Welcome Avatar! At this point you should be familiar with how DeFi works. We’ll walk down the risk spectrum for you. This will help you understand how Institutional Investors will go down the rabbit hole as well.

While Crypto Twitter thinks this is great for them… It isn’t. It means more competition more algorithms and more coordinated attacks on levered positions. If you thought the wipeouts were bad in 2021? It will only get worse. The only way to win is by staying a couple steps ahead.

Part 1: Risk Guide to Farming and Simple Fee Understanding

If you look at DeFi farming and yields there are a handful of major risks: 1) smart contract breakdown, 2) collapse of protocol, 3) De-Peg of stable coin, 4) rug-pull where developers run off with the funds and 5) error in code allows for constant redemptions - as seen with TITAN.

Smart Contract Breakdown: When code is incorrectly written and funds are stolen

Collapse of Protocol: Large amounts of volatility cause the code to execute incorrectly and the project does not operate resulting in massive loss in funds (high risk in times when crypto markets collapse such as May of 2021 and March of 2020)

De-Peg: If your stable coin de-pegs by a magnitude of about 20% or so, it usually means the project is breaking down fundamentally. IE. if you’re farming stable coins at 20% “return” but the stable coin you get is only worth $0.80 you’re not earning anything.

Rug-Pull: Project launches and people send money into a pool, this pool simply results in stolen money.

Error in Code: You create bad code that allows for arbitrage or mint/burn that kills the project. Similar to what happened with TITAN.

These major risks are going to be present at all times. Projects that have been around for a long time still have risk. The difference? As time goes on you can *assume* the risk is decreasing. This is no different than any other software/security product. If you’ve gone 10+ years without a major breach, the chances are generally higher than the code is secure. This is why rates on new projects are usually much higher (you’re taking on more risk) and the rates on older projects are lower (less risk and there is a lot of money in the pools already).

Image from Protective Security Policy Framework - Australian Government

The above image is a good way to think about the risk reduction over time. While the image is related security risks, an investment in DeFi is effectively a software security project.

At the top unless you’re wealthy you shouldn’t be messing with brand new projects or high risk staking (unjustifiable risk vs. your net worth - top left). At the middle if you already have some experience with crypto, you’ll see the best “risk adjusted returns” (make strategic bets/investments). At the bottom is where most people will fall. You are forced to learn DeFi before it is too late and you will start with low risk high use projects.

Onto the Nitty Gritty: Your job? Find projects that are mispriced. For example, if you find opportunities where the yield on project A (less risky) is 20% but the yield on project B is 10% (higher risk), you should jump into project A. To put an actual example around this, all else equal there is no logical reason for BTC to earn a higher yield than a Dog Coin.

We’re more than happy to give a basic risk framework around this: 1) BTC/ETH, 2) LINK/Stables, 3) Defi, 4) NFTs and 5) random new meme coins/hottest trend on Crypto Twitter.

From the above if you spend all day looking at yields you’ll find that the biggest spreads occur on level 3 and level 4. Examples *in the past* have included opportunities related to RARI and new projects like Bancor/Convex etc.

Going forward as the institutions ramp up after the summer there will be tons and tons of new opportunities. That’s why you’re here reading this in the first place!

A Note on Fees: Ah yes…. Gas Fees. To use major DeFi projects you will pay transaction costs. For example: the walk through on Sushi swap (LINK) will cost a few US Trash tokens in fees. As a *percentage* this can add up to be quite a lot! So. You need to be smart about when and how you enter in*any* transaction. *Currently* there is no real way to avoid fees and your best chance is to reduce them by using the table below (LINK)

Turbo Autist Note: Yes. We’re suggesting a newbie familiarize themselves with ETH first before using something like Binance Smart Chain.

Fun Pause and Glance at the Future: With the high level out of the way, you’re looking for risk management and should be on the lookout for new DeFi use cases. They will include: 1) music industry, 2) your home, 3) insurance, 4) annuities and 5) stocks/bonds/commodities in the form of synthetic assets.

The current problem with DeFi is that no one trusts it. You have too many scammers running off with funds and too many software bugs. This is no different than the internet. When the internet came out people said only scammers and crooks used it. Back in the day people said that Craigslist/eBay and all of these online portals for peer to peer sales would be zeros. That didn’t work. In fact, the brick and mortar business suffered dramatically once e-commerce was up and running.

Part 2 - Not So Fast… DeFi Data Is Already Suspect

It’s the wild wild west for a reason! The data is also suspect. Does the project actually make money? Is it just 2-3 guys trading with 100 accounts each? It’s hard to tell. Since many of you want to try and build out these items yourself here is a good summary of all the data sources we’ve looked at along with the issues associated with them.

Data Services Issues

Token Terminal: Can be used as a good sense check as it splits out both the supply side and protocol revenue (can be viewed for free, paid is for exporting spreadsheets). And. It currently does not do multi-chain (no inclusion of Polygon data for AAVE at this time).

The Block: Does not split out supply side vs protocol revenue. Glassnode does not offer much detail on DeFi either.

Nansen.ai: Appears to be promising but they do not allow republication of data, we’ll look into building something out ourselves. Also quite a large lag time to questions/inquiries.

Dune Analytics: This is free, reliable/used by team members on many projects, but only covers Ethereum. Must understand the protocol and construct your own queries. In some cases, there may be some data which is difficult to assemble or verify.

Dappquery: Fair number of issues: 1) None of the paid services offer any detailed sources / calculations to support the numbers they produce; 2) Each project has its own approach to publishing its financial data: APIs are sometimes not working, out of date, or poorly documented (e.g. YFI helped us via Discord at the last minute to access data on a new API endpoint which wasn’t listed in their docs)

Summary: Considerable work is involved in querying each project. The individual also need to look at idiosyncrasies in how they present data. Data in a single location with a common format would improve efficiency (we think this is a long way away at this time).

On a similar note, it would make a lot of sense if every protocol could list out 1) how they generate money, 2) where that money goes (treasury, partnerships, contributors, etc.) and 3) main expenses. Unfortunately… This is also a long way away given that you’re looking at an unregulated global software ecosystem.

Aave Example: After doing research on the project it showed a lack of transparency around proportion of tokens owned by the team. Questions around this topic appear to be ignored consistently. Therefore, we are forced to make simplifying assumptions since they do not provide this information. Autist Note: The next coin we will cover is AAVE and you can see how we made our own calculations and estimates.

General Commentary on the Crypto Space: Admins / developers seem to selectively respond to questions on discord. We’ve seen a lot of important questions left unanswered. Over time as the space gets bigger and larger participants enter, more clout should go to people adding value/asking good questions and this should help us improve projects and get better answers.

BowTiedBull and DeFI Substack: We’ll be monitoring *and* using all of the data sources. This will help save you time unless you’re dedicated to this industry (in that case you’re probably fighting the same battles we are). If you’re looking for a quick fix we’d go with Dune Analytics and One of the BTC/ETH specific data sources (all are quite similar).

Sourcing Data for Non-Ethereum Chains is a Major Pain Point!

Where we have only one source of data, it is less likely that we will notice errors. For multi chain protocols e.g. AAVE we can at least compare ETH vs Polygon usage figures to see if the Polygon data seems reasonable. This would not be possible on Pancake/BSC.

1) Dune Analytics only covers Ethereum (and xDAI); 2) TheGraph covers many of the others including Polygon and BSC however… it uses GraphQL rather than SQL – different computer language, steep learning curve, fewer query examples documented and requires special software (Autist Note: by default returns only 100 transactions, need to request each ‘page’ of 100 transactions in sequence until the whole database has been read)

Some Sub-Graphs have been badly assembled (anyone can make one), either with problems in the schema (e.g. number precision) or they don’t sync to the latest block in the blockchain

Miscellaneous and Explaining the Data Process Going Forward

The state of the data extraction process means that the bulk of time is used poorly without a team working on this. This can impact the quality of the reporting on improvements, protocol risks, and presenting the data in a thoughtful manner to the user.

Over time our plan is to cut down time on things like finding out how to calculate net revenue (AAVE for example). Once we’ve automated this we will then publish data in a consistent format to help save time. Also. This will give everyone the ability to see what is really happening under the hood (given the high number of ponzis that are running in the space). Generally speaking, this means that Ethereum based protocols are easier since the data can be scraped consistently.

For example, we started with REN since it is easier to follow with a single source of revenue (easy to understand use case and market sizing is straight forward). Compare this to AAVE with 30 different assets with different net margins, risk profiles and two different product lines (lending and flash loans)!

Summary of Issues: The state of the data extraction process means that we *will* be forced to make estimates. There is no easy way to answer an important question such as “How much rehypothecation is occurring in DeFi”. Positively, as new data scrapes and software tools become available the information will become clear. Projects will eventually present the data in a thoughtful manner to the user to gain market share (as always we’re optimistic).

Our strategy with all of *you*? Simple. We will get the major issues and major numbers out in a clean format. Similar to YFI and REN. We will clearly disclose *where* there are issues and do our best to explain how we made our estimates. Also.

By providing a range of outcomes in a DCF format or in a "sensitivity table” you can calculate your own estimate. We’re happy to say that there is *no chance* anyone will calculate all of this perfectly (since the data is simply not there).

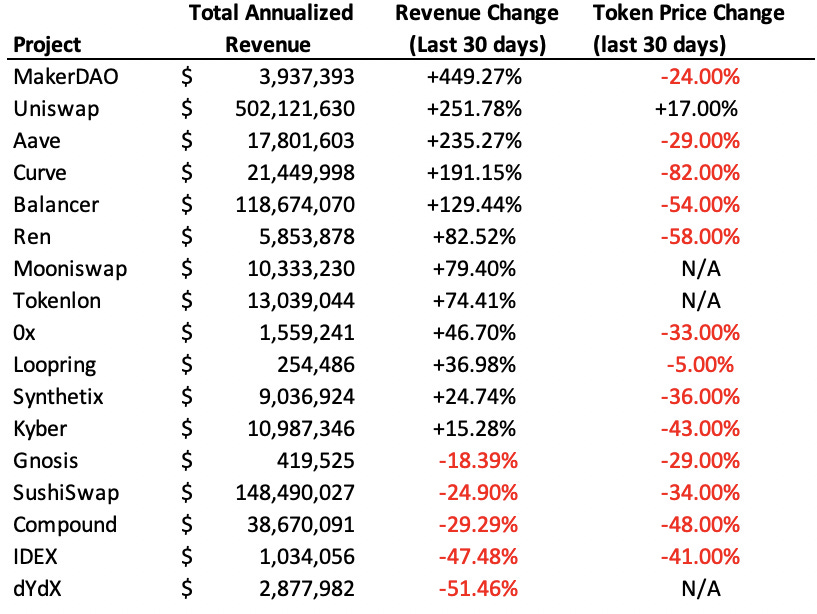

To end with a scary example, take a look at the below. If you didn’t know better you’d think that this was accurate in terms of token holders getting the revenue. It is not. For example… Uniswap is actually a governance token! (another example is this website - LINK)

Chart Below from Coin Telegraph

So there you have it! You’ve got a good feel for what we’re doing and how we’re generating our estimates/assumptions on each major project we look at. There is no perfect answer and this doesn’t even include basic checks on how secure the project is. This is *GREAT* news for *YOU*. Why? It means we’re extremely early. There will be more amazing opportunities and the only thing stopping you from figuring it out is time/effort and caring about the future.

Disclaimer: As usual, none of this is to be deemed legal or financial advice in any way shape or form.

Subscribers: For those interested in DeFi we’ll be covering AAVE next as a token and hosting a Q&A as well. Subscribers get access to 1) Q&As, 2) detailed breakdowns of the DeFi ecosystem and 3) even the chance to ask for specific data that we will dig up (if available! Given all the issues you’ve seen in this post!)

The good news is that Dune Analytics are adding support for Polygon / 'matic!

For the Graph, you can query up to 1000 results at a time I believe if you include `first: 1000` as a query parameter. Still not the best for analytics since it was designed more to populate frontends