Welcome Avatar!

If you’re just joining us here at DeFi Education, we’ll be honest with you.. you are a little behind.

DeFi Ed paid subscribers have been accumulating coins for the last ~16 months.

However, it’s not too late.

There is plenty of juice to squeeze from this bull market, but you will have to get up the curve fast. If you’re relatively new to crypto we highly recommend going through the Academy to set yourself up at a foundational level as quickly possible to avoid losing more time.

Who We Are

DeFi Education is created and produced by a team of ex-Wall Street and Software professionals.

We’re coming up on three years in operation. Unlike most crypto participants with an audience, we don’t “shill” or promote coins. Instead, we give you all the research you need to make your own decisions and act as your guide through this volatile and complex market.

We also put out high conviction trade ideas that are liquid enough to send to a large reader base when we have them (historically about 1x a month, but we expect that to ramp up soon).

Our mission is for our readers to understand the tech, develop a framework for profitable investing, and avoid scams all while building the knowledge to navigate the market on their own.

We assess the security of every project. We also know how institution players think - we used to work for them!

If you want full access to DeFi Education you can become a paid subscriber for only $100 a year (no that is not missing a zero). For everyone else, we put out 1 free post a week.

2024: The Big Picture

Profitability in the financial sector is driven by charging fees for products and services; and by speculating with borrowed money (leverage).

Our main focus (and largest holding) is Ethereum.

Why? Institutional investors want yield, leverage, and products which are familiar and explainable to their clients and managers. The desire to access yield bearing assets and the ability to leverage are the two factors which will explain the transfer of institutional capital into crypto at an unprecedented scale.

Ethereum offers:

a native staking yield (you get paid to own the asset)

yield is derived from fees paid to use the network, so not a ponzi

fee capture which scales with demand - L2s have to pay fees to store their state on the L1 as Etherum Mainnet is the highest security chain / settlement layer

fully developed ecosystem for borrowing, lending, staking, and trading (DeFi)

Autist Note: yes, we know Bitcoin offers some of these things and may aspire to offer others, but the facts are it doesn’t have the technology or adoption yet. As for the ETF, we don’t own it and see no reason to own it. The value proposition of crypto is self custody.

What Do The Significant Players Want?

Instead of asking “which coins should I invest in” let’s turn it around and ask what the entities with the power to create, regulate, and dominate markets want.

ETF issuers like Blackrock and Fidelity want to earn fees from selling a popular product to their clients (pension funds etc). They’d also like to cook up structured products with extra yield and other differentiators in order to charge premium fees.

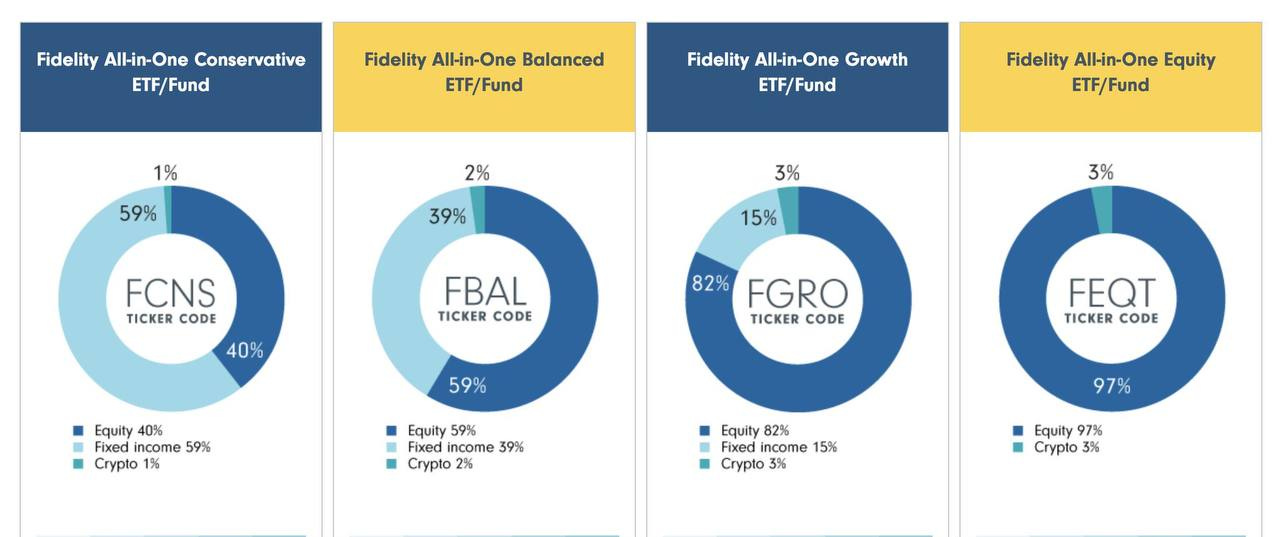

This means we think that an Ethereum ETF is a certainty, whether in this administration or the next. And that it’s quite likely that ETFs will be permitted to stake their Ether at some future point. Cypto assets will become a single digit % “conservative” allocation in funds, eventually on trillions of AUM.

Venture capital powerhouses like a16z need to clear their hurdle rate by investing in the “unicorns” of this new industry. This means protocols which can generate high fee income and therefore command high valuations using familiar cash flow multiple models. The protocols with the ability to generate the highest fees will be, in order:

issuing money

collecting a fee on every asset swap

borrowing and lending

This is simply the proven profit model from the existing financial infrastructure copy pasted onto the blockchain. We don’t expect that regulators will prevent the growth of this extremely profitable and important sector of the economy.

Due to lobbying, the revolving door, and other incentives, regulation is likely to line up with the requirements of the financial industry; provided that compliance/control can also be delivered. Public blockchains like Ethereum permit total surveillance and stablecoin apps like USDC total control via a blacklist function.

If the US government could choose between having the majority of US capital in crypto stored in Coinbase, or Binance (a foreign-owned exchange operating offshore) it’s not hard to see why they support the domestically regulated solution. In short this is why we’re also not concerned about the SEC cracking down on Coinbase.

Sizing The Opportunity

In a bull case, Ethereum’s market cap this cycle could reach the peak of Bitcoin last cycle. That’s roughly a 4x gain from current levels.

Here’s what has changed since last bull market.

Better Tokenomics: Ethereum has moved from Proof of Work technology - wasteful, inefficient, not aligned with corporate ESG goals - to Proof of Stake. This reduces inflation.

Native Yield: Proof of Stake means Ethereum rewards validators with low risk returns - recently 3-6%/year - simply for running servers to operate the chain.

Fee Capture: EIP-1559 ensures that a portion of the fees paid to use the chain are burned, ensuring that the value of ETH scales with demand (ETH deflationary)

Now we look at staking, and staking incentives.

Last bull market there wasn’t much an ETH holder could do with their ETH except use it as collateral to borrow other assets. If users didn’t want to leverage their risks, ETH had little utility. Although staking provides only modest returns, there are now two ways to increase yield by assuming more risk: restaking and liquid staking tokens.

In short, owners of ETH can now double dip. Either they can both stake their ETH and have it available to them for use as collateral; or they can delegate their stake to secure multiple blockchains, receiving a yield from each chain.

This means users have less incentive to sell their ETH.

Spot Bitcoin ETF inflows have been large: $17 billion in net inflows for the 9 ETFs in less than two months. This is 5% of Ethereum’s market cap, and a larger percentage of it’s circulating supply.

The Ethereum market is much smaller than Bitcoin, and more of supply is locked up. ~25% of Ethereum is locked in validator staking. Even if the owners wanted to sell, they can’t do so immediately. The Unstaking Queue would be several years long. Just consider a chunk of this supply permanently off the market.

Eigenlayer, a restaking protocol, has attracted over $7 billion of ETH year to date.

And there’s another feature of the Ethereum ecosystem keeping supply off the market.

Layer 2 Farming

In simple terms: last cycle had investors try to predict “the next Ethereum”, leading to a proliferation of alternative L1s like Solana, Polygon, and Avalanche all offering cheaper fees.

This cycle, Ethereum’s official scalability roadmap promotes L2s - independently operated chains which pay to store their accounting / transaction data on Ethereum mainnet. Each of these chains is operated by a different decentralized foundation or venture capital group. And they all compete for capital.

As before, ecosystems are paying users to lock tokens in exchange for the promise of more tokens. High user activity and Total Value Locked boosts the perception of value on these apps/chains, even if there would be no activity without the subsidy.

So users arrive in the Ethereum ecosystem in search of free money (farming / airdrops). They lock up their Ethereum in smart contracts on Layer 2 for weeks to months. The Layer 2 gets cheap capital and the user gets a return. As long as these incentives continue, there’s little reason for anyone to sell their Ethereum.

Even if holders get spooked by price dropping for a few weeks or even a month, their capital is locked up in the Layer 2 ecosystem.

Summary

Ethereum offers yield, leverage, and an already capitalized DeFi ecosystem → good value proposition for institutions

PoS added yield, removed emissions, EIP-1559 linked value to demand → economics make sense on paper for traditional asset allocators

Lower market cap and circulating supply compared to Bitcoin → can’t accommodate multi billion dollar ETF inflows without price appreciation

Large % of floating supply staked or otherwise locked in validators or Layer 2 → even less supply, could trade like a lower market cap asset

All of the above suggests a priority of owning Etheruem and being up to speed on how staking, DeFi, and Layer 2 farming works. Soon, we’ll share research on specific coins we think are likely to benefit from a wealth effect created by Ether’s rising value.

Updates

High Funding Rates And Ethena

Funding rates on exchanges are reaching highs not seen since the last bull market.

Spot margin traders recently paid as much as 60% APY to borrow USDT on Binance. Funding rates on DeFi perps have been extremely high, reaching over 200% for the most liquid contract, Ethereum perps.

This is where Ethena comes in: they are currently helping keep CEX perps funding in line by shorting around 5% of the open interest across the major centralized exchanges. Although we don’t hold USDe, we think in the short term Ethena’s presence in the ecosystem will push down carry costs for leveraged ETH traders.

Ethena has suffered from some bad PR: an error in a press release incorrectly stated that PayPal had invested in their recent $14mm round, the project has had to defend against speculation that it’s the next Luna, and a proposal to divert 85% of the first week’s yield to operations resulted in some very harsh criticism from the community. Ethena Labs have now paid the full protocol APY attributable to the assets backing USDe to stakers.

The opportunity for you, if you have excess capital or can borrow cheaply, is to acquire additional spot ETH and short an equal value of ETH perps to collect funding on any of the DeFi perps DEXes which are also paying farming rewards. We suggest using Aevo and Hyperliquid as both have current incentive programs on top of the ~60% APY you’ll earn while funding rates are steep.

There’s an interest rate arbitrage on Arbitrum - Aave USDC rates are typically 15-30% whereas ETH perp funding on Hyperliquid runs from 60-100%.

This is a juicy opportunity to lever your ETH stack without taking on more price exposure to ETH, but do carefully manage your LTV to avoid liquidation.

Of course, you could instead choose to stake and farm the sUSDe token to earn Ethena “shards”, but we’re not doing this. (We prefer the more certain yield and flexibility offered by doing our own basis trades while keeping funds in self-custody)

The point is that Ethena provides tokenized access to complex trading strategies. Tokenized means easy to access (point and click to buy token) and composable, e.g can be leveraged by other DeFi apps. Ethena’s success in attracting TVL proves the model. This is a new sub-segment to pay attention to. See our recent coverage of Ethena here.

If you’re ready to get serious about crypto this cycle, join our paid membership.

Until next time, anon..

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

We now have a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Hi DeFi Team,

I've just read "Locking in 38.38% Yield on ETH" on the Espresso Blog (great reading for those who are not familiar with JLabs Digital):

https://espresso.jlabsdigital.com/posts/oba87FTFEokjmgq5sSS6R

Ben explained EigenLayer liquid ETH staking that earns yield as well as EigenLayer (EL) points. Those EL mysterious points could be prerequisites for a potential airdrop. According to the article, there are a number of restaking platforms out there:

Puffer, Swell, Ether.fi, Kelp DAI, and Renzo.

Do you guys have any deep insights into these platforms/protocols and how to take best advantages on brand new ways to leverage on ETH?

Looks like ETH will massively explode in value in the near future as financial institutions starts chasing yields into the stratosphere (coming crypto Lehman Brother) after the switch turns on for the spot ETH ETFs. I'm not sure if there is a pullback soon but I am sure to load up more ETH when that happens.

By the way, I just switched to a yearly plan after updating my card payment information. I cannot believe how much value I am already getting on my monthly subscription. Thank you so much for the education!

Hi guys. I'm from BTB community. Recently subbed to Defi newsletter and also signed up for academy.

Could you give more guidance exactly how to do the below or which lessons in the Academy course would be helpful to study this more to understand the below? I find it very overwhelming and not even sure how to start. 😣

Is there anything in the Academy that covers airdrops btw?

Thanks in advance!

"The opportunity for you, if you have excess capital or can borrow cheaply, is to acquire additional spot ETH and short an equal value of ETH perps to collect funding on any of the DeFi perps DEXes which are also paying farming rewards. We suggest using Aevo and Hyperliquid as both have current incentive programs on top of the ~60% APY you’ll earn while funding rates are steep.

There’s an interest rate arbitrage on Arbitrum - Aave USDC rates are typically 15-30% whereas ETH perp funding on Hyperliquid runs from 60-100%."