Welcome Avatar! Today we explain how to access on chain data using a Block Explorer.

What’s a Block Explorer and Why Would I Use One?

Etherscan.io is a well known popular block explorer for Ethereum.

A block explorer allows you to look up any Etheruem address or any Ethereum block and find related transactions. Without block explorers, you’d need to run a node and download a copy of every transaction on Ethereum since inception.

There are benefits to running a node, like security and contributing to the network, but most new people in DeFi don’t want to do this to get started. Unlike Etherscan, a node doesn’t have a user friendly web interface to query data.

Autist note: running a node requires:

fast computer with unlimited bandwidth

separate hard drive to dedicate to storing Ethereum

computer must be on all the time

takes between a few days and several weeks to process the data

So I can look at wallet balances and transactions. What else?

Etherscan allows you to directly interact with contracts. This means you can:

mint an NFT even if the project website is down

recover your tokens or interact with an app when the website no longer exists (or has censored some tokens, like Uniswap did)

view and revoke token approvals on your wallet (important for security)

Etherscan also shows important details about a transaction so you can uncover:

whether an influencer really minted an NFT or if it was sent to their wallet by scammers

if a token swap was frontrun or sandwiched by an MEV bot

instructions from the owner of a contract to control how it works

Sounds pretty dry. Where’s the alfa?

Glad you asked. Keep reading and you’ll learn how to:

check token vesting schedules and unlock dates

check if an influencer really minted that NFT, or if it was airdropped to them

mint an NFT even if the mint page has crashed due to high activity

check and revoke token approvals (important for security)

Verify smart contracts, including security audit information

make money by backrunning transactions

Check token vesting schedules / unlocks

Most vesting contracts are some variation of OpenZeppelin’s code. If you click on the Contract tab in Etherscan and there’s a file called TokenVesting.sol containing the following code, you are looking at a vesting contract.

/// @title TokenVesting

/// @dev This contract allows vesting of an ERC20 token with multiple beneficiary.

/// Each beneficiary can have a different vesting schedule.

/// This implementation uses timestamps, not block numbers.

/// Based on openzeppelin's {VestingWallet}

You are now looking for the project multisig / deployer contract. When you find it, look in the Transactions tab in the Method column for calls to Vest Tokens. Click into the Txn Hash on any of these you see.

Scroll to the Input Data section on the Transaction Details page and press Decode Input Data

Beneficiary is the Ethereum address entitled to the tokens, totalAllocation is the quantity (remember to divide by 10^18 for most tokens or by the appropriate token decimal, if different). The next three fields are dates in the Unix Timestamp format.

What is the Unix Epoch? January 1, 1970 at midnight UTC. We count time in seconds since that date for the purposes of token vesting contracts. Use this site to convert.

Start will be an exact date, cliffDuration and duration are periods of time (so subtract the Epoch from the date given).

An example vest could look like

start: Jan-6-2023

cliffDuration: 6 months (shown as July-1-1970 if you use a timestamp converter)

duration: 1 year (shown as Jan-1-1971 if you use a timestamp converter)

Now you know when the team and other insiders can sell their tokens!

Bonus tip: you can use Etherscan to set an email alert for activity on team / investor / advisor wallets. Then you’ll get an email they transfer or sell tokens on-chain. Steps: Login (you’ll need to create a free Etherscan.io account if you don’t already have one), visit watch list page, add the address of interest, then in Notification Settings select “Notify on Incoming & Outgoing Txns”.

Did an influencer really mint that NFT collection?

A common scam in the NFT world is for projects to airdrop their NFTs into the public wallets of key influencers. The obvious intent was to lure retail ‘flippers’ who were using Nansen and Etherscan to copy whale mints.

Etherscan shows the difference between a wallet initiated transaction sending Ether to a NFT minting contract, and an unsolicited token transfer from a third party wallet.

Let’s compare a real and fake transaction:

Real Mint

Fake Mint

Note that in the fake mint, the “Mint To” address doesn’t match the “From:” address, and the tokens “Transferred To” address doesn’t match the “From:” address. If you click the "From:" address you’ll see the collection was also +minted into public wallets of other influencers.

Keep an eye out next time you start spying on wallets!

Mint an NFT even if the mint page has crashed due to high activity

This used to be great alpha during the NFT mints craze. It is still useful to know how to interact with a contract directly. Steps:

Enter the project contract address in Etherscan

Access the Contract tab

You will see Code, Read Contract, Write Contract. Click Write Contract.

Click Connect to Web3 button, approve on MetaMask.

This next step is contract specific. You should see several method names. There should be one named Mint. Click into this.

There should be options to select quantity. Sometimes there is an option for price and the contract will mint as many as you have paid for. You need to be careful with this step (know the correct mint price) and use common sense. Other times you’ll need to input both quantity and total price.

Click Write and review your transaction in Metamask. **WARNING** if the suggested gas fee is unreasonably high (0.5 ETH or more / thousands of dollars) it means the transaction will not complete at all. DO NOT APPROVE IT. Usually this means the project has minted out, or you have made an error with the values you have input to the contract.

If the gas price is reasonable (compare with Etherscan or another gas checker), go ahead and approve the transaction. You have minted your NFT.

Check and Revoke Token Approvals (Important for Security)

Sometimes you’ll hear about a vulnerable or hacked project and you may have approved it to spend your tokens! You’ll need to revoke approvals as soon as possible. It is also good practice to review token approvals in your main wallet regularly.

Etherscan’s Token Approvals tool shows all the smart contracts you have approved to spend your tokens. You can easily revoke (or decrease approved amount for any contract.

Autist note: if you want to revoke token approvals directly without going through any third party website like Etherscan or Revoke.cash, check out this Turbo Autist level guide on BowTiedIsland courtesy of @BowTiedPickle. This will work even if all the main revoke sites are down e.g. if there is a major hack and everyone is trying to revoke at the same time.

Verify Smart Contracts, Including Security Audit Information

Good practice is to always check the contract address before you sign a transaction. Failure to do this consistently can lead to being rugged if the frontend you are interacting with has been hacked, like in the BadgerDAO exploit. Or you are the victim of a hack. What are you looking for when you verify a contract?

Paste the address into Etherscan and click the Contract tab. If the source code has been published, it will have a green checkmark and the rubric Contract Source Code Verified will be displayed.

Important: verified only means that the source code displayed matches the contract deployed on the blockchain. It means you can read the code to know what it does, it DOES NOT mean the contract is safe. However, if the contract is not verified, this is a red flag. You won’t usually see an unverified contract from a legitimate project.

What will give more information is whether the contract is marked as Audited (see opposite Other Settings: in the screenshot above). Clicking Audited should take you directly to the report.

Now you’ll want to check the auditor is reputable. These are very good auditors:

Certora

Consensys Diligence

OpenZeppelin

Trail of Bits

If another company has audited, search their name in this BowTiedIsland guide to see if they are reputable. There’s no point putting weight on an audit by a no-name company who may not be competent, or worse a front for the scammer (bad actors are getting more sophisticated and setting up fake VCs, fake auditors, and other front companies).

If the contract is verified and linked to an audit by a reputable firm (takes 2 mins to check) you’re probably not sending your funds to a rug!

Make money by backrunning transactions

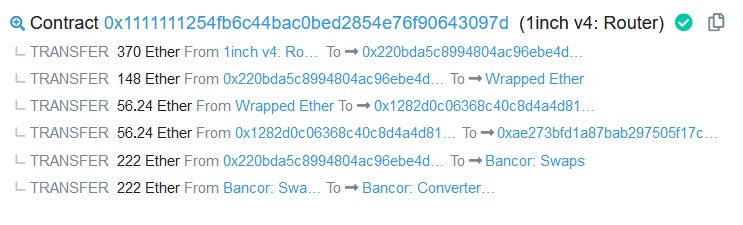

A long time ago, at a treasury far far away, someone who probably didn’t have much trading experience was in charge of executing an 8 figure order. They decided to spray million dollar market orders into a smallcap token, suffering massive slippage.

Whenever this particular wallet interacted with the 1inch router contract, it was always a huge trade in the same smallcap token. You could run an Ethereum node, monitor each new block for a transaction between that wallet and 1inch, and if there was one you immediately buy on all the CEX via their APIs using a bot. 30 seconds later the price on CEX would have risen between 2% and 8%. Close position. Repeat. As it was a smallcap you couldn’t make more than $10k a time, but this happened dozens of times before the order was fully filled.

Digging on Etherscan turned up the wallet / opportunity (the chain checkooooor).

Other Tips

remember to set email alerts for addresses you’re tracking

you can search by .ens name to get registration information and expiry date

search a token and click ‘Holders’ tab to see the wallets of the largest holders

use comments and labels to see metadata users have added to a wallet or transaction - this is useful for learning if a wallet was associated with a hack

find projects early by checking the most recent verified contracts

Block Explorers on Other Chains

EVM Compatible

Avalanche, Binance Smart Chain, Fantom Opera etc are Ethereum compatible chains and therefore have copies of Etherscan called Snowtrace, BSC Scan, and FTM Scan. These work the same way as Etherscan.

Cosmos-based

Since Cosmos isn’t Ethereum compatible their block explorers are very different. Not all the information will be available and it will not be presented in the same way as Etherscan.

If you’re not familiar with Cosmos we’d suggest reading our deep dive over at BowTiedBull (Part 1 and Part 2).

tl;dr each “zone” on Cosmos is its own independent blockchain with its own rules.

You can use Mintscan by Cosmostation to view the popular zones (Osmosis, Secret Network).

How do you use a block explorer? Drop any useful tips in the comments!

This is a free article. We are a niche research publication building an in-depth fundamental analysis and educational platform to give crypto users and investors better odds against VC Funds, influencers and whales that control the market. We teach you to think like them.

Our publication relies purely on content quality and word of mouth to grow so we would appreciate if you could give this article a share.

In our paid substack, we dive deep into protocols and tokenomics as well as provide broader market commentary. Thousands of readers trust us for our analysis. No frills no shills.

Join our community below.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

This is great, did some tests on JPEG to see vested schedule. They only have 3 vested transactions, is this normal? I would think there would be more since the number of people involved. Im a little confused on the divide by 10^18 to get the token amount, if i drop the 0's i get about around 1b, which makes sense. Also, looks like one of them will vest on 4/20 lol

great post, definitely would like to learn more about navigating the block explorer, more specifically identifying + interpreting certain txns that may not be intuitive

examples would be helpful too - went through some txns that I thought should be token vesting, but didn't find any meaningful values when hitting "decode input data" :(