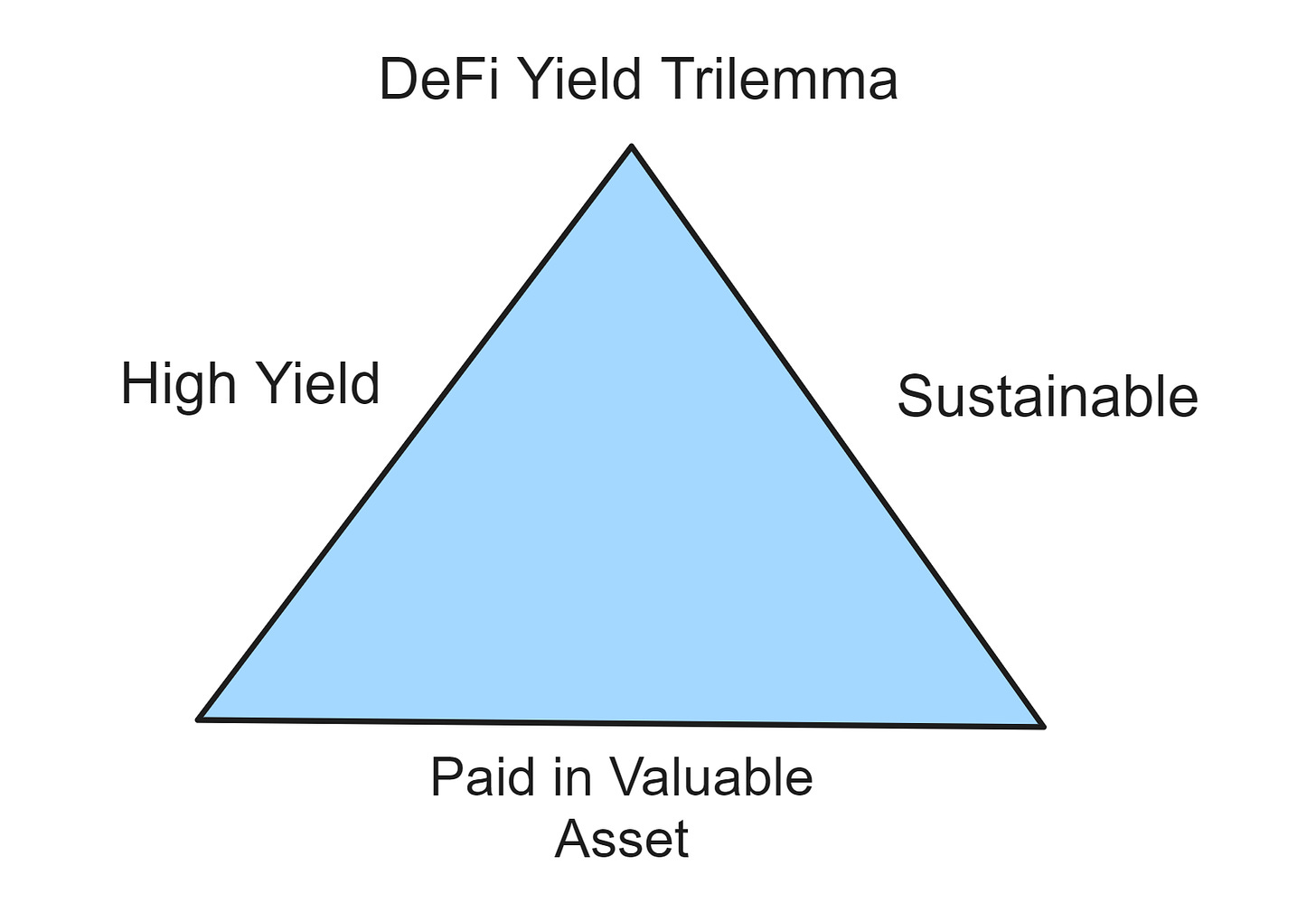

Ethena is the latest in “decentralized stablecoins” (or their preferred term, a synthetic dollar) to hit the field promising attractive returns to yield-seekers. Yields on dollars are an area of crypto that has seen huge booms and massive busts (remember Luna?).

The chase for yield will never leave the crypto space (or the financial sector more broadly).

Past attempts at providing yields on stablecoins have suffered from issues including:

Yields too low (DAI)

Unsustainable, typically suffering from centralization and lack of transparency (BlockFi, Celsius, etc.)

Paid in worthless coins

Ethena has stepped in with their take - a basis trade with some extra steps.

Autist note: A basis trade is when you exploit the price difference between a futures contract and the underlying asset’s spot price. In a simple basis trade you might buy the underlying asset in the spot market and sell futures contract for the same asset, locking in the future price. As the contract approaches expiry the prices would converge and allow the trader to profit from the “basis” (discrepancy between the spot and future price).

How Does Ethena Work?

Let’s walk through an example of exactly how Ethena works.

You begin with a certain amount of dollars. Let’s say $3 million.

Ethena uses this capital to buy 1,000 ETH, assuming an ETH price of $3,000 per unit.

Ethena mints their USDe stablecoin equivalent to the value of the ETH purchased (in essence, your initial dollar investment is turned into their stablecoin).

A portion of the ETH bought is staked at around 4-6% per year.

The remainder of the ETH is transferred to custodians who work with centralized exchanges, ensuring safe storage and management of these assets.

Ethena opens futures contracts to sell 1,000 ETH across five centralized exchanges (Autist note: A futures contract is an agreement to buy or sell an asset at a future date at a predetermined price). This locks in the sale price of ETH, hedging against future price volatility.

In essence, you give Ethena ETH, which they use to 1) stake and 2) sell futures.

Let’s breakdown the yield you could earn.

First, recall that the protocol converts your collateral from stablecoins to ETH. This allows you to earn the Ethereum staking yield by participating in network consensus. Ethena offloads this task to the liquid staking providers, which could net 4-6% per year.

Second, traders typically pay a net premium to buy futures contracts (due to demand for leverage). As the counterparty, short sellers are supplying the capital longs need to increase their exposure. This positive yield is around 20-40% in bull markets.

Ethereum stakers are exposed to the risk of price going down and futures shorts are exposed to the risk of price going up. However, if you did both strategies together, you would not have much exposure to the price of ETH. Regardless of what the market does, you’ll have roughly the same amount of dollars (in most cases).

In other words, by staking ETH and simultaneously opening futures contracts to sell ETH at a fixed price in the future, Ethena mitigates the risk associated with the volatile ETH price.

This strategy balances the risk of ETH price fluctuations, essentially providing you with a position similar to holding stablecoins.

So next time someone asks you “where is the yield coming from?” you can tell them the yield comes from two sources:

Ethereum staking rewards (4-6% per year)

The premium from selling futures contracts (20-40% in bull markets)

Synthetic Stablecoins - Where Have I Heard This Before?

Perhaps it was on DeFi Education.

A few years ago, when market conditions caused major volatility in stablecoins, we suggested a safer option for those who held ETH but didn’t want price risk during the bear market.

Keep 70-80% of your capital in ETH

Send 20-30% to a reasonably safe on-chain DEX like dYdX

Short futures against your spot to be delta neutral

This creates a synthetic stablecoin position in self-custody.

What’s The Catch?

There have been many critiques of Ethena, some more on target than others.

A tokenized basis trading strategy has been tried before and has failed.

This doesn’t guarantee Ethena will fail, but it’s worth noting. Senioriage share based stablecoin models had been tried before (and failed) before Luna appeared to have succeeded (and then failed).

Ethena just trades one set of custodians for another, it’s centralized / not DeFi.

This has some force but we think increasing user choice (who to trust) is a good thing. And this is an opportunity for perp DEXes to compete to be serviced by Ethena. If successful, this will drive down the excessive funding rates for DeFi DEX users.

If Ethena scales it could become a victim of its own success as its trading activity would compress yields and it would incur higher trading costs establishing and rebalancing its hedges.

At some equilibrium point, Ethena could serve some USDe stakers/holders and simply have a yield below what is needed to attract marginal supply, preventing the protocol from outgrowing available liquidity. Market forces should ensure that Ethena can deliver a positive return so long as there is demand for leverage in crypto.

So, Is It Safe?

We expect this protocol to grow, gain mass adoption, and for other protocols to interoperate with it. Eventually this means leveraged positions.

But we see a fundamental flaw in the design.

Ethena departs from the traditional basis trading model by choosing to use staked ETH derivatives rather than ETH as the collateral asset. However, there’s no liquid *futures* market for staked ETH. Instead, the protocol will short ETH futures.

But ETH and stETH are NOT the same asset.

They may be related. Their prices may be correlated.

But they are not equal from a risk perspective.

All forms of staked ETH carry more risk than ETH. This has to be true by definition on a Proof of Stake network, otherwise validators would have “nothing at stake”.

Risks of staking include illiquidity, as the validator exit queue will cause significant unstaking delays under precisely the conditions where many stakers have an economic incentive to unstake immediately.

This raises the familiar question in financial risk: what size is the fire exit?

DeFi Money Legos have many positives, but participants should not ignore systemic risks and tail risks. Few people give credit to the possibility of a mass slashing event or software bug at Lido, but these events are possible (although unlikely) and would have catastrophic consequences for anyone who levered up on a token backed by a long stETH short ETH structure.

We think a version of Ethena which ignored the ETH staking yield would be the safer choice, and because the structure is tokenized it could allow a higher risk adjusted return - e.g. the token could be leveraged for a higher delta-neutral yield. We wouldn’t lever USDe because of depeg risk if there was an event affecting Ethereum’s liquid staking tokens.

However.

Crypto market participants are notoriously bad at two things:

Pricing risk

Caring about risk in the first place

That means this thing probably runs as long as yields are good. Such is the game!

If you’re interested in more deep dives on crypto (or want to make requests) sign up for our paid membership. We’re the most trusted analysts in DeFi - thousands of paid subscribers have been with us for years.

If you’re new here and want to get up the curve on crypto quickly, we’ve designed a course with our wins & learnings in crypto. Check it out here.

Until next time..

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

We now have a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

What an interesting article and concept.

First concern was why do they need a new stablecoin in the first place? Wasn’t clear on this.

Looking at the their webpage and GitHub overview, there are a lot of functions that seem to give Ethena Labs god-control over the protocol. Such as the Gatekeeper role which can remove mint/redeem functionality. These roles appear to be in place to protect against bad actors or hacks but presence raises concern for abuse.

Process appears to be deposit ETH and Ethena gives you USDe, which you can stake to get sUSDe which gives 27% yield. Unstaking cooldown for sUSDe is 14 days (configurable to 90 days; configuration seems subject to change at whim of Ethena with no notice or notification, also a concern).

So in case of fire, if had sUSDe, you can unstake…and hope to get USDe back in 2 weeks. At which point you hope things haven’t gotten so frothy that the protocol Gatekeepers (whoever they may be) didn’t decide to turn off the Redeem function which allows you to convert USDe back into ETH. Which would trap your ETH and stETH in the protocol.

Why would a fire exit need a portcullis? Seems ominous. Wonder if there’s a liquid secondary market to swap out of sUSDe?

So are you guys going to use it for some time while it's still new?