Welcome Avatar!

In today’s holiday edition of DeFi Education, we wanted to give all our readers a review of everything that’s happened this year.

As part of this review we’ll cover our major lessons from our adventures as cartoons in crypto.

In our next post for paid subscribers, we’ll also cover our 2024 crypto market outlook.

Let’s dive in.

Q1 2023

It was a hellish start to the year in crypto. Bitcoin was trading at ~$16,500, and regulators brought an onslaught of legal action to kick the year off.

The Winklevoss Twins and Gemini squared off publicly against Barry Silbert over claims related to the multi-billion dollar bankruptcy of trading firm Genesis. This contentious deal continues as we speak, with both parties suing each other to reduce claims.

We wrote earlier in the year that Barry Silbert may have been taking a “delay and pray” approach whereby he was deferring negotiations as long as possible to allow for the recovery of the crypto market and, as a result, DCG’s portfolio. DCG is the creator and owner of Grayscale (GBTC, ETHE, etc.). The company’s troubles don’t stop at their portfolio — DCG was sued in October by the New York Attorney General for allegedly defrauding over 200,000 investors of more than $1 billion.

On-chain, liquid staking protocols like Lido saw massive gains, leading the DeFi ecosystem’s performance. Spot volumes increased quietly from Q4 2022 to Q1 2023 while negative crypto sentiment dominated headlines. The total crypto market cap increased nearly 50% to $1.2 trillion.

Blur marketplace also flipped Opensea as the #1 marketplace for NFTs. And. Arbitrum conducted an airdrop for $ARB, netting many people 5-figure airdrops. We showed our readers how to expertly navigate this airdrop which was essentially priced to perfection.

We also began work on LizardOS, the software used by our resident security expert.

While regulators turned their eyes to crypto, they completely ignored signs of cracks from a rapid rise in interest rates.

In January, Silvergate bank reported rapid outflows of crypto deposits. Silicon Valley Bank collapsed in March 2023 after announcing a sale of shares and disclosing it had a $1.8B shortfall. Credit Suisse was acquired by UBS.

The banking troubles led to the depeg of USDC which crashed down to $0.85! One of our team members was on vacation and was scrambling to find a way to buy. USDC market cap has been “down only” ever since, collapsing from $43 billion in March to $25 billion today. There has been a slight uptick but by and large USDC has been rapidly outpaced by USDT, which has grown from $77 billion to $91 billion over the same period.

By the end of Q1, it was clear that the worst of crypto was behind us as and anyone who bought alongside us in November 2022 was rewarded with BTC climbing over $20,000 in January. Bitcoin was the best performing asset in Q3 2021, returning a whopping 72%.

Crypto Twitter got too excited and began claiming an alt season was coming, an illusion we quickly dispelled for our readers and prevented them from becoming exit liquidity. As a bonus in the same post, we called the all-time high of GMX within a few bucks! Crypto Twitter participants weren’t the only ones who got too excited — Balaji Srinivasan made a $1 million bet that Bitcoin would hit $1 million in 90 days!

DeFi Ed Top 3 of Q1 2023:

Q2 2023

BTC ended Q2 with a “mere” 6.9% gain, and trading volumes collapsed. Ethereum withdrawals were enabled which led to a growth in ETH staking. Total crypto market cap was basically flat QoQ.

Despite the market being flat, there was a ton of action.

The SEC sued both Coinbase and Binance. Pepe hit $1 billion market cap. The big tradfi institutions applied for spot ETFs, a major sign of adoption by the traditional financial sector.

On the DeFi Ed side, we officially launched LizardOS!

We also recommended Coinbase as a buy at $50 despite the extreme negative sentiment across the Twitter and financial media. COIN trades at $182 per share at the time of writing (3.7x, for those who are holding).

Meanwhile, DeFi stalwart Curve Finance was facing a bad debt crisis as a result of $100 million borrowed by the founder. It appears the winner of the Curve Wars was the arms dealer.

We also recommended getting off of Ledger in May of this year and removed it from our recommended wallet list.

DeFi Ed Top 3 of Q2 2023:

Q3 2023

The echo bubble…popped.

BTC traded from above $30k at the beginning of the quarter to below $25k, with most of this movement occurring during a single dramatic crash day in August.

ETH lost ~25% during the quarter trading down to $1520.

Our Q1 warning was validated.

Late buyers who FOMO’d into the Q2 top were punished if they panic sold the lows in Q3. We can see from August liquidations data that many crypto holders were forced out. Against the backdrop of the prior bear market, we think it unlikely that they survived to rebuy again before the huge Q4 rally.

As usual we were ahead of the curve by suggesting to de-risk before the crash and pointing readers towards the highest on-chain yield available on a safe stablecoin (DAI) in July. The DAI savings rate later peaked at 8%. The main Q3 narrative was “Real World Assets - bringing treasury yield on chain” - fueled by rising TradFi rates and declining native ETH staking yield (market saturated with new validators).

The on-chain Tbills sector will likely disappear after a pivot back to a zero (real) interest rate policy. Who wants to “own bonds, but on Ethereum”? Or own bonds under ZIRP? Maybe blockchain technology provides a settlement layer for TradFi, but that’s not imminent. For now, DeFi’s crowning achievement is providing an interest-bearing USD “bank account” to anyone in the world who has Internet access. Not to be dismissed.

Although it wasn’t time to go full risk on, we took a small altcoin position - which was our first in a long time - betting that Frax Finance was well positioned to grow thanks to capturing both sides of the on-chain yield play; Liquid Staking Derivatives and Treasuries/RWAs. After a few months of breaking even vs ETH and USD we exited.

The second half of Q3 was also marked by lackluster trading volumes on both CEX and DEX, low on-chain activity, and a growing skepticism of crypto. In DeFi land, builders kept building but there has been low interest / adoption.

For example, two first generation DeFi protocols Aave and Curve launched their own stablecoins. We predicted that GHO would flop (today it has ~35% of the market cap of Curve’s stablecoin) but were skeptical that there would be much adoption of either.

Today these two products combined account for $135mm of the $130.8b stablecoin market cap, or 0.1%. For DeFi only coins, our preferred options are Liquity’s LUSD ($176mm) and DAI ($5.2b).

Our initial suspicion was that the Curve stablecoin was more of a meme to ease pressure on the Curve founder’s CRV-secured DeFi loans (the whitepaper was released last November 22, 2022 when whales were hunting Egorov’s liquidation price on Aave). Speaking of those loans, they were unwound during Q3 in a series of OTC trades following another dramatic attempt to trigger liquidation. We traded around this and did quite well following the playbook we shared last November. Once you’ve been involved in crypto for ~1 year you learn to spot patterns which can be applied during future events/cycles.

Curve was also hacked in Q3, initially causing major losses to several protocols which were LPing on Curve including JPEG’d and Alchemix. Most funds were recovered and the Curve DAO recently voted to reimburse the remainder.

While we ruminated on DeFi’s big problem - not enough users - we shared some thoughts about where crypto’s pain points lie (in the opinion of some cartoons). This is a good starting point if you want to launch or work at a crypto protocol.

Finally, as there wasn’t much happening we concentrated in on a few market makers who were suspected of pumping some smallcap tokens and manipulating funding rates. (to be clear, the MMs doing this are likely anonymous, not DWF Labs). This gave us an opportunity to explain how market making works and how market making activity levels form an input into our token investment decisions.

Also in Q3:

FTX received court approval to sell all of its crypto holdings

Coinbase launched their Ethereum L2 using OP stack - BASE chain

Greyscale won a significant court case paving the way for a spot Bitcoin ETF

Major CeDeFi firms from last cycle start to emerge from bankruptcy

DeFi Ed Top 3 of Q3 2023:

DeFi Debt Crisis: The Great Curve Loan & Curve Exploited! DeFi in Danger from Bad Debt? & DeFi Lives to Fight Another Day (explains our trades)

Q4 2023

On October 16, Cointelegraph’s social media team posted a tweet stating that the United States Securities and Exchange Commission had approved BlackRock’s iShares spot Bitcoin exchange-traded fund. This was the result of a clever hoax where someone posted a doctored screenshot purportedly from Bloomberg Terminal which was then picked up by the rumor mill and disseminated by Cointelegraph’s social media team without editorial approval. Bitcoin spiked above $30k on the news before retracing below the key level on the denial. However, this fake news focused market participants on the likelihood of a real spot Bitcoin ETF approval. Front-running the approval sparked a rally shortly after, leading to a ~50% gain for Bitcoin in Q4.

It’s been an extremely busy quarter for trading, here’s the highlights:

COIN was one of the strongest crypto stocks, while Bitcoin miners also caught a bid, then later, retail focused trading app Robinhood gained ~30% in December

Solana gained $100 from ~$21 to $121 during the quarter; some users received a JTO airdrop worth 5 figures, and a billion-dollar memecoin was minted (BONK)

A new blockchain platform, Celestia (TIA) launched a token which ran from ~$1-2 prelaunch on Hyperliquid to a record high of $15 during the quarter. Fun fact: it’s founded by an actual hacker (convicted for activities relating to “Lulzsec” group)

Old market themes repeated with Avax rising from ~$10 to to $50 as a Solana catch up trade (remember SOLUNAVAX from last cycle?)

TradFi entered Bitcoin in size, with exchange powerhouse CME Group flipping Binance in Bitcoin futures volume and open interest

DeFi team spent a lot of time researching which DeFi derivatives DEX are well positioned to succeed and the most promising candidate is Hyperliquid, already doing $3-400 million of volume a day and listing all the new coins, including TIA pre-launch. Token coming soon, so make sure to farm some airdrop “points” by placing trades on the platform. Farming alpha coming soon for paid subs.

Other perp DEX contenders include Infinix, a high performance frontend for Synthetix Perps made by the Synthetix team, and dYdX (the highest volume DeFi perps DEX from last cycle, now on its own appchain).

Q4 2023 also gave many crypto participants some closure. In November a jury in New York delivered a unanimous guilty verdict on all seven counts of fraud, conspiracy, and money laundering charges against SBF.

DeFi Ed Top 3 of Q4 2023:

Our end of October market update had some alpha which has paid off in spades:

We doubled down on our prediction from May that Coinbase was an essential / top 3 crypto holding, and that the regulatory problems were overblown. Our buy recommendation went out at the end of October around $70 and the stock doubled during Q4.

We started our rotation of nearly all our BTC into ETH at around 0.05 ratio. This trade can be done in size, and even leveraged if desired by borrowing wrapped BTC from Aave and swapping for ETH. The trade is up 10% since inception.

Our resident security expert correctly predicted a frontend attack which affected many DeFi protocols in November. Use this post to refresh on how to check transactions for fraud before approving them on your hardware wallet.

Rounding out the quarter was a rare guest post setting out one path for launching a career in crypto. As a reminder we’re in the process of adding a new module to our popular DeFi Academy covering how to break into smart contract development.

DeFi Ed Team Lessons, Reflections, & Core Memories from 2023

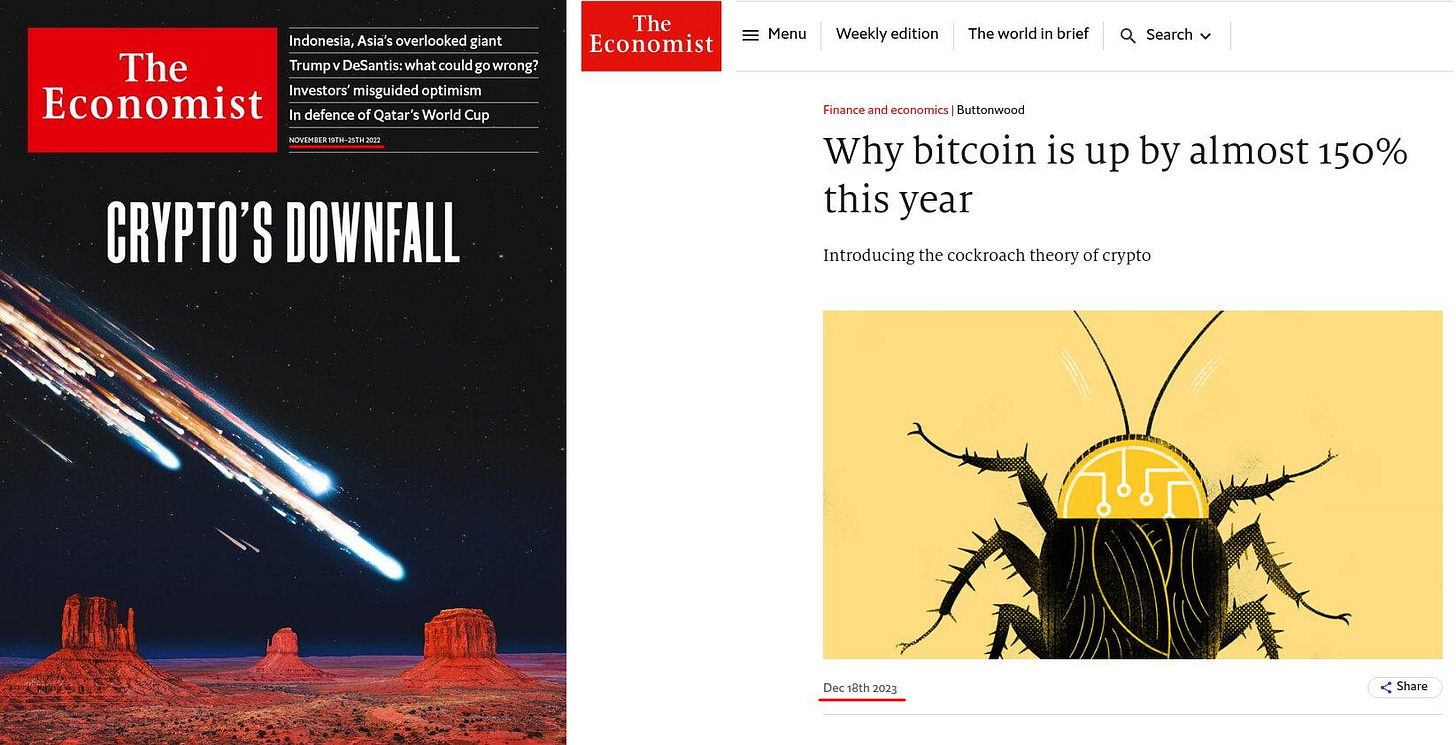

Headlines never tell the full story. And. They often tell the wrong one. Consider the Gell-Mann Amnesia effect

You open the newspaper to an article on some subject you know well. In Murray [Gell-Mann]’s case, physics. You read the article and see the journalist has absolutely no understanding of either the facts or the issues. Often, the article is so wrong it actually presents the story backward—reversing cause and effect. I call these the “wet streets cause rain” stories. Paper’s full of them. In any case, you read with exasperation or amusement the multiple errors in a story, and then turn the page to national or international affairs, and read as if the rest of the newspaper was somehow more accurate…

Crypto will not die in our lifetimes. Crypto going to zero is inverse “supercycle”. Study prior market cycles for context. Bitcoin, Ethereum / smart contracts, and stablecoins are legitimate and useful inventions which are here to stay. If you’re an optimist by nature, think of the great things which can be built with the technology. If you’re cynical by nature, replace a fear that the government will ban it with the sober recognition that corporate interests will make far too much money - profiting from gambling addictions - for it to ever be banned or die. There will always be opportunities, but they’ll get smaller each cycle and harder to compete on, so be prepared and give it your best endeavors.

Reflexivity. Prices do, in fact, make the technology seem better. Study Soros on Reflexivity (again) - see our Holiday Book List.

Self Management: if you’re going to succeed in crypto you’re probably going to go through a period of time where you have to work a lot to capture opportunities. If you have a large percentage of your portfolio in crypto you’re going to be forced to make decisions which will have a large financial impact - even if the decision is whether to de-risk to the point where you can monitor your portfolio less actively. It’s important to be aware of how the interplay between health, stress, and decision making could affect you and your book. Take a step back if you need to - the market will be here when you return.

Push it: That said, there are times in life where you need to push extremely hard to make a leap. Whether its building a startup/new business, getting into better shape, or some other important goal, windows of opportunities open and close. When you feel the opportunity in your gut, go all out to capture it.

Become a paid subscriber and receive our 2024 outlook in a few days.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from an anonymous group of cartoon animals with Wall Street and Software backgrounds.

We now have a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Thanks for all that you do. Happy new year.

MURRRIIIIICCCAAAAAAAAAA! SEE YA ALL IN NEW YEeEar