Welcome Avatar! At this point you understand the big picture (LINK) , you also understand how it works and how to do your first transaction (LINK). This is a good starting point and we’ve gone from Definitely NGMI, to simply NGMI status.

Opportunity

Since you’re sharp… you’re probably frothing at the mouth thinking about how much opportunity there is. If you want to put some numbers around it think about it like this:

1) The Alternative Asset Management Market is $10 Trillion US Token (LINK), 2) the 100 largest sovereign wealth funds are $8.4 Trillion (LINK), 3) worlds larges financial companies are roughly $6.7 trillion (LINK), 4) Global Bond market is roughly $120 Trillion (LINK) and 5) Negative yielding bonds - buying something that guarantees a loss - is $18 trillion (LINK)

For Visual Learners the below is the scale of the Opportunity.

We do need to throw some cold water on this. For one, the global bond market is a completely different risk level as it includes corporate bonds etc.

Example. Pretty unlikely that a major US Token flow positive business like Coca-Cola goes bankrupt any time soon. However. The Negative yielding bond market is a good proxy for the long-term potential. You’re looking at a market where people are paying to lose money (makes no sense). You’re effectively paying to avoid holding large amounts of money in a vault.

To reiterate, the reason why the opportunity is so large is two fold: 1) you have fiat money being printed at all times and 2) you have *much* lower cost of business as people are being replaced by lines of code - same thing that happened to the music industry when it went digital.

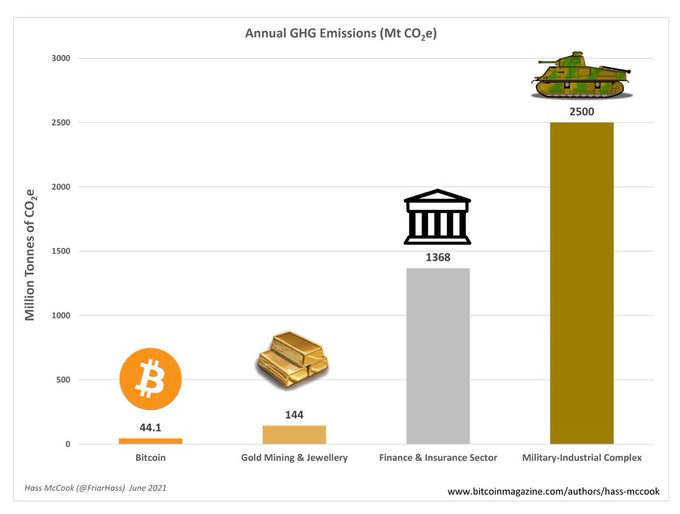

No matter what the news says, as DeFi and other crypto assets scale, they will consume much less energy than the financial institutions (computers don’t need copious amounts of energy, people and real estate do).

Risks

You are in the Wild West. If anyone says it will be an easy road, they are lying. If anyone says they never miss, they are also lying. Mark Cuban got rugged with TITAN. Every single wealthy DeFi investor has gotten rugged. There is just no way to learn something without making mistakes. The best you can do is learn as much as possible and stay on top of all the changes. And. That is exactly why we’re here!

Even with our full team built out, there is no way to stay on top of *all* the changes (we have a 1,000x better shot with a team). So. We know with certainty that the information will be valuable as a group of people will constantly monitor the changes.

Key Risks: 1) you put money into a pool that suddenly gets “hacked”. Could be a legitimate hack or the anon founders bolt with the money, 2) there is a buggy system issue that causes arbitrage - as seen on TITAN and explained on BowTiedBull, 3) the stable coin pegged to the protocol is a scam and does not hold to $1, 4) as more coins use USDC to back their stable coin it is essentially centralized and 5) many of the protocols don’t actually make money but move up and down due to marketing and liquidity trades.

As you can see, there is just no chance that you *won’t* lose money from time to time. You are in the Wild West. This would be similar to the internet days when people were selling $1.99 ringtones that were basically stolen songs loaded onto a square phone. Those guys made a killing.

Also. In those days people got away with selling fake tickets to sports games, shoddy/half broken cars etc. In the end, the internet worked and think of this as investing in your knowledge of how to utilize the internet! You’re just entering in the 1990s.

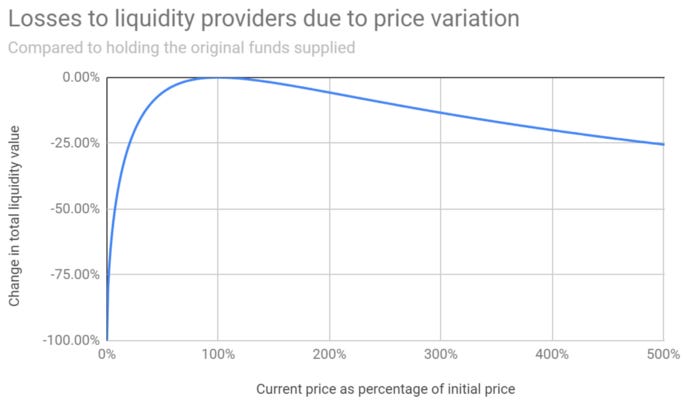

Impermanent Loss : One risk that we do need to cover for people new to DeFi is Impermanent Loss. Keeping it simple, if you go into a pair pool with a 50/50 split you’re *hoping* the prices move up in a 1:1 ratio. If you put $1,000 US Token worth of XYZ coin, you want to match it with $1,000 US Token worth of ABC coin *and* the ideal situation is that the price of both coins goes up exactly the same or is stable.

In a bad situation, one coin will go straight down causing you to suffer extreme losses unless the price recovers. For a visual explanation here is a good chart. (Chart from medium - LINK)

As you can see from the chart above, it can get ugly quite quickly. Even if you think you’re in a “stable pair” it can go south quickly if a token suddenly runs. For example, the time frame when ETH went from $400 to $4000 suddenly or when LINK went from $1 to $29. In those cases, you were much better off just holding the coin. As usual, timing does matter and you just want to be smart about the type of risk you take on.

Down the Rabbit Hole We Go

Congratulations anon! If you’ve read the first three posts here, you have enough basic understanding to become a DeGenerate. Perhaps you make it to the island, perhaps you do not. That said, we’re going to provide people with free content that will keep the high level updated and the paid content will be quite detailed with the ability to even ask for specific data scrapes over time. The current structure is as follows.

Now how are we going to “define” DeFi? Good Question! As you can imagine it is going to be a *TON* of work.

We will utilize: 1) investment banking style presentations for consistency, 2) subscribe to all scrapers to figure out how to best use them, 3) build out some of our own data analytics and 4) ideally we are successful enough to bring more people in and improve the project as DeFi expands!

Here is a big picture on how to segment the market (June 27, 2021).

This will evolve with certainty. The way we intend on handling it is as follows.

Step 1: We will try to do the bigger picture larger coins first so the audience gets a feel for the flow of the presentations/overviews.

Step 2: We will start with REN (something easy to understand) then move to Yearn Finance and AAVE as one is an automated strategy and the other is Lending.

Step 3: We’ll allow the subscriber base to begin to drive the Substack in terms of deeper analysis, different coins etc. (we have a backlog already so no worries!)

Step 4: Infrastructure like LINK or GRT would be covered on BowTiedBull as that is a much bigger picture item and less “DeFi”. From time to time we will cross share some paid posts if it appears to be “on the line” in terms of information.

REN will be released on July 1. You can directly interact with all contributing members on the paid section of the substack for questions, data requests etc.

Final Note: We will have a free post that explains all of the terminology pinned to the top within the next week or two. This will be constantly updated just like an FAQ to make sure *everyone* understands the language if life gets in the way. As always. Equal Opportunity, Unequal Results.

So that's why there isn't information on LINK in the substack :)

Do you think that Uniswap V3 can prevent permanent loss?