How to Earn Higher Interest Than Banks with Fantom DeFi - Hint Banks Are Zeros.

Level 1 - NGMI

Welcome Avatar! Crypto prices may be down but there are other ways to make money. Today we show you how to earn high yields with low risk by yield farming on Fantom. You deposit USD stablecoins so you are not at risk from falling crypto token prices.

What is Fantom and what problem does it solve?

If you’ve tried to use Ethereum DeFi you’ll have noticed ‘gas fees’ - simple transactions can cost hundreds of dollars in busy times and $20-40 normally.

Fantom Opera is an Ethereum-compatible blockchain with full solidity smart contract support but powered by an asynchronous consensus mechanism with fast finality.

What does this mean in plain English?

Transaction fees (gas) cost *pennies*

You can use familiar wallets like Metamask on Fantom

Popular apps like Sushiswap and Curve (DEX), Yearn (yield), and Abracadabra (borrowing) are live on Fantom

It’s fast. Transactions confirm in a few seconds

Banks Are Zeros

And the best interest rates they pay…start with zero. You are losing when you deposit dollars in a bank account because the interest is far below the official inflation rate of 6.8%. If you have $10,000 in savings you need to make $680 interest per year in order to break even (buy the same goods and services with your savings as you could afford the previous year).

By the time you finish this article you’ll know how to earn hundreds of dollars per year on your savings by using Fantom DeFi while insured against smart contract risk, and without exposure to volatile crypto tokens.

But. Time is running out. High yields on DeFi won’t last forever.

The sooner you learn the more you can earn.

Let’s dive in!

Basic Yield Example

You’re going to follow these steps to earn up to 13% per year on your dollars.

Put some money on the Fantom blockchain

Stake with a reputable protocol like Curve, Yearn, or Abracadabra

Earn APY on your USD

(Optional) insure your deposit with Nexus Mutual (costs 1.3%)

Depositing to Fantom

This guide works with Metamask, the most popular wallet. If you use another wallet search the documentation.

You can use the same Metamask wallet you use for Ethereum.

You will need to add Fantom to Metamask. Easy - just visit SpookySwap.finance.

You’ll get a popup from Metamask to connect to the site.

If this is the first time you have used Fantom with Metamask, you’ll get a prompt to add the new network. Check the details are exactly as in the screenshot (Chain ID 250) and click Approve.

Then everyone will get a prompt to Switch Network.

You now have a Fantom wallet. Make a copy of your address, you’ll need this to deposit.

Two choices to move funds onto Fantom:

From Ethereum, BSC, Polygon, Avalanche, or Arbitrum you can use the SpookySwap Bridge: Instructions

Withdraw FTM tokens from Binance (CEX) - make sure to select the Fantom Opera network when withdrawing

You will need to have some FTM in your wallet at all times to pay gas fees, so make sure you send some FTM tokens first using either Binance or the Bridge.

If you’re new to DeFi…

You’re going to have a lot of questions and the process will be unfamiliar. The good news is our guide is easy to follow so most readers will get through the process in half an hour. But you might not be comfortable depositing thousands of dollars of your savings yet. Here’s what we suggest: gas (transaction fees) is cheap on Fantom, so you can literally get started with $10. So just deposit $10 to your new Fantom wallet and follow the whole process. Then reverse the process to know you can get your money back out. Once you know how to do it, then research the risks and details of how DeFi works, if you want to. If you subscribe to our substack you have access to our detailed reviews of every DeFi protocol we recommend in this article. Our team verify the security audits (software background) and analyze the economics of the protocol (Wall Street background). And remember you can also buy insurance (although this is only cost effective for larger deposits, $20,000 and up, although we expect insurance to get cheaper this year).

Earning Yield

The first thing to do is head over to Abracadabra.money to check out their Farming options.

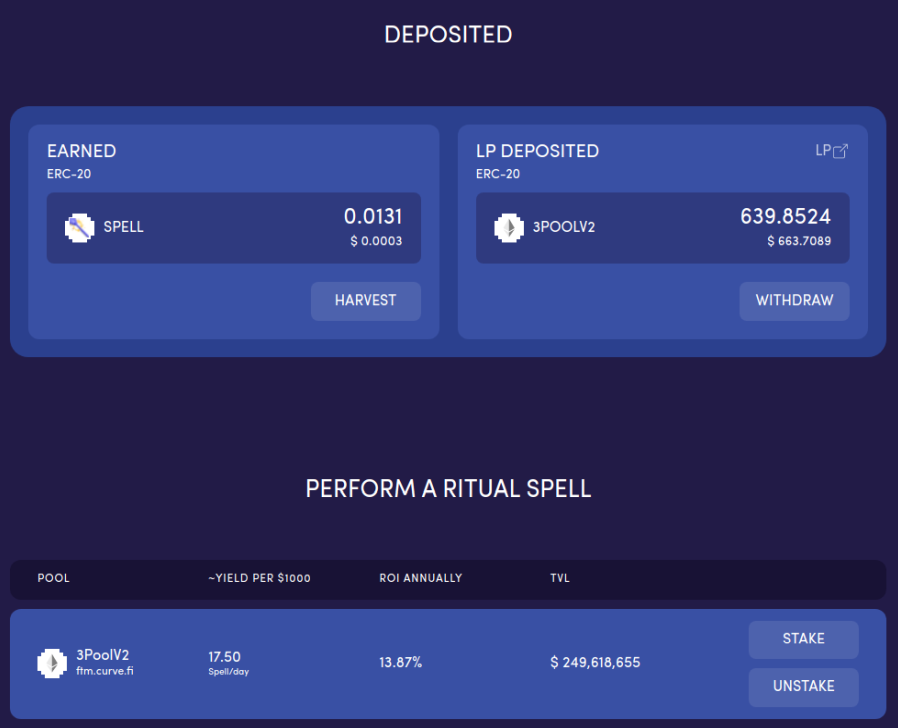

13.87% APY on US Dollar deposits is much better than a Clown Bank. How do we earn this APY? In the Pool column you’ll see that you need to use Curve’s 3PoolV2, so lets head over to Curve on Fantom - ftm.curve.fi

Pick the 3PoolV2 from the list and choose the Deposit option (or click here )

You need to deposit USDC, MIM, or fUSDT (Tether on Fantom). These are all USD stablecoins, meaning each coin is designed to be worth $1. As a liquidity provider to the pool you will have exposure to all 3 assets, meaning that you could lose money in the unlikely event that any of these stablecoins fail. If you want to know more about stablecoins and their risks, we have a free guide, but it isn’t required to complete this farming tutorial.

It doesn’t matter which one you deposit into the pool as you will receive a token representing a proportional share of all 3. So bridge USDC, USDT, or MIM to Fantom; or bridge any other token and swap for USDC on SpookySwap like this:

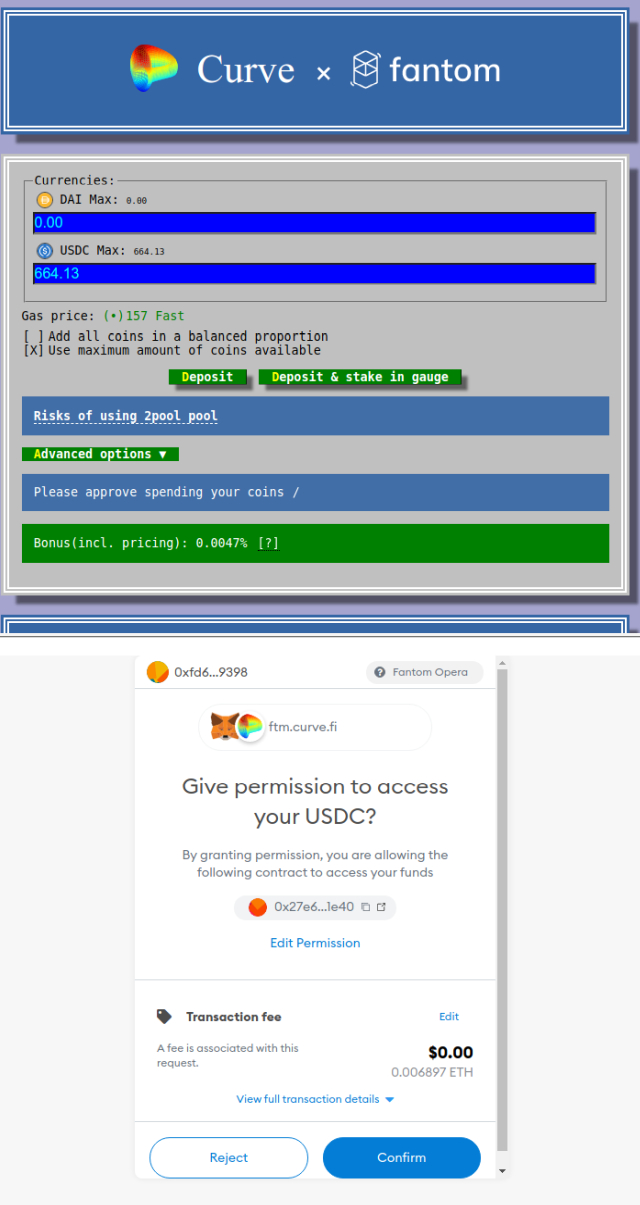

When you have some USDC, fUSDT, or MIM in your wallet, go back to the Curve page click ‘Deposit’.

You’ll need to Approve Curve to use the token you deposited. You may also wish to visit Curve’s Risk Disclosure.

After approval, you have exchanged a stablecoin (USDC) for a share in a stablecoin pool. You will receive an LP token representing your share in the pool.

Now head back to Abra to stake your LP token to earn your SPELL rewards.

Under Perform A Ritual Spell section click Approve next to the 3PoolV2. Confirm the approval. When the page reloads the Approve button should have disappeared and is replaced with a Stake button. Press this button and approve staking your tokens.

Now you should see your funds under the LP Deposited section.

You are now earning yield!

What next?

You have deposited USD but your rewards are in SPELL token. Every so often you may want to ‘harvest’ your rewards (claim SPELL to your wallet) and then swap your SPELL for USDC. You can then compound the interest by reinvesting the USDC in the Curve pool and staking the LP tokens in Abra.

While your rewards are accruing in SPELL token you are exposed to SPELL price risk on your interest not on your principle (the USD you invested). This means that if the price of SPELL falls your rewards may not be worth 13% in US dollar terms (if the price of SPELL rises you may earn more than 13%). This is why it is important to periodically swap your SPELL rewards for stablecoins to lock in a dollar based return *if* you don’t want to invest your rewards.

Autist note: you might be wondering why we said high yields in DeFi won’t last forever. Protocols are essentially paying people to create liquidity for their products. This is a marketing expense which costs protocols millions of dollars *per week*. Protocols are actively working to reduce their expenses, we cover this in detail for paid subscribers. You are early to DeFi so benefit from these rewards, but when everyone uses DeFi it won’t be as easy to make money passively. The sooner you start the more you can earn.

Insurance

If Abra or Curve get hacked, you could lose funds. You can buy cover from Nexus Mutual. Nexus is a regulated financial mutual based in England. You’ll need to apply for membership and pass KYC before you can buy cover. You can bypass KYC by using a broker like Armor.fi but you’ll pay double the premium to do this.

Unfortunately, Nexus is on the Ethereum network and the gas fees are therefore much higher than Fantom. Insurance probably suits deposits of $20,000 or greater ($2,600 per year yield at 13% APY - worth paying a few hundred dollars in gas fees and a 1.3% premium - $260 - to insure).

Tell us in the comments if you want a step by step guide to becoming a member of Nexus and buying cover for these risks.

Higher risk (degen) strategies

So far we’ve described a low risk higher interest alternative to a Clown Bank savings account. You deposit stablecoins so you don’t lose money if crypto prices go down. But what if you want to take on more risk?

There are many ways to earn higher yield on Fantom. You could:

Invest in Yearn vaults - Yearn uses automated strategies to find the best yields lending your funds out to borrowers on Aave or Compound (low risk)

Provide liquidity on Popsicle - when Sorbetto Limone launches, you will be able to automatically provide liquidity to the highest yielding pools across all chains (higher risk)

Borrow MIM against your crypto investments to provide liquidity on Curve and earn more SPELL rewards (medium risk)

Let’s say you own some FTM and are happy to hold it for six months. You can deposit FTM in Abra to mint MIM. Using a 40% loan-to-value to be conservative. Deposit the borrowed MIMs in the Curve pool. Then stake the LP tokens in Abra. Same process as above, but with borrowed money. You will pay ~2% a year to borrow and earn ~13% in staking rewards (SPELL tokens).

You need to monitor the price of FTM to ensure your loan is not liquidated. If you want to deleverage (or withdraw your FTM to sell it), simply reverse the process. Unstake your LP tokens from Abra, withdraw your MIMs from the Curve pool, repay the loan on Abra.

You can also take advantage of Fantom native projects such as SpookySwap, Fantom’s DEX (BOO token). New projects often offer farming rewards and some are good token investments. Projects which don’t yet have a token may ‘airdrop’ free tokens to early users.

We aren’t recommending any specific Fantom tokens but will be covering the Fantom DeFi ecosystem in more depth as we believe it is the best place for beginners. You might have heard about Solana - unfortunately many Solana tokens are venture capital backed cash grabs with poor products and sky high valuations making it unlikely for you to profit by owning the tokens.

For example the much hyped Oxygen ‘prime brokerage’ (OXY) protocol raised billions from investors in a heavily marketed FTX exchange launch, trading at a valuation of $30 billion on the day of the listing in March 2021. Less than 1 year later the token trades at $0.60. A $10,000 investment at $3 on listing day would be worth $2,000 today. The same investment in Ethereum would be worth around $18,000 today. Many reviewers of the Oxygen app on the Google Play store say it still doesn’t work properly and the website appears not to have been updated since launch. OXY is not the only Solana token to have lost *tens of billions of dollars* in fully diluted market value despite 2021 being a record breaking bull market year in crypto. DeFi Education substack can help you avoid scams and token economics structures which benefit insiders at the expense of ordinary investors.

Summary

We’ve researched a low risk alternative to USD savings accounts which anyone can use without paying high transaction fees. This is a great way to get started with DeFi and works with familiar wallets like Metamask. And we’ve made some suggestions for those wishing to take on more risk to earn higher returns. We’ll cover other Fantom opportunities in more detail for our paid subscribers.

If you found this information useful, please help us out by sharing this free article with people who are sick of zero interest banks

Disclaimer: None of this is to be deemed legal or financial advice of any kind and the information is provided by a group of anonymous cartoon animals with backgrounds in Wall Street and Software.

since btb recommended STX once and you cover yield strategies it would be interesting to see a due diligence of

https://app.arkadiko.finance/stake and

https://app.stackswap.org/farm/list.

With these protocols you deposit STX and stack STX, mint their stablecoin (and repay it with the stacked STX) and provide liquidity earning rewards of 100+% a year.

Great post as usual. The step by step guide to becoming a member of Nexus and buying cover you suggested can't come soon enough!