Welcome Avatar!

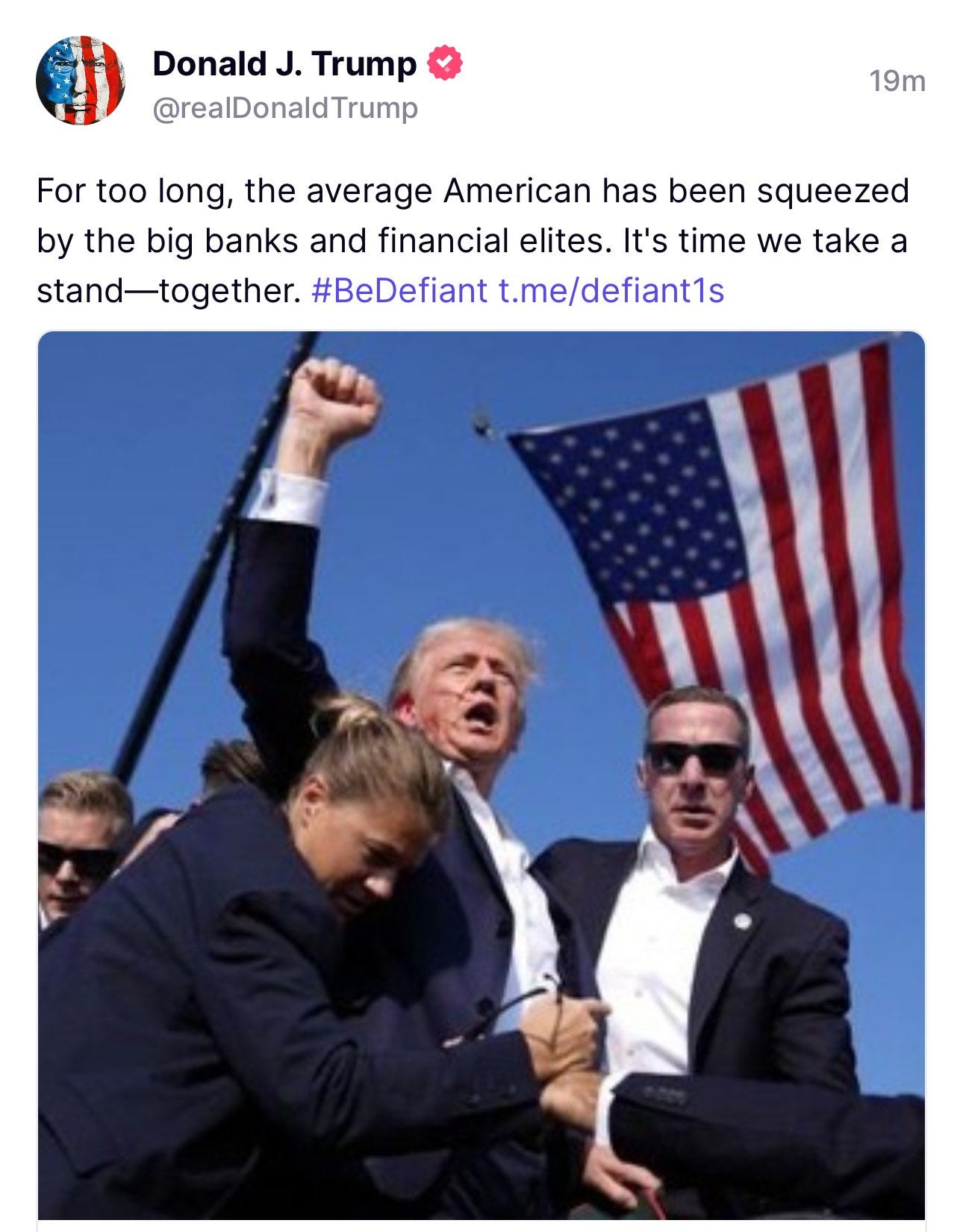

Beginning with Donald Trump’s endorsement of DeFi today, the next year is going to be the most important year for decentralized finance since its invention.

Regardless of your politics there is no downside to one of the most prominent public figures in the world endorsing a DeFi project:

hundreds of thousands of people, many who never heard of DeFi (or who wrote crypto off as a total scam) are going to find our growing industry

the financial fairness issue is top of mind at a time when many Americans are struggling: and it’s true that legacy finance is captured by abusive, rent seeking intermediaries

regardless of who is elected, you don’t need permission to use DeFi. It just works, anywhere in the world with an Internet connection. It’s battle tested. Quality protocols have remained solvent through periods of extreme volatility.

Political endorsements, institutional adoption, and increasing public awareness of the technology will combine to create a DeFi renaissance. More adoption → more TVL / activity → more DeFi native revenues→ regulatory improvements → better revenue sharing with stakeholders. That’s the bigger picture.

If you’ve stuck it out with us over the years when DeFi governance tokens underperformed, through a brutal crypto bear market, when people rightly feared that the SEC would try to shut everything down. This year is when your patience gets rewarded. And. If you’re just joining us. You’re right on time.

Making DeFi Great Again

The Trump family has a laundry list of crypto projects they have launched over the years. These include:

Donald Trump NFT collections

Numerous Melania Trump NFTs

DJT memecoin (confirmed involvement, unclaimed by the Trump family)

RTR memecoin (rumored involvement, we have been unable to confirm)

The next project is “The Defiant Ones”, being launched by Eric and Donald Trump Jr. This project has received an official endorsement from Donald Trump himself.

A likely outcome is a fork or frontend of an existing DeFi primitive like Maker or Aave (we don’t expect the creation of an entirely new primitive, but that would be an upside surprise). The other possibility is real estate tokenization.

Our internal odds are:

60% chance lending protocol

20% chance tokenized real estate

20% chance some other thing we haven’t thought of

A token could accompany the launch, or not exist at all. Based on what we know about the DJT coin, the Trump family has been talking to various industry participants for advice on how to execute these projects. This explains how the set of Trump projects released this year have clear crypto native expertise built-in (such as the use of single-sided liquidity on DJT).

The Trump family has now done projects in NFTs, memecoins, and DeFi. That means these sectors are likely all going to be in the clear from a regulatory standpoint under a Trump presidency. If we had to guess what doesn’t receive a regulatory pass, we’d say privacy protocols.

Under a Harris administration we’d anticipate regulatory crackdowns on CeFi, DeFi, and decentralized stablecoin issuers. We don’t think memecoins as a category get a crackdown because they only affect retail and not the wealthy or institutional players. As Logan Roy put it in the TV show Succession: NRPI. No Real Person Involved. It’s more likely that specific projects that do presale rugs and other blatant scams are targeted (like what happened with NFTs), due to resource constraints at the SEC and their preference for enforcing after the fact rather than providing a framework upfront. The U.S. will become one of the worst places in the world to be a crypto founder.

Enough depressing talk though — we could be on the verge of a DeFi renaissance. Aave, UNI, CRV, and some other DeFi coins have rebounded strong after years of underperformance. There are both coin-specific and structural dynamics at play here. There are crypto VC funds that benchmark their performance against BTC, which is up 57% YTD. Outside of a few trades on “tech alts” like TIA, Ondo, and TAO at the beginning of the year, there have been limited opportunities to make meaningful returns in altcoins.

Liquid funds need scalable, liquid opportunities to outperform. Due to their lower liquidity as well as a funds’ mandate/branding to their investors, many were likely left out of the memecoin mania entirely. As such, these funds are forced buyers of tech alts. Among tech alts, DeFi has the clearest and strongest narrative today especially when taking into account an official, publicly endorsed Trump DeFi project on the way. Protocols like Aave and Maker are cash flow generating battle-tested protocols with a clear set of winners and proven product-market-fit. While we detest the term “blue chips” in crypto due to the inherent volatility of protocol revenue, the leading DeFi protocols are the closest thing crypto has to blue chips.

The downside? We are not in a market regime that makes us comfortable holding altcoins due to their correlation to Bitcoin, which has been in a downward trend since March 2024. You could be right about the narrative, the catalysts, the flow of attention, and still lose if BTC goes down 10%. We think it is nearing the time to start focusing on altcoins, but as trades rather than holds. It’s simply too risky in this market for a buy and hold strategy on alts.

Selecting the right coins is just as important as good market timing. Note the dispersion in DeFi tokens performance compared to Bitcoin since just before the crypto crash at the beginning of August.

Bets on Chainlink, the price oracle which powers most of DeFi underperformed Bitcoin. MKR, the token of one of the earliest and most successful DeFi protocols went down 13% during a period where Bitcoin was flat. Aave has been the strongest DeFi coin recently, as there are a number of narratives working in its favor:

potential for institutional investors to bid liquid DeFi coins with revenue and a proven track record

more favorable regulatory conditions could enable protocol revenues to flow through to token holders (“fee switch”)

major improvements slated for Aave v4 and a roadmap to unify liquidity on Aave markets across blockchains in future

Quick Thoughts on Cyclicality

If we left curve the entire crypto market and assume it’s simply 4 year cycles and everything else is noise, it implies a cycle peak in 2025 not 2024 (2017 → 2021 → 2025). That would mean this year’s early performance was purely an event-driven trade surrounding the BTC ETF. This goes back to our prior market post that describes crypto’s idiosyncracy (and why our internal probability of the cycle being over is only ~20%).

Since crypto is much larger than in the past between cycle peaks both in terms of capital and attention, we’ve gotten miniature alt cycles periodically. However, we continue to believe it’s largely crypto native capital. There has been new retail onboarded as there was noticeable participation from non-crypto retail in March/April but that was quickly washed out by the summer.

We continue to believe this will be a temporary (albeit at times painful) blip in the broader market cycle. The U.S. presidential choice may impact altcoins, the narratives, and the length of the cycle but is largely irrelevant for Bitcoin. If Trump wins all alts likely pump. If Kamala wins, it’s probably just memes as real tech continues to be targeted by the same regulators in place today.

For our in-depth market thoughts and deep dives on protocols, check out our paid list.

Subscribed

If you’re just joining us as a free subscriber, the next section is for you.

New? Start Here: What Is DeFi?

DeFi uses blockchain technology (Ethereum and smart contracts) to build a better financial system, using code to replace intermediaries like banks and stock brokers.

Here are some key decentralized finance primitives:

“Stablecoins” allow anyone in the world to convert their cryptocurrency to a dollar-pegged token and earn interest.

DeFi money markets act like banks: customers can deposit assets, earn interest, and borrow tokens.

Decentralized Exchanges (DEX): Stock exchanges are replaced with computer programs which allow you to trade any asset, go short, and finance positions with margin loans.

If you’re just getting started, here are some of our most popular free posts.

Career opportunities include inventing, building, and managing these new financial applications (protocols), using skillsets from software development, finance, sales, and operations. If you’d like to get up the learning curve quickly, we have an intensive course designed for those who want to work or invest in DeFi.

Paid Substack: Our role is to keep you informed on the key developments in the industry, help you develop your framework for investing in tokens and spotting market opportunities, and get you up to speed on how the technology works (including the critically important topic of security, as billions of dollars have been stolen from DeFi users). Paid subscribers have access to our bi-monthly Q&A sessions.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

We now have a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Thanks for the article! My sense is that there is going to be a recession. If so, how does that impact this? Crypto took a nosedive with recent stock flash crash. I imagine it would be far worse if that was something sustained.